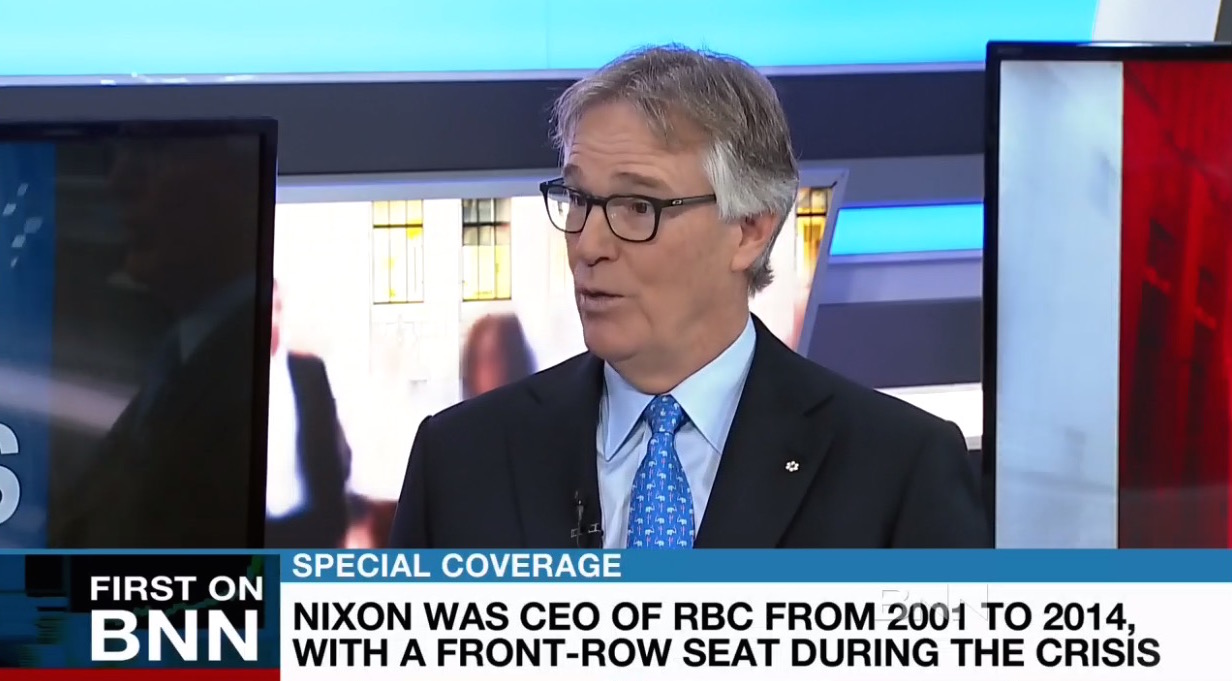

- The former head of Canada’s largest bank says new mortgage rules aimed at cooling hot housing markets are “reasonable” but says fears of a housing crash are overblown. “The pundits have been raising red flags on the Canadian housing market for more than five years – and have been consistently wrong,” Gord Nixon, former CEO of RBC, told BNN in an interview Tuesday.

- Earlier this month, Finance Minister Bill Morneau unveiled new mortgage rules that force banks to stress test all new insured mortgages at a dramatically higher interest rate. The federal government is also looking at the option of forcing banks to take on more of the risk of mortgages that could default.

- Nixon said those moves are reasonable. “I’m always a little cautious in sort of overstepping government intrusion into natural markets,” he said. “I think being more conservative at a time like this is certainly a natural reaction and not an overreaction.”

Source: BNN