by Don Vialoux, Timingthemarket.ca

Observations

The energy sector on both sides of the border led equity prices on the downside. Include solar energy stocks in that category (much to the chagrin of the environmentalists. Solar energy is proving to be an economic challenge as crude oil prices come down)

Encouraging news by Apple and the biotech sector (e.g. Biogen’s good news on a Multiple Sclerosis drug) partially offset weakness in most other sectors. Nice relative performance!

StockTwits Released Yesterday @EquityClock

September Quad Witching historically a volatile event, but next week may be a greater concern.

Editor’s Note: See 50 year study of S&P 500 Index showing performance for the week after September Quad Witching (probably the weakest week of the year)

http://www.equityclock.com/2016/09/13/stock-market-outlook-for-september-14-2016/

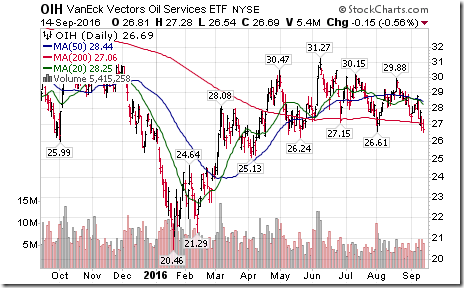

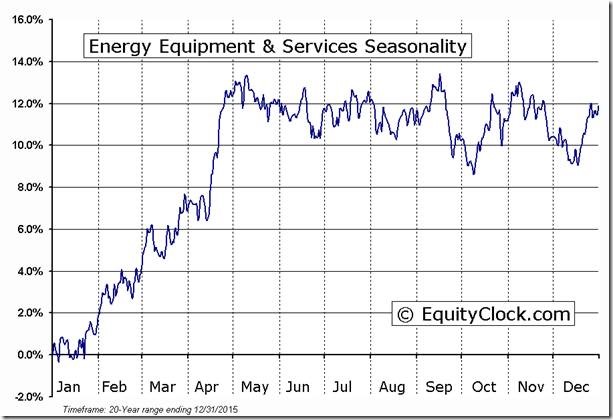

Oil Services ETF $OIH briefly moved below $26.61 extending intermediate downtrend.

‘Tis the season for the oil services sector to move lower to mid-October $OIH

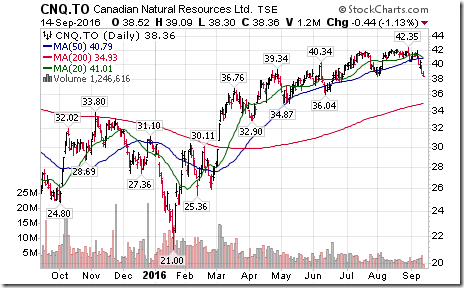

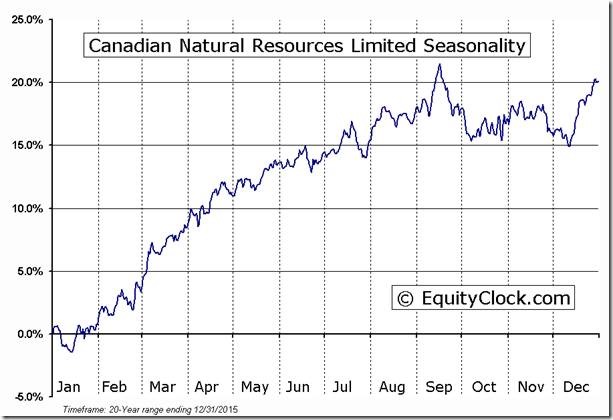

Canadian Natural Resources $CNQ.CA completed a double top pattern on a move below $38.36.

‘Tis the season for Canadian Natural Resources to move lower to the end of October.

Technical action by S&P 500 stocks to 10:10: Quietly mixed. Breakouts: $WYNN, $AAPL. Breakdowns: $XOM, $PDCO

Editor’s Note: After 10:10 AM EDT, another five S&P 500 stocks broke support: IRM, MOS, ALL, LLL and NFX

Nice breakout by Apple $AAPL above resistance at $110.23 and $111.11 extending intermediate uptrend.

More energy stocks breaking support! $XOM, a DJIA stock broke below $$84.86 extending intermediate downtrend.

