Confused?

by Blaine Rollins, CFA, 361 Capital

Mixed messages in the markets are causing confusion. The initial start to the Q3 earnings period turned positive with better-than-expected results from CSX, JP Morgan and Citigroup offsetting the misses at Alcoa and Ilumina. Unfortunately, some mixed Chinese trade data, a plunging British Pound on hard Brexit talk, and political shifts affecting Healthcare, gave investors other things to worry about besides earnings. And while the exit of the Wells Fargo CEO was not a surprise, the news of it likely took some wind out of the sails of Bank stock investors. But with weekend polls showing that U.S. voters are willing to split their votes, it is unlikely that there will be a complete Democratic sweep in three weeks. Current numbers suggest that the Republicans will keep the House majority forcing the two parties to work together if they want to get something done in Washington. Of course, the best news for today is that we are only 21 days from the 2016 election being over.

The most important breakout last week was in the U.S. Dollar…

A higher US$ makes it much more difficult for equities and other risky assets to appreciate. Better for Small Cap equities which tend to have less non-US$ sales. But all else being equal, portfolio managers would prefer not to see a spiking U.S. dollar. If you are long, hope for a reversal in this chart.

One reason for the U.S. Dollar strength was the confusing Chinese trade data that we received last week…

“The disappointment in the September trade report looks somewhat puzzling, considering recent constructive signals. For instance, the export order component in the September Markit manufacturing PMI rose to 50.1, the highest level since November last year.” (JPMorgan)

Maybe the Chinese trade data was overly affected by the Hanjin shipping bankruptcy because weakness was not showing up in other important data series like electricity usage…

CHINA’S power use growth, a key barometer of economic activity, accelerated in September due to more consumption by the service sector, an increasingly significant driver of the Chinese economy, official data showed yesterday.

A total of 496.5 billion kilowatt-hours of electricity was consumed last month, up 6.9 percent year on year, according the National Development and Reform Commission.

The growth was in sharp contrast to a 0.1 percent drop in the same period of 2015 and extended year-on-year increases seen since July.

Electricity consumed by the service sector expanded rapidly in September, with information, computing and software industries surging 17.1 percent year on year, NDRC official Zhao Chenxin said.

Power use by commerce, hospitality and catering industries grew 14.5 percent, while financial and real estate industries as well as business and residential services rose 15.5 percent.

And Alcoa had good things to say about its China business…

China could actually be better than what we saw in the last quarter:

“On China, we actually believe that it’s going to be better than what we saw in the last quarter, 6% to 8% we see here up from the 3% to 5% that we saw before. Production is up almost 11%, sales up 11%, and some of the legislation is helping us to get boosted. So that’s the picture on automotive.”

We also know Intel, and other semiconductor manufacturers, are seeing good numbers which has led to strong stock prices, which are highly correlated with Global PMI…

(JPMorgan)

A look through the YTD returns shows only a handful of assets with gains or losses in each time frame…

Those names winning in the one-week, one-month, three-month and YTD time frames…

And those names losing in each of the one-week, one-month, three-month and YTD time frames…

It is usually safer for stock prices to enter an earnings period with low expectations and pressured stock prices…

Based on their 50-day moving averages, most sectors are oversold going into Q3 reporting season. Now if investors could only ignore politics and the US$ strength, then maybe we could get some good reactions to those companies posting better-than-expected results.

(@bespokeinvest)

Case in point was JP Morgan which had a much better-than-expected Q3. Unfortunately, with all the Fed speak causing violence in Bonds and the US$ and Politics crushing Healthcare stocks, JPM finished lower on their good numbers…

Net interest income was $11.9 bln, up 6%, primarily driven by loan growth and the net impact of higher rates, partially offset by lower investment securities balances.

Noninterest revenue was $13.6 bln, up 10%, primarily driven by the Corporate & Investment Bank.

Noninterest expense was $14.5 bln, down 6%, driven by lower legal expense, partially offset by higher compensation expense.

Net revenue was up for all major groups: Consumer & Community Banking (+4%), Corporate & Investment bank (+16%), Commercial Banking (+14%), and Asset Management (+5%).

