Train wreck...

by Blaine Rollins, 361 Capital

There was only one story over the weekend and it had nothing to do with the Judd Apatow movie. Any GOP candidate with a car hooked to the Trump train has now derailed. With the RNC pulling ad support, ground troops defecting and voters pulling up their yard signs, the Trump locomotive will be going at it alone. Many House and Senate members began to defect away from the POTUS candidate over the weekend, and it is likely that party leaders will shift all efforts to trying to keep one chamber of Congress. There won’t be new good polling data until mid-week which should reflect both Friday’s video and Sunday’s debate. But it does not take a rocket scientist to determine how the new polls will shift. I agree with my wife, and most other voters in this election, and would like to hit the ‘Reset’ button so that we can put both political parties’ derailments behind us. Hear me now David Fincher, I dare you to top real life in House of Cards season five.

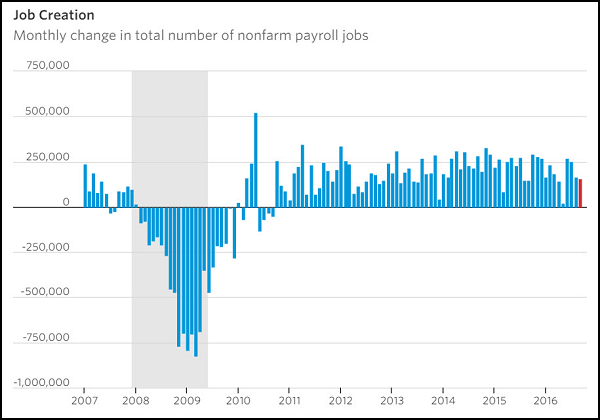

Before Twitter blew up Friday afternoon, the Department of Labor did post the monthly Jobs numbers in the morning…

A Non-Farm Payroll gain of +156k was about as exciting as your typical library hall banter. But actually, boring growth is good for the risk markets because it keeps the Fed in a healthy debate and interest rates in check.

(WSJ)

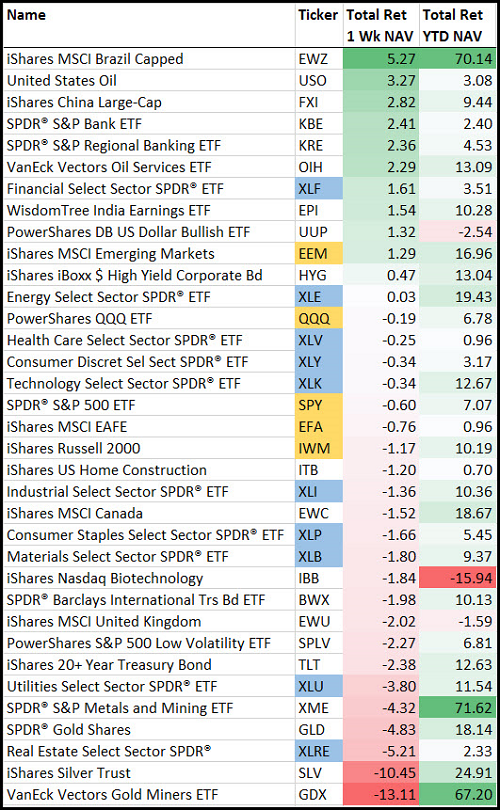

For the full week, it was a more difficult one for risk as falling Bond prices took center stage…

ECB taper tantrums led the worries which created ripples into the Forex and Commodities markets. Equity yield proxies (Utes, REITs, Staples) again suffered, while Bank and Financial stocks enjoyed the upward glide in rates. Gold, Silver and Mining took a shovel to the head with the big move up in the U.S. Dollar and the ECB backing away from stimulus. Emerging Markets outperformed—helped by both rising Energy prices and specific issues in both Brazil and China.

(Prices as of 10/7/16)

Crude Oil continues to make gains as OPEC’s collusion to raise prices gathers steam…

Stability in Crude Oil taking prices above $50 is a significant positive for Energy credits…

@jsblokland: ICYMI! The US high yield energy spread has tightened by almost 1000 bps since #oil bottomed in February.

