by Lance Roberts, Clarity Financial

Howard Marks once stated that being a “contrarian” is tough, lonely and generally right. To wit:

“Resisting – and thereby achieving success as a contrarian – isn’t easy. Things combine to make it difficult; including natural herd tendencies and the pain imposed by being out of step, particularly when momentum invariably makes pro-cyclical actions look correct for a while. (That’s why it’s essential to remember that ‘being too far ahead of your time is indistinguishable from being wrong.’)

Given the uncertain nature of the future, and thus the difficulty of being confident your position is the right one – especially as price moves against you – it’s challenging to be a lonely contrarian.”

The problem with being a contrarian is the determination of where in a market cycle the “herd mentality” is operating. The collective wisdom of market participants is generally “right” during the middle of a market advance but “wrong” at market peaks and troughs.

This is why technical analysis, which is nothing more than the study of “herd psychology,” can be useful at determining the point in the market cycle where betting against the “crowd” can be effective. Being too early, or late, as Howard Marks stated, is the same as being wrong.

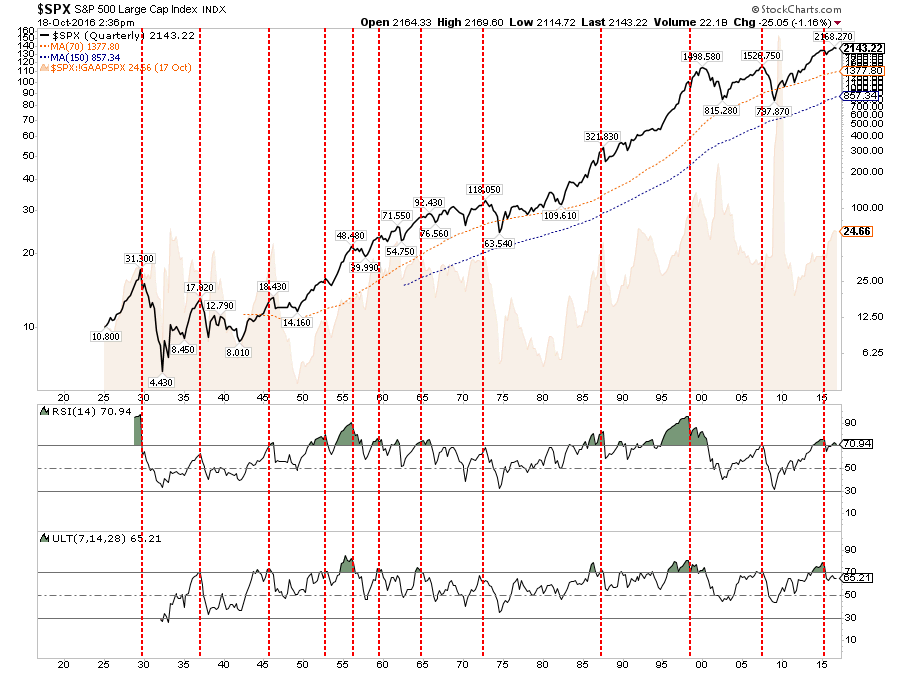

The chart below is a historical chart of the S&P 500 index based on QUARTERLY data. Such long-term data is NOT useful for short-term market timing BUT is critically important in not only determining the current price trends of the market but potentially the turning points as well.

While valuation risk is certainly concerning, it is the bottom to parts of the chart above that are the most concerning. When the long-term indicators have previously been this overbought, further gains in the market have been hard to achieve. However, the problem comes, as identified by the vertical dashed lines, is when these indicators reverse course. The subsequent corrections have not been forgiving.

Furthermore, virtually all internal measures of the market are also throwing off warning signals that have only been seen at previous major market peaks.

These “warning” signals suggest the risk of a market correction is on the rise. However, all price trends remain within the confines of a bullish advance. Therefore, while portfolios should remain tilted toward equity exposure “currently,” the risk of a sizable correction has risen markedly in recent months.

The mistake that most investors make is trying to “guess” at what the market will do next. Yes, the technicals above do suggest that investors should “theoretically” hold more cash. However, as we should all be quite aware of by now, the markets can “irrational” far longer than “logic” would suggest. Trying to “guess” at the next correction has left many far behind the curve over the last few years.

This is the “Howard Mark’s” problem defined. There are plenty of warning signals that suggest that investors should be getting more cautious with portfolio allocations. However, the “herd” is still supporting asset prices at current levels based primarily on the “fear” of missing out on further advances. Becoming too cautious, too soon, leads to“emotionally” based decision making which generally turns out compounding the problem.