Average core loans increased 15% year-over-year and 2% quarter-over-quarter.

Tangible book value per share—a key financial performance measure—increased to $51.23 from $47.36 in the same period a year ago.

Return on tangible common equity—also a key financial performance measure—held steady versus the second quarter at 13%.

Total deposits increased 8% to nearly $1.4 trillion; and net yield on interest-earnings assets was 2.24% versus 2.16% last year.

(Briefing)

Another factor to flow through corporate earnings will be the weather. It was just too warm for retailers to get their fall seasonal sales going which hit last week’s Retail Sales figures…

Looking straight at core retail sales (ex auto’s, gasoline and building materials) in September saw a gain of just .1% m/o/m, three tenths less than expected after a .1% decline in August. The strength in sales was seen in auto’s and building materials with sales gains up 1.1% and 1.4% respectively. Core sales grew by just 2.5% y/o/y, the slowest pace of gain since November 2015.

What followed the core retail sales miss was a cut in the Atlanta Fed GDP. Now Q3 estimate to 1.9% from 2.1%. Their estimate was 3.8% two months ago.

Also adding to future woes will be Hurricane Matthew. As a result of warm weather and the hurricane, JP Morgan took down numbers on four of the department store companies on Friday…

And as mentioned above, the lower Retail Sales pushed the Atlanta Fed to lower its Q3 GDP forecast…

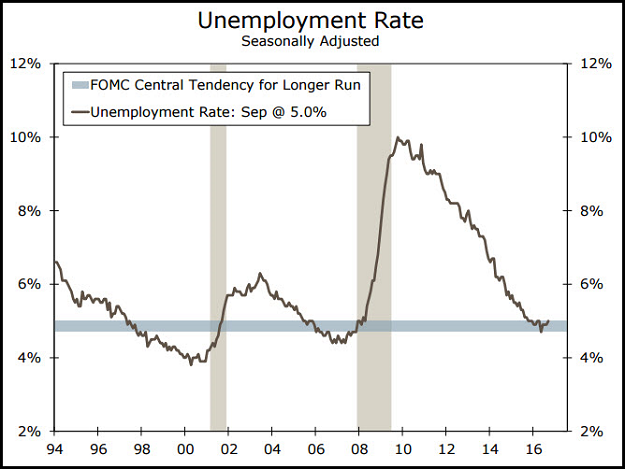

While the environment is affecting retail sales, it seems to be having no impact on job growth which continues to click along…

“My own view is that if the unemployment rate falls as much as I’m expecting, then it is possible that we’ll have to raise rates faster than the summary of economic projections,” Rosengren said in an interview with CNBC.

Rosengren said he thinks the unemployment rate will drop to around 4.5% by next year. He said he was concerned this was unsustainable, and may force the Fed to hike rates much more quickly than he hoped would be needed.

While the economic data sends mixed signals, 10-year bond yields have one direction… higher.

JP Morgan debates if stocks can break from bonds and move higher while bonds sell off…

On the positive side of the ledger for stocks are (1) reduced imminent recession risk; (2) a forecast rebound in global growth from the low part of the range to the higher part; (3) higher output price inflation that together with higher real growth should raise global nominal GDP by 1%, translating into a ~10% rise in profit growth; (4) reduced uncertainty about the US elections; (5) a rising likelihood of a modest US infrastructure spending bill; and (6) a global retail investor who this year net sold equity funds in favor of credit, something they previously only did in a recession.

(JP Morgan)

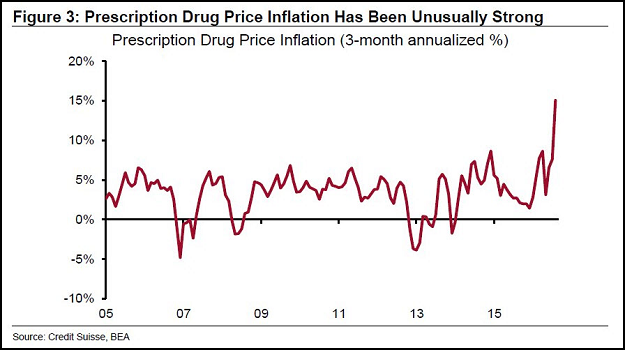

Will this become one of the most popular charts in Congress in 2017?