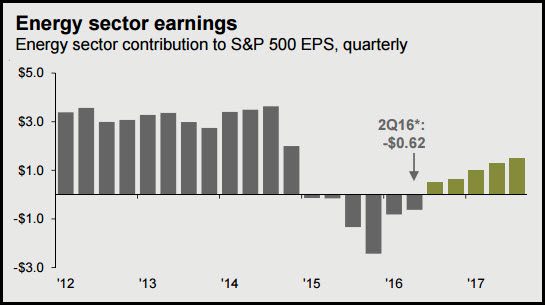

Rising energy prices will also occur at the same time that Energy companies will be turning the corner and reporting positive Q3 earnings…

We can’t blame the XLRE separation from XLF as the reason for its underperformance, but we can observe the two post spin…

Interest rate hike talk in the U.S., less accommodation by the ECB and a stronger U.S. dollar = worrying news for Gold.

Will the 200 day moving average be a rubber bumper or a new ceiling?

Among other news in the world, Q3 earnings start up this week. Goldman is doing its best to keep your expectations low…

Negative changes in most macro variables suggest 3Q earnings will disappoint relative to expectations (see Exhibit 3). The conclusion is based on our analysis that utilizes five macro factors that have historically been correlated with earnings surprises: US economic growth, interest rates, oil price, the dollar, and consensus EPS revisions. Of the five factors, four have shifted in a direction that typically weighs on earnings surprises. Oil price change is the only factor that should positively contribute to 3Q surprises. During the last 15 years (60 quarters), an average of 46% of S&P 500 firms reported EPS results more than one standard deviation above consensus estimates. Our model suggests that a modestly below-average share of firms (43%) will post positive EPS surprises in 3Q.

(Goldman Sachs)

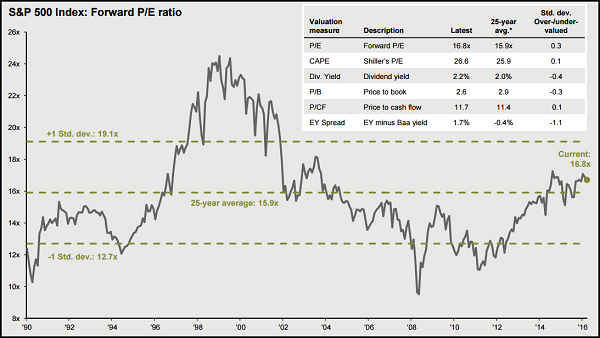

For a glance at market valuations, JP Morgan presents a mixed picture…

But stocks still much cheaper than bonds focusing on Earnings Yields versus Bond Yields.

Big, long thoughts from Eric Peters which all kids, millennials and a few of us old guys can foresee…

2026: “In ten years I see banks making no money,” said the Lithium, hands free on Highway One. “I see auto companies making no money, oil companies making no money.” That’s zero. “The oil thing is obviously coming to an end, and if you don’t have a growing population, it’s not clear that you need a growing banking sector.” Driverless automobiles will collide with state sponsorship of manufacturers, ensuring overcapacity. “Maybe landlords make some money, healthcare companies too, and technology firms that control retail transactions.”

(EricPeters/WkndNotes)

Additionally, others close to making no money will be the TV networks and local broadcasting stations…

So far this NFL season, TV networks have missed their estimates by about 20 percent, requiring them to offer advertisers what the industry calls “make-goods,” according to one ad buyer who asked not to be identified discussing private information.

A larger-than-expected number of make-goods so far is stoking concern that the NFL may be in trouble. Last year, one buyer purchased 100 NFL ad spots and got six free commercials to make up for ratings that fell short of estimates. This year, that same buyer acquired 100 ad units and expects to get about 10 make-goods.

The decline in NFL viewership raises new questions about the invincibility of live sports at a time of great anxiety for the media industry, marked by a loss of subscribers to conventional cable and satellite services, falling broadcast-TV ratings and fierce competition from digital outlets. And National Football League games aren’t alone. The Olympics on NBC and the U.S. Open tennis tournament on ESPN also drew fewer viewers than previous years.

As the hedge fund shorts begin to unwind and take their profits in DeutscheBank, maybe there is value in the long side…

Of course you need to get comfortable with their $70 trillion derivatives book. But in a world that is flush with capital, maybe this analysis by Dr. Damodaran is worth your time.

(Musings on Markets – @AswathDamodaran)

Copyright © 361 Capital