by Eric Bush, CFA, Gavekal Capital

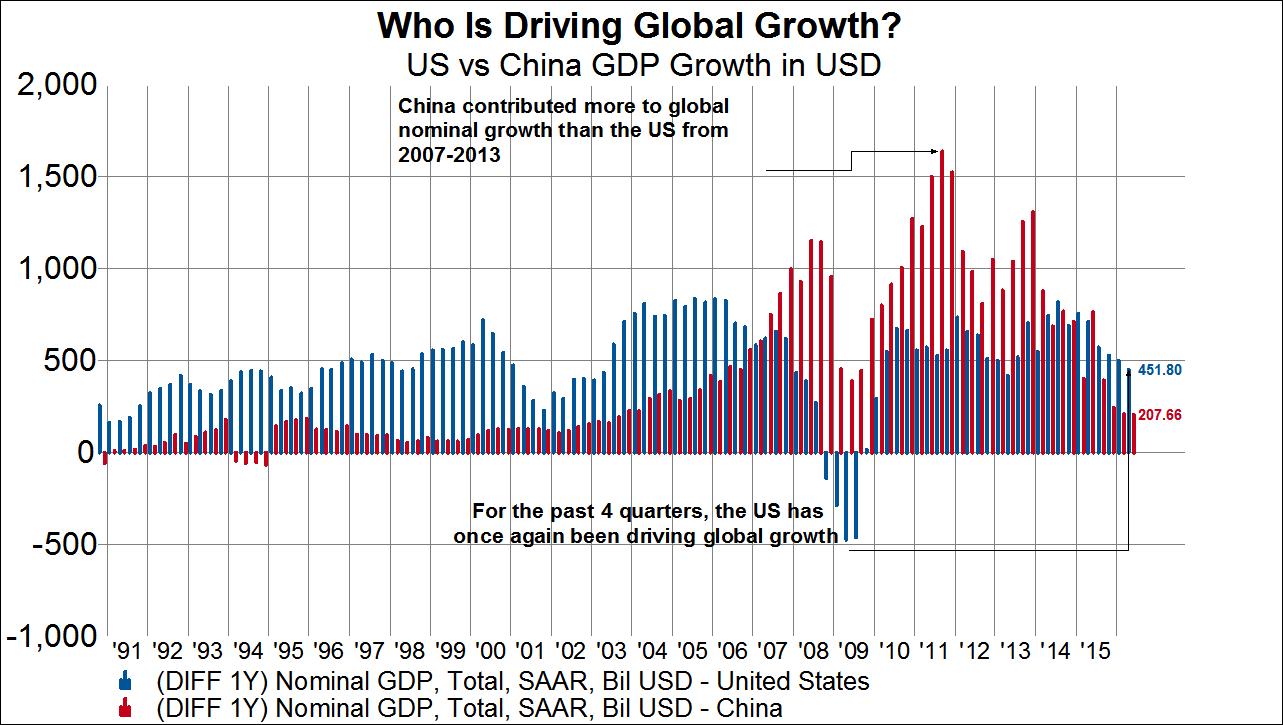

China’s role in keeping the global economy from falling into a more severe recession, or even a depression, during the financial crisis is probably greatly underappreciated. As US nominal GDP went from contributing $435 billion to global economic out put in the 1Q08 to subtracting $472 billion in 2Q09, China’s nominal GDP kept overall global economic output afloat. Granted, China’s nominal GDP contribution to global GDP did slow from $1.2 trillion in 2Q08 to $390 2Q09. It quickly rebounded (thanks to questionable fiscal stimulus) and eventually peaked out at more than $1.6 trillion in the 3Q11.

Investors everywhere are now very familiar with the growth concerns that have plagued China over the past few years but may not have realized just how far China’s impact on the global economy has fallen. Similar to the period prior to the financial crisis, the US is once again contributing more to global nominal GDP growth. In the latest quarter, the US actually contributed over 2x as much to nominal global GDP than China. All of this is to say that unlike the 2007-2013 period, the US is now the driver of economic growth in the world. The US has added, on the margin, more to global economic output than China over the past four quarters.

(note: all GDP data above is SAAR in USD)