@georgepearkes: CS thinks pharma price explosion is going to become a headwind for PCE over months.

California voters are about to front run any drug pricing restrictions by Congress next year…

California voters are set to weigh in on a referendum known as Proposition 61. That proposed law would mandate that state agencies would pay no more for prescription drugs than the price paid by the Department of Veterans Affairs. The federal agency by law is owed steep discounts from a given drug’s list price and is also empowered to further negotiate on price.

Polls suggest the measure has a realistic chance of passing.

(WSJ)

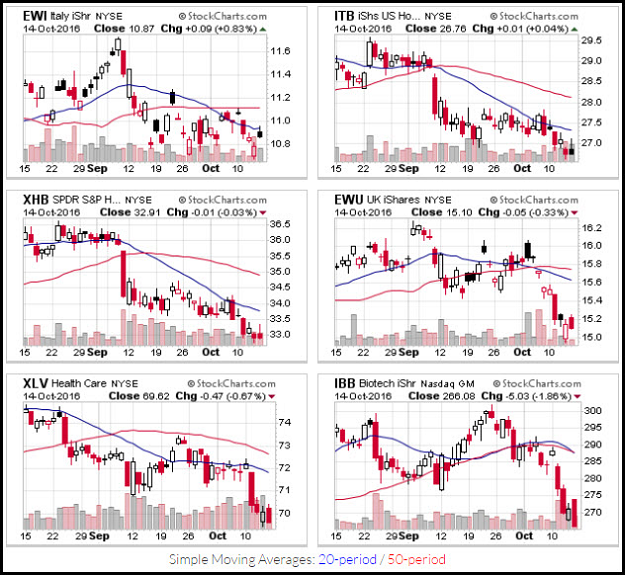

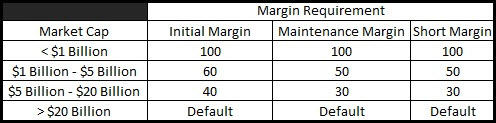

Even one brokerage firm is worried about its investors exposures to drug and biotech stocks…

@GRDPnL: $IBKR raising risk-based margins from 15% to 20% for Pharma & Biotech stocks over 5 daily 1% increments

Due to increased event risk in the Biotechnology and Pharmaceutical sectors, margin requirements which take into consideration the market capitalization of the individual security will go into effect starting October 11, 2016. These Initial, Maintenance and Short position margin requirements are outlined in the table below. Please note that these represent minimum requirements and individual securities may be subject to other house charges which may result in a higher Initial, Maintenance or Short margin requirement.

It was a tough week for Healthcare, and especially Biotech stocks…

Assuming the polls are correct, and the GOP will keep the House, then the relationship between Paul Ryan and Hillary Clinton will become very important…

One such area could be an infrastructure spending bill, which Clinton has said would be an immediate priority. Ryan, too, has in the past year privately reached out to top Democrats about beginning infrastructure talks, which the U.S. Chamber of Commerce and other pillars of the Republican establishment have championed.

Clinton also would seek to work immediately on an overhaul of immigration law, an issue that Ryan has advocated but that has become anathema in parts of the Republican conference. It is possible that a Trump loss in November could shift political winds in the GOP, creating momentum for Ryan to consider starting discussions.

“It’s got to be done in stages and pieces, not some big, massive bill that ends up collapsing under its own weight,” Ryan said at the Economic Club about the prospect of an immigration pact next year.

There are other areas of mutual agreement, such as on criminal justice. Clinton and Ryan have expressed concern about mass incarceration and advocated changes to sentencing laws, and there are bipartisan efforts afoot.

Another issue is fighting poverty, something Clinton and Ryan prioritize, although they have clear disagreements on the solutions. Ryan sees it as his personal mission and thrust it to the forefront of the GOP policy agenda. His confidants said he would feel invested in reaching an anti-poverty accord with Clinton.

