by Don Vialoux, Timingthemarket.ca

Observations

More news pointing to a slowdown by the U.S. economy! Consensus for August ISM Services was a slip to 54.7 from 55.5 in July. Actual was 51.4, lowest level since February, 2010.

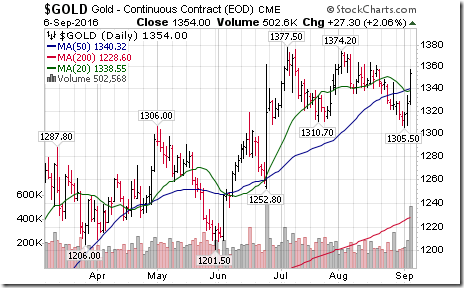

Weaker than expected August ISM Services triggered strength in Treasury prices, weakness in the U.S. Dollar Index, strength in international equity markets, strength in crude oil prices and strength in precious metals prices/precious metal stocks.

StockTwits Released Yesterday @EquityClock

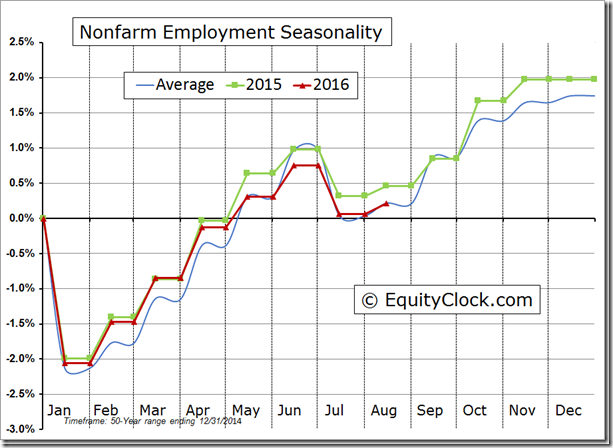

Seasonality report showing August Non-farm Payrolls

Technical action by S&P 500 stocks to 10:00: Quietly mixed. Breakouts: $EOG, $SE, $ALK, $FIS. Breakdowns: $MNST, $HES

Editor’s Note: After 10:00 AM EDT, breakouts included AES, FB and WMB. Breakdowns included PHM, TRIP, CNC and LOW.

Coal ETF $KOL moved above $$11.00 extending an intermediate uptrend.

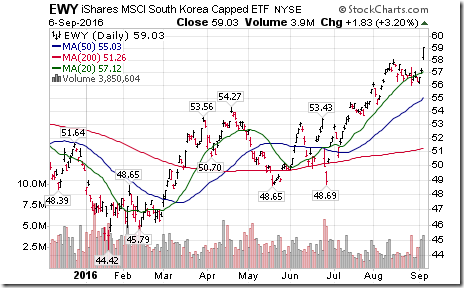

South Korea ETF $EWY moved above $58.08 extending intermediate uptrend

Eurozone iShares $EZU moved above $35.04 completing a double bottom pattern extending intermediate uptrend.

Emerging Markets ETF $EEM moved above $37.98 extending an intermediate uptrend.

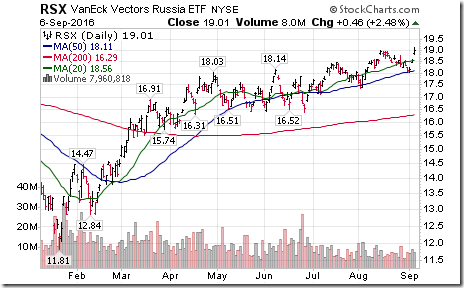

The Russian ETF $RSX moved above $18.99 extending intermediate uptrend.

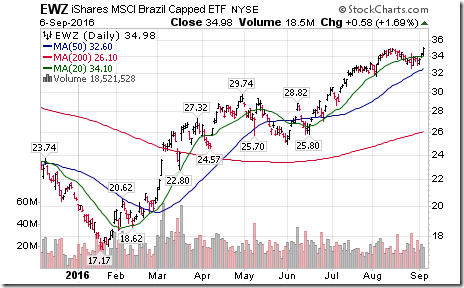

Editor’s Note: Other international markets breaking to new highs included Brazil and Japan.

Enbridge $ENB.CA moved above $55.36 Cdn. extending intermediate uptrend.

CSTA Events

Kitchener Waterloo Guelph Cambridge (KWGC) Meeting

Date and Time: September 8th 7:30 PM EDT

Location: 4355 King St.E Kitchener

Register at www.CSTA.org

Oakville Meeting

Date and Time: September 14th 7:00 PM EDT

Location: QEPCCC Program Room 3

Speaker: Jason Ayres

Register at www.CSTA.org

National Conference October 15th

Locations: Vancouver, Calgary, Winnipeg, Toronto

Save by registering prior to September 15th

Register at www.CSTA.org

Mr. Vialoux presenting at the Toronto MoneyShow

Presentation is held from 2:45 to 3:30 PM EDT on Saturday September 17th .Topic is “Sell in May and Go Away???”

On the surface, headline for the presentation sounds like a recommendation to sell equities. On the contrary, the presentation will explain why “Sell in May and go away” no longer is accurate and, indeed, provides a watchful buying opportunity during the historically volatile mid-June to mid-October period.

Attendance at the show is free. See you at the show!

Trader’s Corner

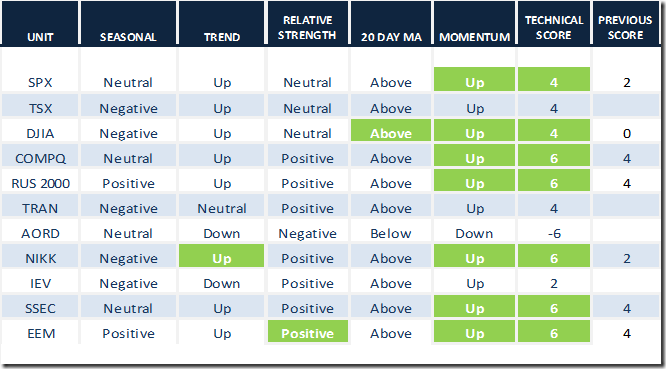

Daily Seasonal/Technical Equity Trends for September 6th 2016

Green: Increase from previous day

Red: Decrease from previous day

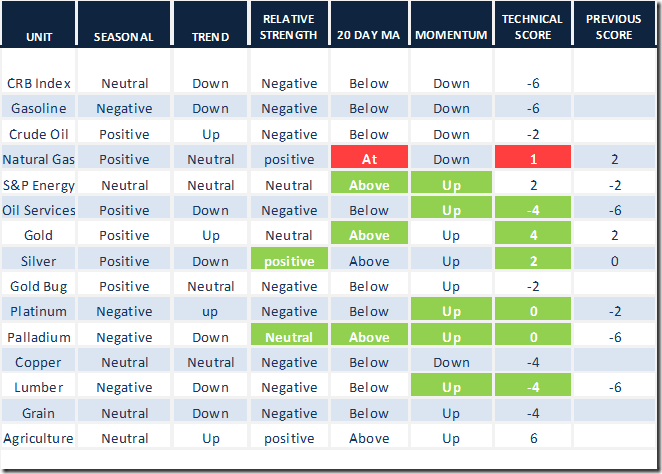

Daily Seasonal/Technical Commodities Trends for September 6th 2016

Green: Increase from previous day

Red: Decrease from previous day

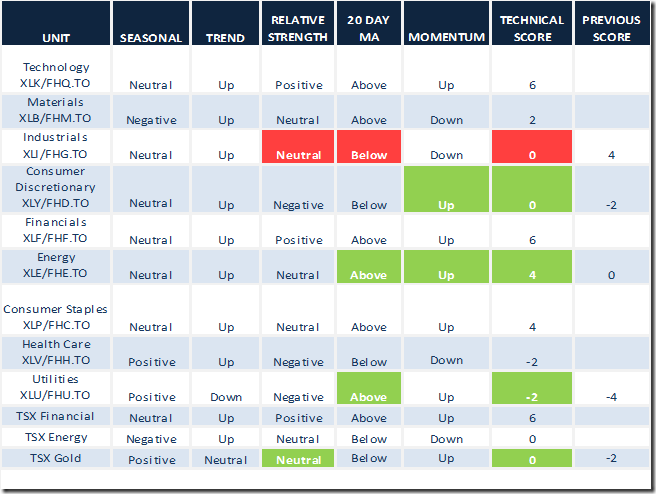

Daily Seasonal/Technical Sector Trends for September 6th 2016

Green: Increase from previous day

Red: Decrease from previous day

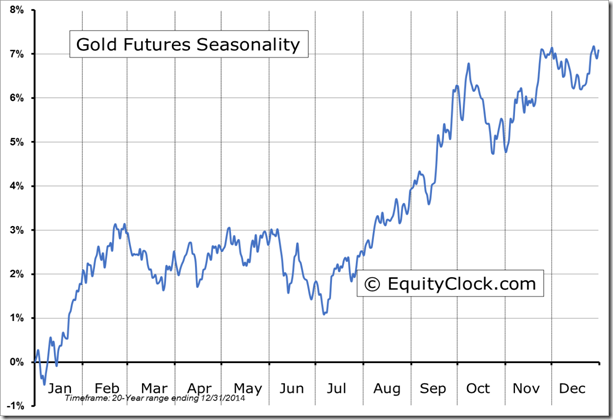

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

S&P 500 Momentum Barometer

The Barometer added 0.40 to 61.40. It remains intermediate overbought and trending down.

TSX Momentum Barometer

The Barometer gained 4.29 to 66.52 yesterday. It remains intermediate overbought

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca