by J. R. Reiger, Managing Director and Global Head of Fixed Income, S&P Dow Jones Indices

High yield bonds have been marching along and putting up returns that are dominating the investment grade bond markets.

U.S. junk bonds continue to have no stink to them as demand for yield far outweighs the supply and seemingly the credit risks associated with these bonds. The bonds of larger entities tracked in the S&P 500 High Yield Corporate Bond Index have returned 15.57% year-to-date modestly out performing the broader S&P U.S. High Yield Corporate Bond Index. The S&P 500 High Yield Corporate Bond Index tracks the junk bonds of issuers of the S&P 500 and as the yields indicate, on average, they tend to be better quality than the bonds in the broader index.

Floating rate senior loans, as tracked by the S&P/LSTA U.S. Leveraged Loan 100 Index have returned over 8.5% year-to-date and are yielding just 110bps lower than fixed rate high yield bonds. Demand for yield combined with the benefits of floating rate interest payments and better security provisions than fixed rate junk bonds all helps to draw attention to this asset class.

High yield municipal bonds have also been in demand and also have benefited from a rally in Puerto Rico bonds. The S&P Municipal Bond High Yield Index, which includes Puerto Rico bonds has returned just about 9.5% year-to-date. Without Puerto Rico bonds the index would have returned 8.19% year-to-date.

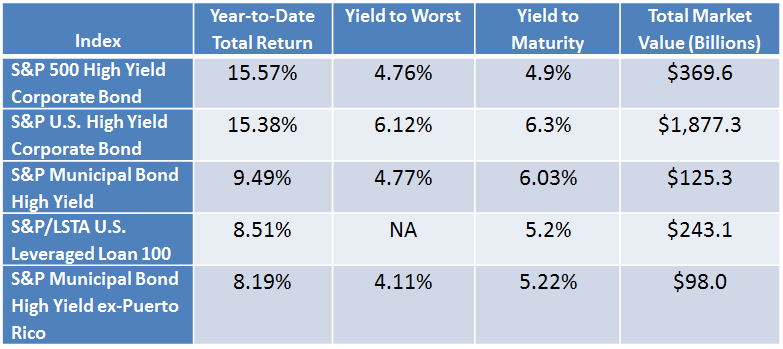

Table 1) Select indices, their year-to-date returns, yields and total market value as of September 30th, 2016:

Source: S&P Dow Jones Indices, LLC. Data as of September 30th, 2016. Table is provided for illustrative purposes. It is not possible to invest directly in an index. Past performance is no guarantee of future results.

This article is a publication of S&P Dow Jones Indices LLC. © S&P Dow Jones Indices LLC 2016. S&P® is a registered trademark of S&P Financial Services LLC. Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. S&P Dow Jones Indices LLC is not an investment advisor. This publication is not a recommendation by S&P Dow Jones Indices to buy, sell, or hold a security, nor is it considered to be investment advice.

Copyright © S&P Dow Jones Indices