As Mr. Marks suggests, being a “contrarian” is a tough and lonely existence.

The Most Powerful Force – Reversion To The Mean

One of the primary issues currently being ignored by the markets is the inherent risk of mean reversions.

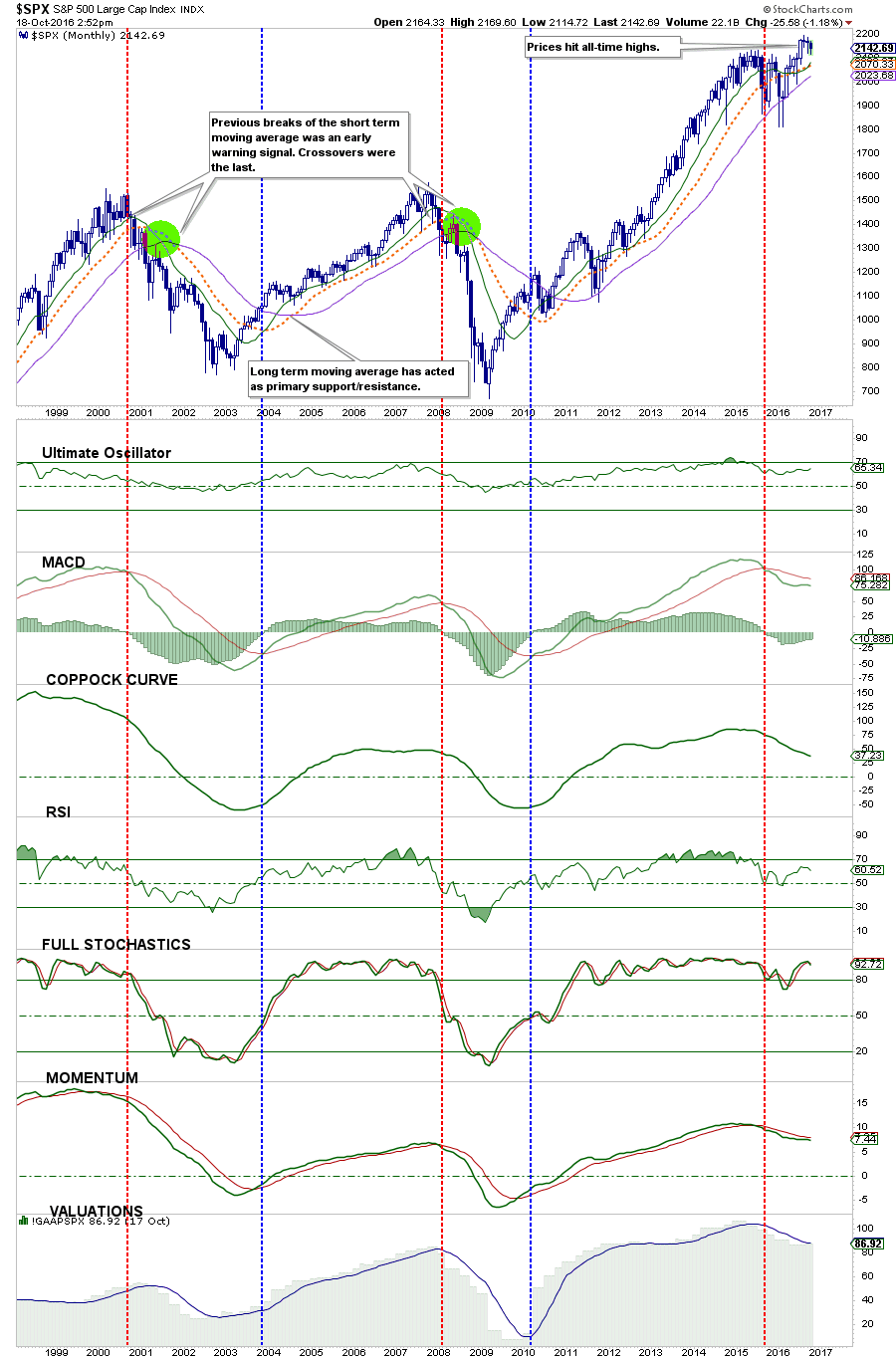

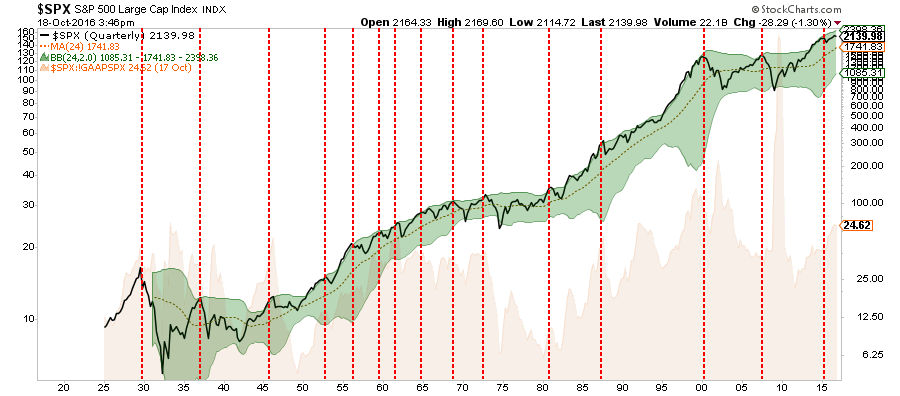

Mean reversions are one of the most powerful forces in the financial markets as, like gravity, moving averages provide the gravitational forces around which prices oscillate. The chart below shows the long-term view of the S&P 500 as related to its long-term 2-year moving average.

Not surprisingly, when prices deviate too far from their underlying moving average (2-standard deviations from the mean) there is generally a reversion back to the mean, or worse.

As you will notice, the bear markets in 2000 and 2007 were not just reversions to the mean but rather a massive reversion to 2-standard deviations below the mean. Like stretching a rubber band as far as possible in one direction, the snap-back resulted in large advancing cyclical bull markets.

The problem, is these cyclical bull markets are quickly believed to be the beginning of the next secular multi-decade bull market. However, as discussed on Monday, this is currently unlikely the case given the lack of economic dynamics required to foster such a secular period.

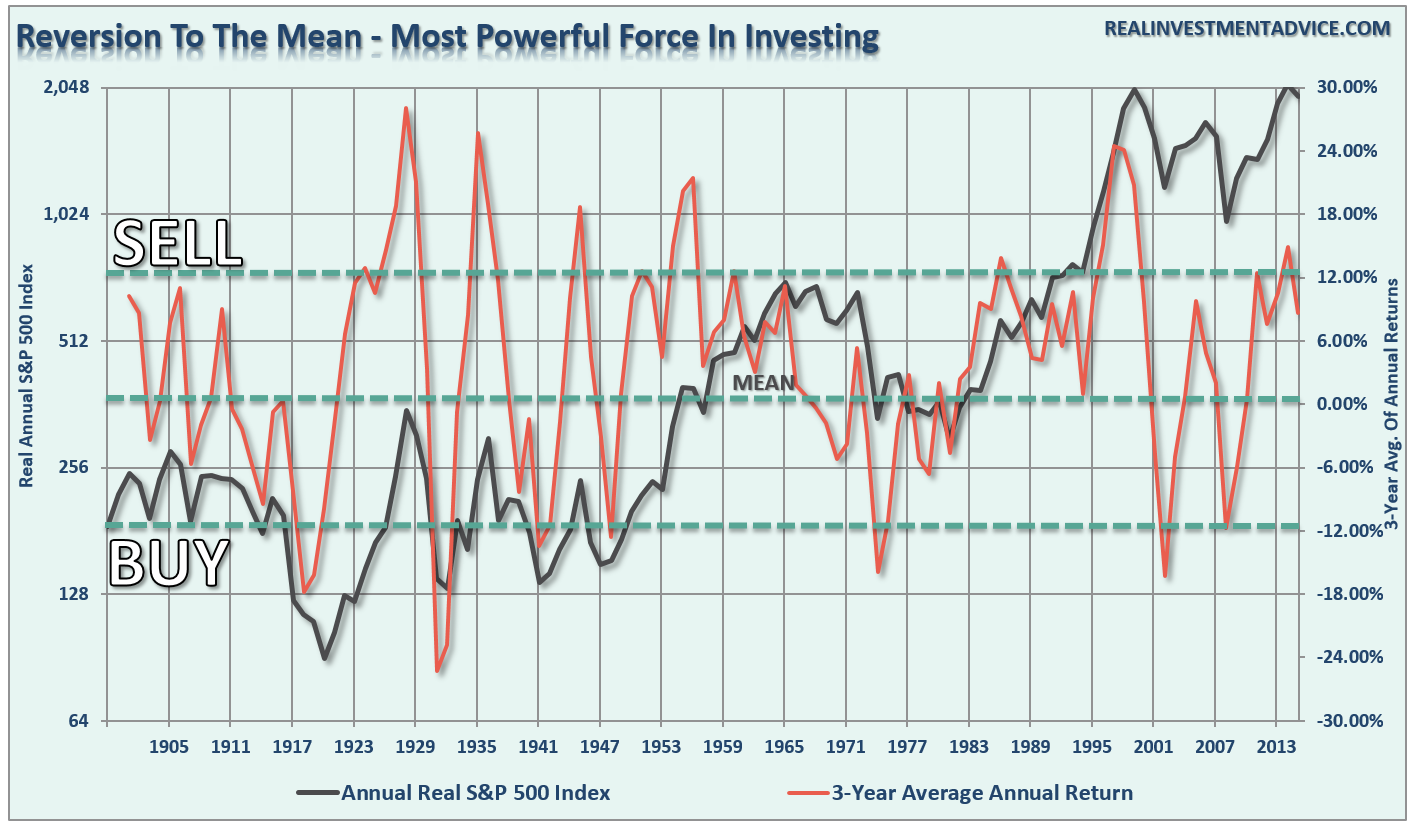

The chart below brings this idea of reversion into a bit clearer focus. I have overlaid the 3-year average annual real return of the S&P 500 against the inflation-adjusted price index itself.

Historically, we find that when price extensions have exceeded a 12% deviation from the 3-year average return of the index, the majority of the market cycle had been completed. Currently, over the last year, the markets have failed to make much of an advance as prices had exceeded 12% historical deviation.

While this analysis does NOT mean the market is set to crash, it does suggest that a reversion in returns is likely. Unfortunately, the historical reversion in returns has often coincided at some juncture with a rather sharp decline in prices.

Stocks On The Wrong Side Of A Rate Hike

It’s been an interesting few weeks for interest rates. As I discussed this past Tuesday:

“With interest rates extremely overbought, the reflexive bounce in rates following the flight to “safety” for the “Brexit” is now functionally complete. This rise in rates is both a blessing and a curse.”

What is interesting is the main spin from the media is rates are rising in anticipation of a Fed rate hike in November or December. The hike, of course, is predicated on a recovery in economic growth and higher rates of inflation which currently, outside of higher health care costs and rent, is nascent at best.

Importantly, there has never been a cyclical bull market in the U.S. stock market that has gone this long without the Federal Reserve increasing interest rates. While much of the mainstream media continues to expect valuations to keep rising, one has to wonder if they are asking too much if history is any guide.