Another base metal stock completed a double top pattern! $FCX briefly broke support at $9.82

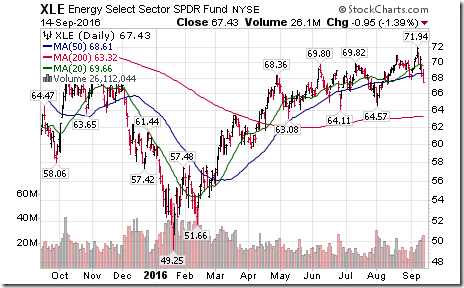

Energy SPDRs $XLE broke support at $67.77 completing double top pattern.

Trader’s Corner

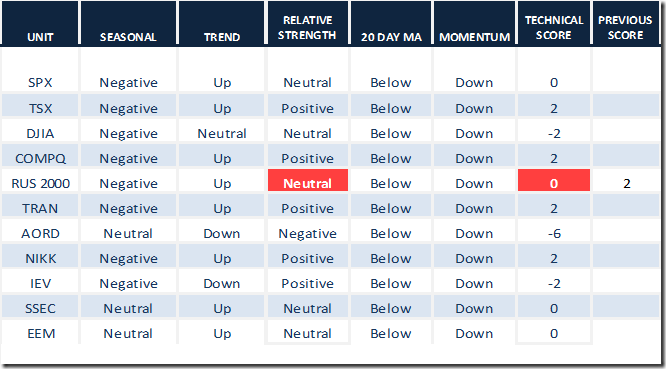

Daily Seasonal/Technical Equity Trends for September 14th 2016

Green: Increase from previous day

Red: Decrease from previous day

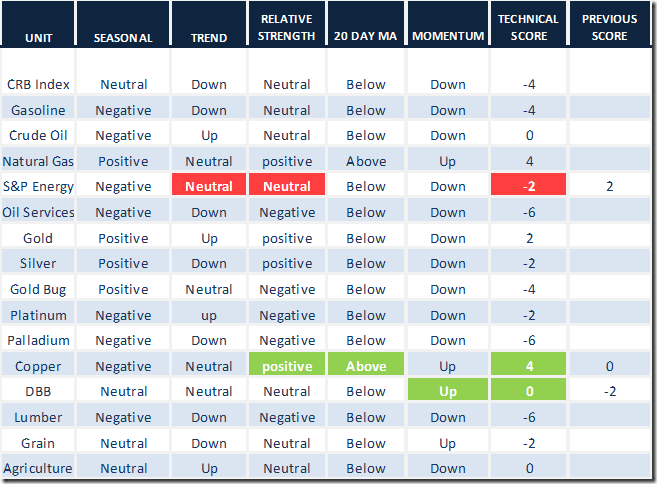

Daily Seasonal/Technical Commodities Trends for September 14th 2016

Green: Increase from previous day

Red: Decrease from previous day

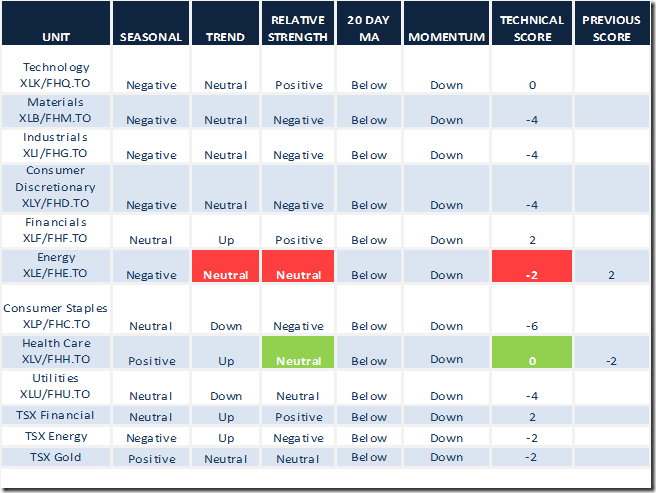

Daily Seasonal/Technical Sector Trends for September 14th 2016

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometer

The Barometer fell another 2.80 to 29.80. It remains intermediate oversold, but in a downtrend.

TSX Momentum Barometer

The Barometer added 0.43 to 37.50. It remains intermediate oversold, but in a downtrend.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca