by Eric Bush, CFA, Gavekal Capital

There seems to be several compelling reasons at the moment to mine developed market Asia for new equity investment ideas. Earlier this week we noted that the changing liquidity environment could move investors’ regional equity preference from North America to Asia. In this post we are evaluating current equity valuations and the most obvious conclusion to draw is that DM Asia equity valuations are much cheaper than DM Americas and DM EMEA valuations. Two quick notes: 1) all data is on an equal-weighted, USD basis 2) all charts below can be enlarged by clicking on the chart.

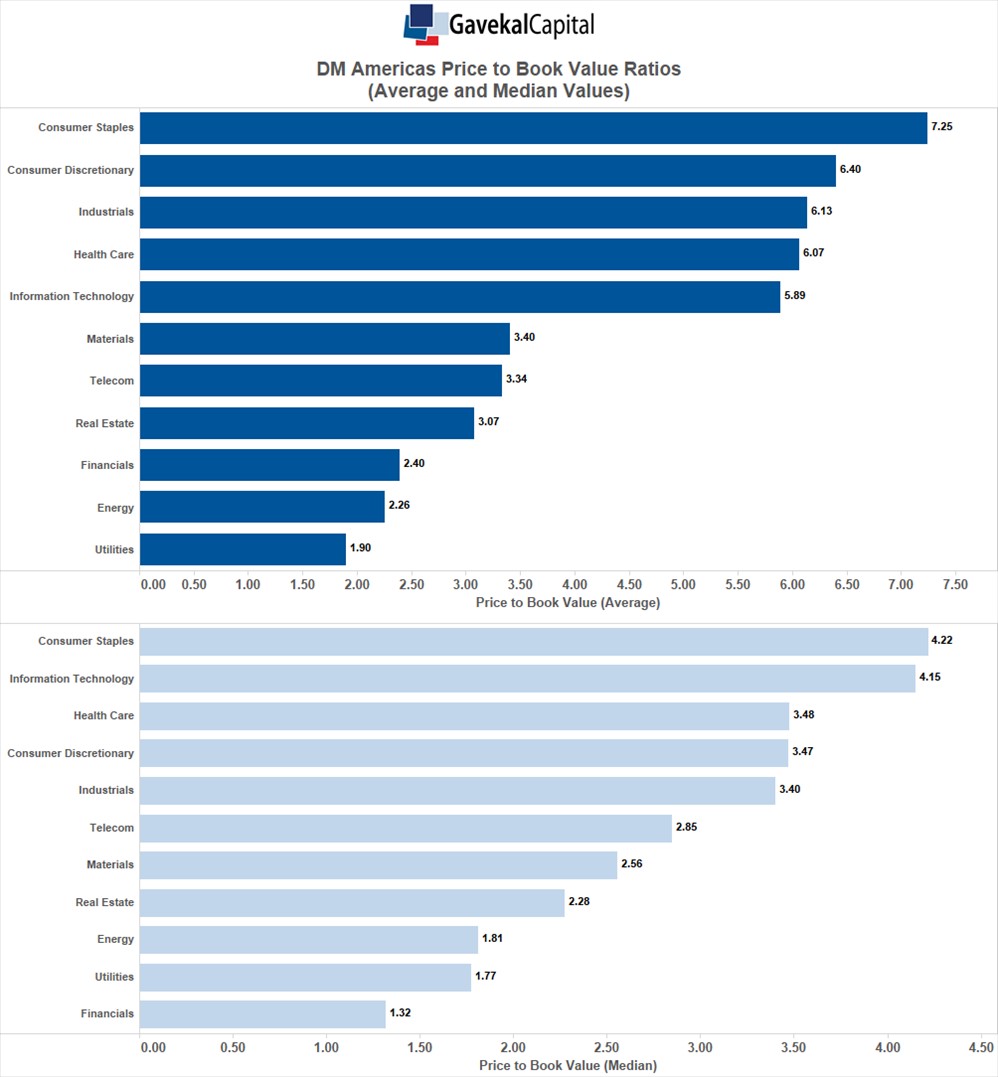

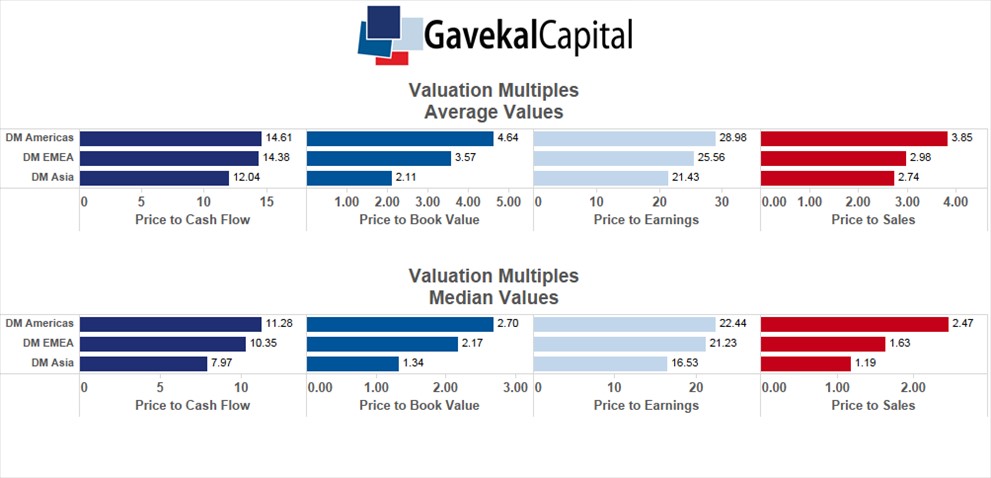

Across the four major valuation ratios (P/CF, P/BV/, P/E, P/S), DM Asia is the cheapest region in the developed world. Asian equities really stand out when we look at price to book value and price to sales ratios. In both of these cases, equity valuations are roughly half as much in DM Asia as they are in DM Americas. Additionally, DM EMEA falls in the middle across all metrics but tends to have valuation levels closer to DM Americas rather than DM Asia.

