by LPL Research

The impact of elections on stock returns has been a hot topic recently, but less is written on the impact on bond markets. We explored the impact of elections on the 10-year Treasury yield in May (see the Bond Market Perspectives, “Bonds in an Election Year”) and today we look at the impact on total returns for the Barclays Aggregate Bond Index.

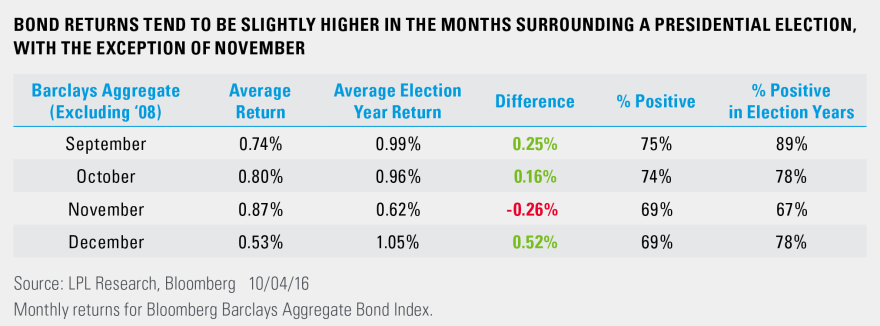

As the chart below shows, since the Barclays Aggregate was created in 1976, average election year returns for the index over the last four months of the year have been slightly higher than non-election years, with the exception of November. Looking at the percent of time that total return was positive for the month, November also sticks out. While most months show a higher percentage of positive returns in election years, November is actually lower.

As with any presidential election study, the sample size is limited, with only 10 elections taking place since the Barclays Aggregate Bond Index was created. Additionally, we chose to remove 2008 returns as they were outliers (to the downside in September and October, and to the upside in November and December).

Overall it appears that bond total returns over the last four months of election years tend to be higher than non-election years, with the exception of November. However, differences in average returns are small, and Federal Reserve policy, economic growth, and inflation expectations are likely to remain larger drivers of bond returns than elections.

***

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

The Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS (agency and non-agency).

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-542415(Exp. 10/17)

Copyright © LPL Research