When Are Roth IRA Distributions Tax-Free?

by Commonwealth Financial Network

As you’re probably aware, not everyone can contribute directly to a Roth IRA. Those with a modified adjusted gross income of more than $132,000 (single) or $194,000 (married filing jointly) in 2016 will be completely phased out and will have to find a different retirement savings strategy (e.g., the backdoor Roth IRA). But for those whose incomes are below the established thresholds, a Roth IRA can be a powerful retirement tool.

As you’re probably aware, not everyone can contribute directly to a Roth IRA. Those with a modified adjusted gross income of more than $132,000 (single) or $194,000 (married filing jointly) in 2016 will be completely phased out and will have to find a different retirement savings strategy (e.g., the backdoor Roth IRA). But for those whose incomes are below the established thresholds, a Roth IRA can be a powerful retirement tool.

One of the perks of investing in a Roth IRA is tax-free growth; funds are also generally more accessible from a Roth IRA than from a traditional IRA, especially if a client needs to withdraw funds early. Although clients can withdraw their regular contributions at any time, tax- and penalty-free, this isn’t the case for earnings on those contributions or for Roth conversions and rollovers. So, when are Roth IRA distributions tax-free? To answer this question, you must first understand the five-year rule.

When it comes to Roth IRA contributions, conversions, and rollovers, it’s essential that you and your clients understand exactly when the five-year clock starts and ends. Each bucket has its own clock and its own set of rules. If your client taps into Roth funds too soon, he or she could unintentionally trigger taxes, penalties, or both.

Contributions. The five-year clock for withdrawing tax-free earnings begins on January 1 of the tax year in which the client’s first contribution to any individual Roth IRA is made. The clock ends on December 31 of the fifth year. (Note that the contributions themselves can always be withdrawn without tax or penalty.) Let’s look at an example to illustrate this point:

If a client makes his first Roth IRA contribution on March 1, 2016, for tax year 2016, the clock would begin on January 1, 2016, and end on December 31, 2020. A distribution made on January 1, 2021, would satisfy the five-year rule.

Any subsequent contributions the client makes (e.g., in 2017 or 2018) would fall under the same initial five-year clock; all contributions are aggregated together beginning with the client’s first contribution to any Roth IRA.

Converted assets and rollover money. The five-year clock for a penalty-free withdrawal of principal begins on January 1 of the tax year in which the conversion or rollover occurred and ends on December 31 of the fifth year. So, if your client completed a Roth conversion or rollover on June 1, 2016, the five-year clock would begin on January 1, 2016, and end on December 31, 2020. Unlike with contributions, however, Roth conversions and rollovers have separate five-year clocks; they are not aggregated.

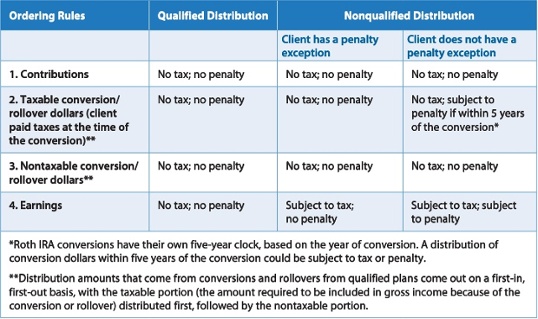

IRS ordering rules for distributions. Although contributions and conversions are reported on IRS Form 5498, clients should maintain their own records to keep track of these transactions. When a client takes a distribution from a Roth IRA, the IRS considers the funds to be distributed from the account in the following order:

- Regular contributions

- Conversion and rollover contributions: Taxable portion first and and then the nontaxable portion

- Earnings on contributions

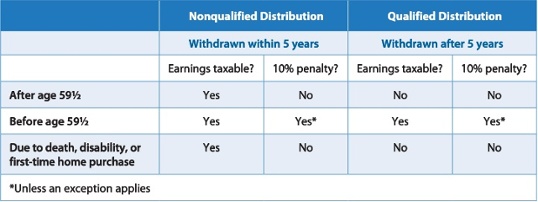

Qualified distributions. Qualified distributions from a Roth IRA are tax- and penalty-free. To be considered a qualified distribution, the account must satisfy the five-year rule and the owner must have attained age 59½ or meet a separate exception to the premature distribution penalty.

To find out if your client can take a tax-free Roth IRA distribution, you’ll need to determine the type of distribution, how the Roth has been funded, and which monies the client is distributing.

Step 1: Determine the type of distribution. Here, you want to know if the distribution is qualified or nonqualified (see chart below). A qualified distribution from a Roth IRA is one that:

- Satisfies the five-year rule; and

- Is made for one of the following reasons:

- After the client reaches age 59½

- Due to death or disability

- To fund a first-time home purchase ($10,000 lifetime limit)

Step 2: Find out what the account balance consists of. Roth IRA rules permit clients to withdraw the nontaxable part of their money first. The first dollars distributed from a Roth IRA are considered to be a return of regular contributions (with the exception of returning excess contributions, which may require the removal of attributed earnings). Per the IRS’s aggregation rules, you’ll essentially need to group all of the client’s Roth IRA balances together and “treat them” as a single Roth IRA to determine the total amounts of the following categories:

- Contributions

- Conversion dollars

- Rollovers

- Earnings

Most custodians don’t keep track of Roth IRA basis. To determine a client’s basis, you’ll need to review his or her tax documents (e.g., 1099s and 5498s), plus account statements. If the client has taken previous distributions from the Roth IRA, you will need to factor those into the calculation as well.

Step 3: Based on the IRS ordering rules, determine which monies the client is distributing. Remember, regular contributions come out first (see chart below), and all of the client’s Roth IRAs are aggregated together like one big Roth IRA.

After you determine which Roth monies the client is distributing, you’ll know how much of the distribution is subject to taxes or if it’s tax-free. If the distribution is nonqualified and greater than the client’s Roth IRA contributions or basis, the amount taken over the basis may be subject to taxes, a penalty, or both. But, again, as long as your client’s distribution is qualified, it is tax-free.

Although the process for determining when Roth IRA distributions are tax-free may seem complicated, by helping your clients understand the ins and outs of the five-year rule and IRS ordering rules, you can maximize the value of their Roth IRA as a retirement planning tool.

Do you recommend the Roth IRA as a retirement planning tool? Have you taken advantage of the backdoor Roth IRA for wealthier clients? Please share your thoughts with us below!

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult your tax advisor or legal advisor regarding your specific circumstances.

Commonwealth Financial Network is the nation’s largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm’s corporate blog.

Copyright © Commonwealth Financial Network