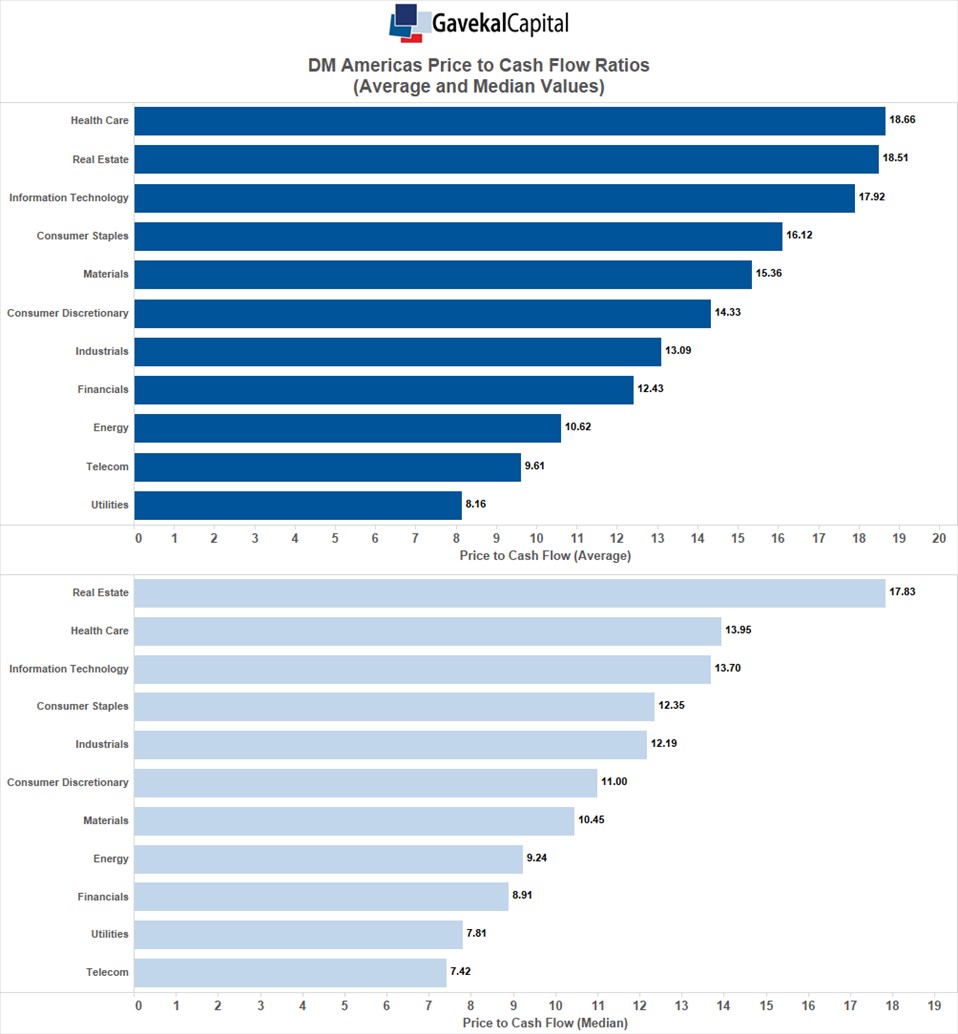

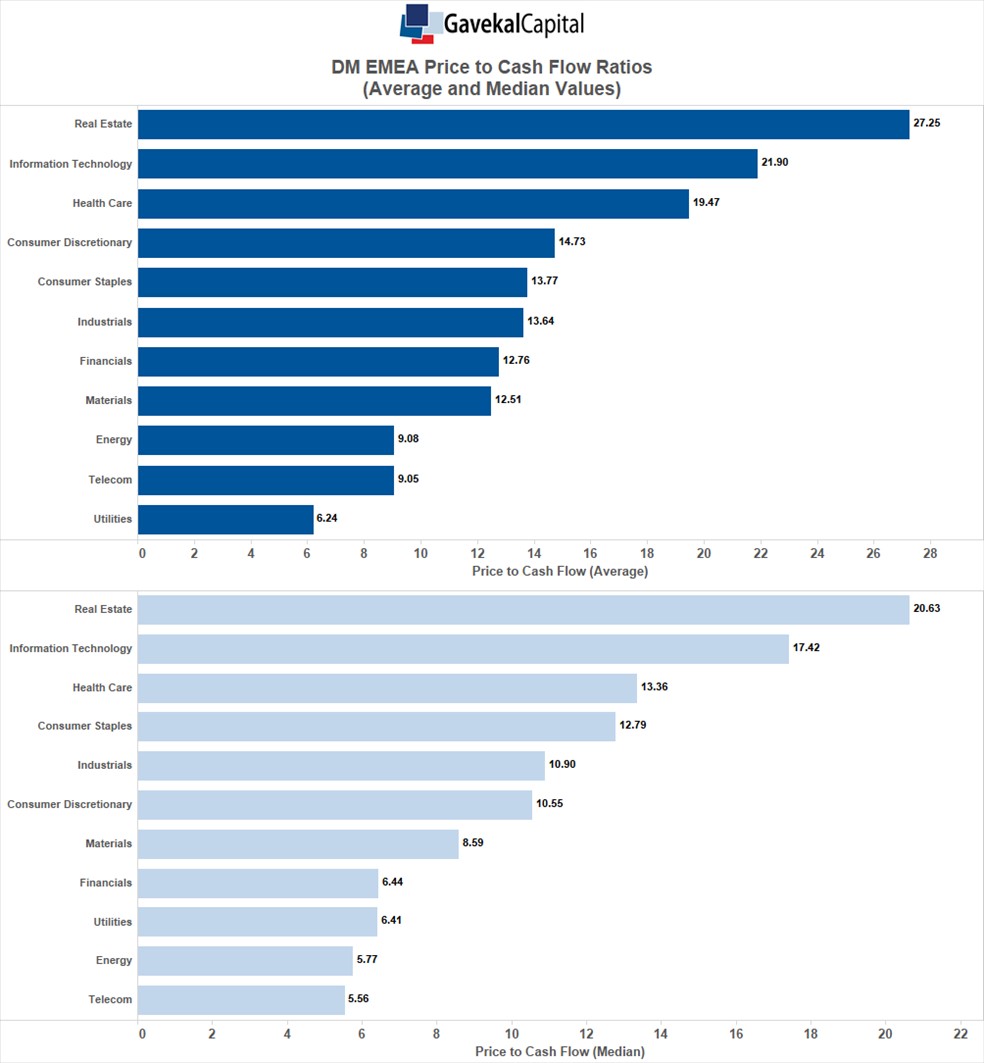

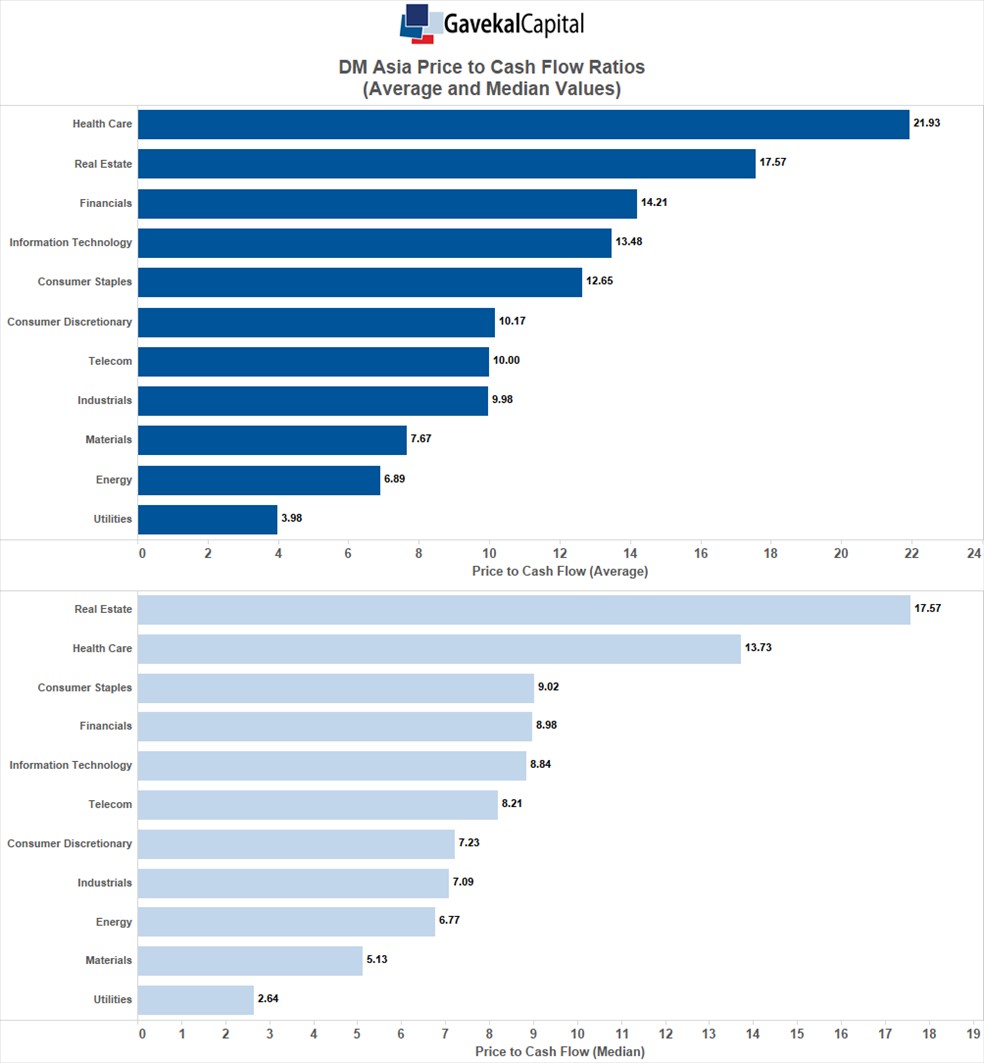

Taking a closer look at price to cash flow and price to book values, we can see that health care and the new carved out sector, real estate, are the most expensive sectors across the developed world. Real estate stocks in DM EMEA are particularly rich with a median price to cash flow ratio over 20x! Consumer staples, industrials, and utilities stocks are particularly cheap in DM Asia relative to the other regions. Health care and real estate are priced similar to the other DM regions while the median DM Asia utility stock is actually more expensive than utility stocks in DM Americas and DM EMEA.