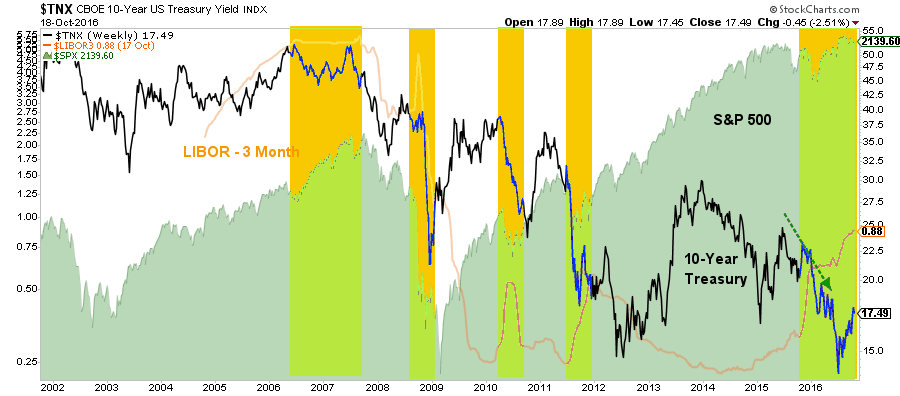

The chart below shows the 3-month LIBOR which has already risen sharply in recent months. Unlike the Fed Funds rate, LIBOR actually impacts many variable rate type loans. Higher borrowing costs negatively impact consumer spending and ultimately economic growth. However, in particular, periods of increases in LIBOR have been associated with stock market corrections or worse.

Furthermore, if the FOMC begins to raise short-term interest rates further, the current environment is actually worse now than December of 2014 when the first hike was done. Economic growth is weaker, corporate profits have declined, debt and leverage are at or near record levels, the US Dollar is stronger and markets are starved for liquidity. This suggests, that further increases in interest rates may not go so smoothly in terms of the impact on financial asset prices.

Again, just as a reminder, higher interest rates are a brake on economic growth. Given that “low interest rates” have been a primary argument used to justify high stock valuations, rising rates will nullify that support.

Sure, this time could be different. But that is probably a bet with very low odds of actually winning.

Just some things I am thinking about.

Lance Roberts

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of “The Lance Roberts Show” and Chief Editor of the “Real Investment Advice” website and author of “Real Investment Daily” blog and “Real Investment Report“. Follow Lance on Facebook, Twitter and Linked-In

Copyright © Clarity Financial