What makes a market is when two investors do not see eye-to-eye. Clearly Dr. Damodaran is not a fan of how Bernstein approaches valuations…

“This piece by Bernstein tells me more about how DCF is practiced (or mangled) at Bernstein than it does about DCF itself. As the piece indicates, a Bernstein DCF is a Robo DCF where as the risk free rate changes, nothing else does and not surprisingly the value goes up.

In reality, the risk free rate is part of a macro economic ecosystem that is interconnected. As the risk free rate has dropped, it is reflecting lower economic growth and inflation (which should be showing up as lower growth rates in your cash flows) and higher risk premiums (the same factors driving down risk free rates are increasing risk worries). The net effect is what drives value.

If there is a message in this Bernstein piece, it is that you should not trust DCFs done by Bernstein and by extension their active money management practices, which they so absurdly defended in their piece on how passive investing is leading us to serfdom.”

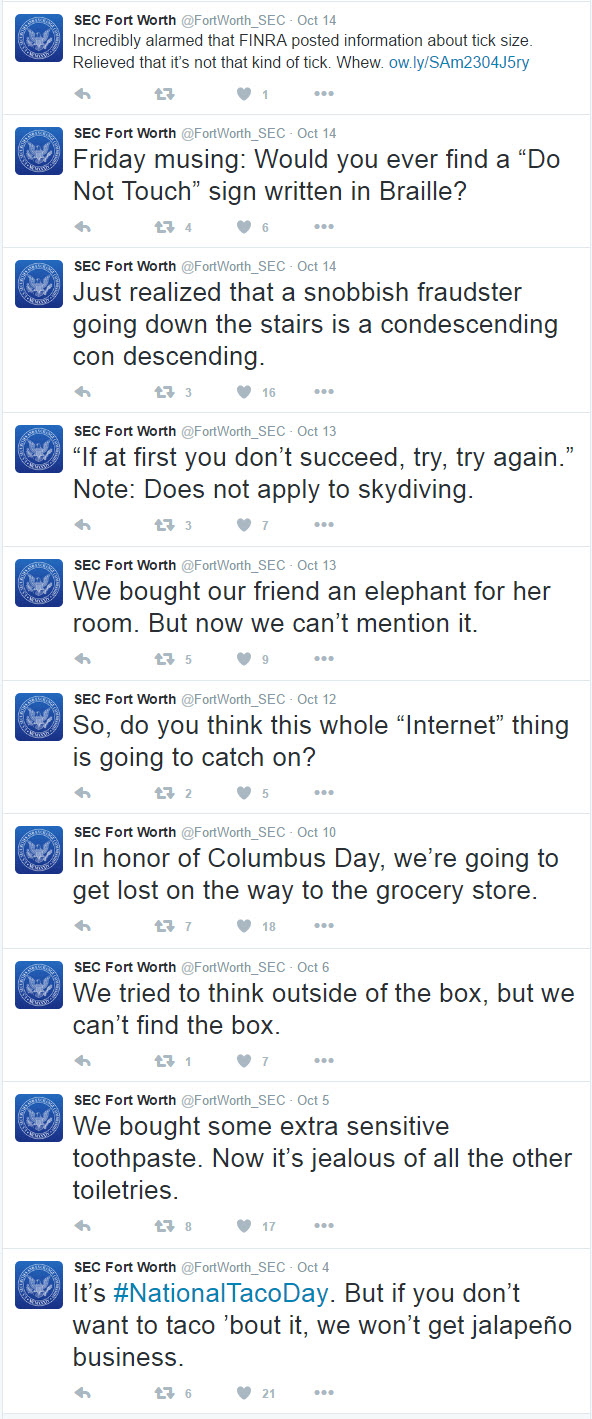

Finally, who says the SEC twitter account can’t be funny?

Here is a sampling of some of the Ft. Worth office’s tweets from October. The upcoming tweet war between @FortWorth_SEC and @SenWarren might need its own late night TV segment on Jimmy Fallon.

Copyright © 361 Capital