Taking a closer look at price to cash flow and price to book values, we can see that health care and the new carved out sector, real estate, are the most expensive sectors across the developed world. Real estate stocks in DM EMEA are particularly rich with a median price to cash flow ratio over 20x! Consumer staples, industrials, and utilities stocks are particularly cheap in DM Asia relative to the other regions. Health care and real estate are priced similar to the other DM regions while the median DM Asia utility stock is actually more expensive than utility stocks in DM Americas and DM EMEA.

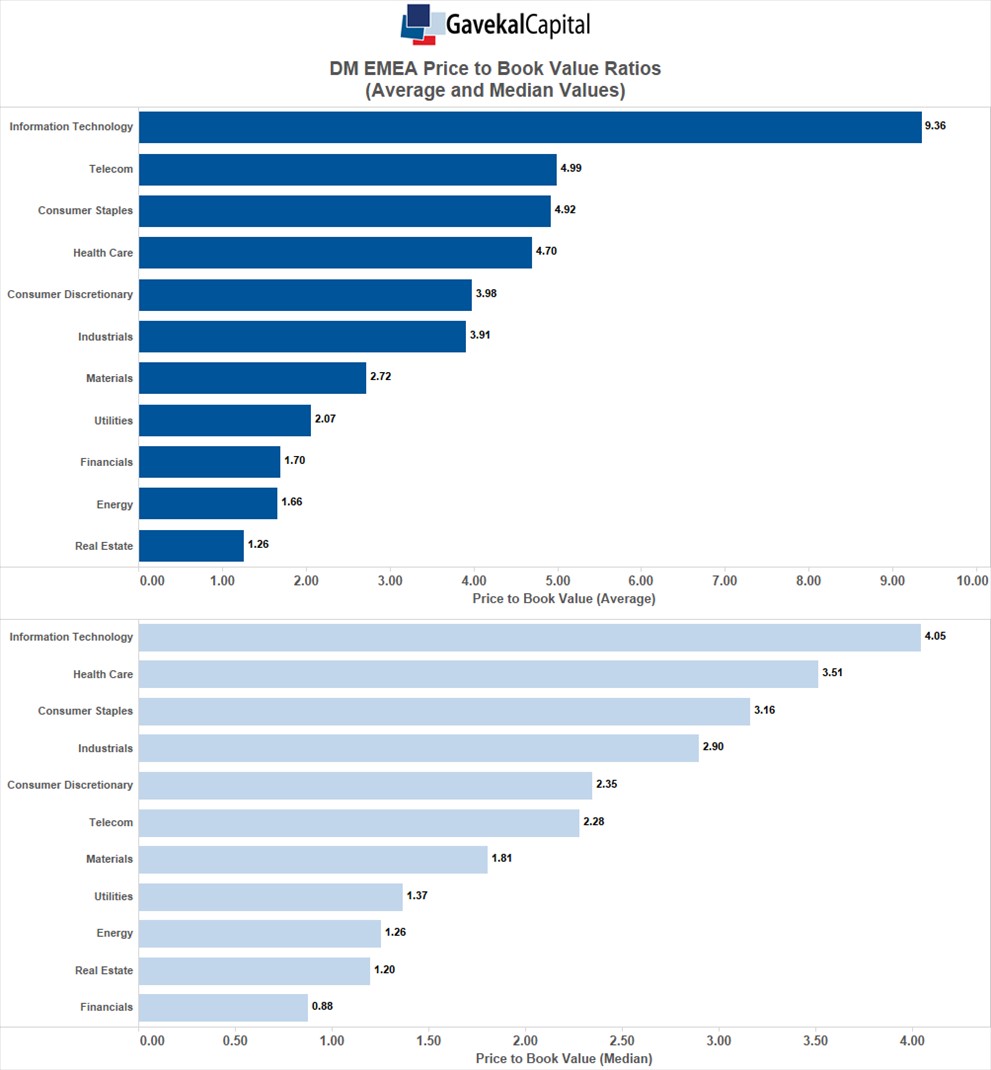

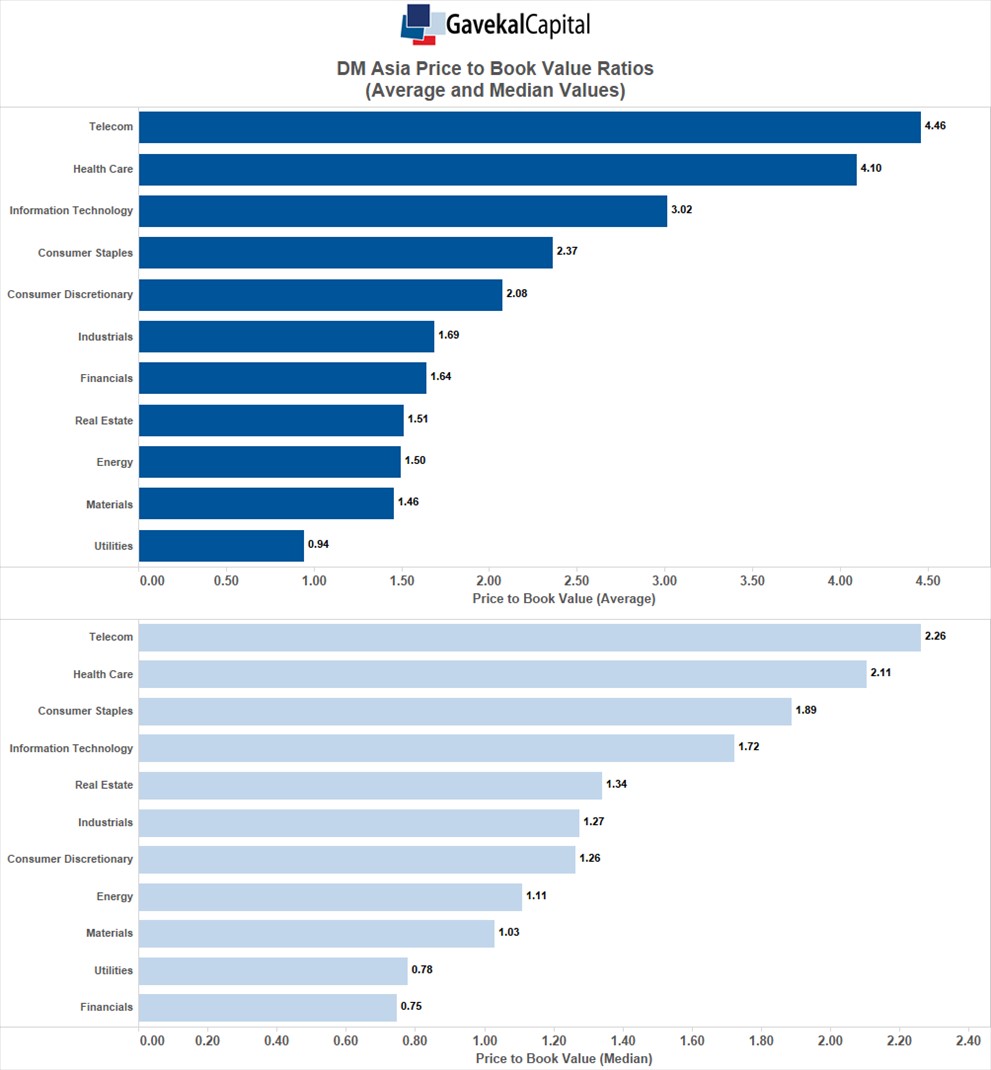

On a price to book value basis, DM Asia health care, industrials, information technology, and materials all look compelling compared to their regional peers. You could even throw in consumer discretionary and consumer staples in to that category since, for example, median DM Asia consumer discretionary stocks are trading at 1.3x compared to 3.5x in DM Americas. There is a very large discrepancy in price to book value ratios for DM EMEA information technology depending on if you look at average or median values. Using average values, DM EMEA information technology looks very expensive at 9.4x book value which is by far and away the most expensive sector in any region on a price to book value basis. However, using median valuations, DM EMEA doesn’t look nearly as rich at 4.1x book value.

Copyright © Gavekal Capital