Finding the Right Retirement Plan Recordkeeper for Your Client

by Commonwealth Financial Network

You’ve probably heard that retirement plan recordkeeping is commoditized. But is it? In my view, each provider has strengths that should be considered. When you incorporate information about all interested parties (including your services as the plan’s advisor) that will interact with the provider during the lifetime of the relationship, the “right” recordkeeper can emerge. Conversely, failure to do so will eventually cause a point of failure. For example, a decision based solely on the plan sponsor’s needs might not integrate with your practice’s needs, meet the usability needs of plan participants, or fit the functional needs of the plan’s third-party administrator (TPA).

You’ve probably heard that retirement plan recordkeeping is commoditized. But is it? In my view, each provider has strengths that should be considered. When you incorporate information about all interested parties (including your services as the plan’s advisor) that will interact with the provider during the lifetime of the relationship, the “right” recordkeeper can emerge. Conversely, failure to do so will eventually cause a point of failure. For example, a decision based solely on the plan sponsor’s needs might not integrate with your practice’s needs, meet the usability needs of plan participants, or fit the functional needs of the plan’s third-party administrator (TPA).

So, when conducting your next search, move beyond comparing slick brochures and proposals. Instead, consider this four-step process for finding the right retirement plan recordkeeper for your client.

First, identify anyone with an interest in provider selection. This includes any party:

- Involved in decision making

- Measuring the relationship’s ongoing success

- Working directly with the recordkeeper after selection

Here, I’ll limit the discussion to the four most common parties: plan advisor, TPA, plan sponsor, and eligible participants.

Next, collect each party’s objectives and needs to create the buying criteria that define the essential components for selecting retirement plan recordkeeper candidates.

Plan advisor

Interested parties. This includes you and your staff.

Advisor objective. Ensure that the services you provide, methods you use to work with service providers, and support you need are incorporated into the buying criteria.

Method. Establish services that you will provide for each case and your expectations of the service providers. Some considerations include:

- In-house expertise

- Investment philosophy

- Service model segmentation

- Capacity

- Profitability

- Use of resources

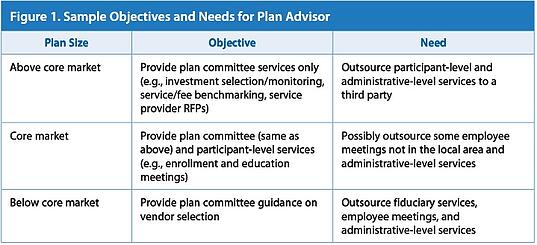

Figure 1 outlines the objectives and needs if, for example, you’re an advisor whose core market is local plans with $2 million to $7 million in plan assets, and you have internal staff for enrollment and client service.

TPA

Interested parties. TPAs are often used if the plan design is complex, the employer wants to outsource transaction and compliance oversight, and the employer prefers working with a local service provider.

Advisor objective. Determine if a TPA will be part of the service model.

Method. Due to technology/data compatibility and service philosophies, many TPAs align themselves with preferred recordkeeping partners. Be sure to familiarize yourself with these relationships.

Plan sponsor

Interested parties. These include the business owner, senior leadership (e.g., finance, human resources, and legal), and functional leaders (e.g., payroll).

Advisor objective. Understand each party’s role in the decision-making process, as well as their roles after selection.

Method. Organize information from key decision makers and staff who will be interfacing with the recordkeeper on an ongoing basis. Figure 2 identifies a sampling of objectives and needs that should be evaluated when constructing the buying criteria.

Eligible participants

Interested parties. Include all eligible employees (not just active participants).

Advisor objective. Identify the needs and priorities of eligible employees and establish their buying criteria.

Method. This comprises three key steps:

- Collect demographic characteristics (e.g., age, compensation, language, education, and location), data (e.g., deferral rates, tenure, and accumulated balances), transaction history, employee surveys, and industry-specific benchmarking data.

- Use this information to build a participant profile(s). For smaller plans, the participant profile may be a single aggregate profile. For larger plans, there may be several profiles based on unique characteristics of various employee audiences.

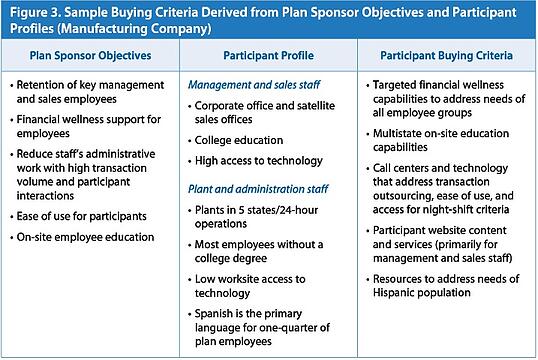

- Formulate the aggregate employee buying criteria using the participant profiles. Figure 3 provides a sample alignment of the plan sponsor’s objectives with information about eligible employees and their plan interactions to create a participant buying criteria profile.

Now, it’s time to aggregate and prioritize the buying criteria.

Advisor and TPA. Here, best practice is to introduce the advisor and TPA statement of services to the plan sponsor before initiating the recordkeeper search. By predefining these roles and services, it places the buying criteria for these entities into the realm of requirements for the recordkeeper solution set.

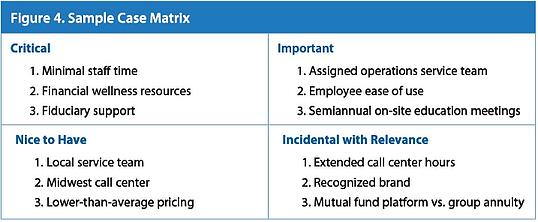

Plan sponsor. Using the buying criteria in Step 2, the plan sponsor must integrate and prioritize the lists for the company and eligible plan employees. If there are several interested parties at the plan sponsor organization, have each one prioritize its list. Then, facilitate a meeting where each party presents its ranking of the buying criteria and works together to determine a common set of priorities. Figure 4 presents a sample case matrix.

At this point in the process, recordkeepers will look similar in cost, services, size, and target markets. Your job is to help the plan sponsor uncover distinguishable recordkeeper characteristics that strengthen the alignment with the buying criteria or add “bonus” benefits not previously considered. For example:

- Operational proficiency (e.g., the cleanest auto-enrollment/opt-out process)

- Needs that were not identified (e.g., expertise in M&A for a growing business)

- Book of business concentration (e.g., an organization that works with similar clients—health care, manufacturing, retail)

- Philanthropy (e.g., cultural alignment on giving back to the community)

Following these steps will help you identify and align provider strengths with your client’s objectives and needs, as well as solidify your practice’s ability to efficiently work with all parties in the service model. As a result, you may find yourself spending less time selling and more time consulting—a great way to source future referrals.

Do you think of retirement plan recordkeeping as commoditized? What other steps do you follow when trying to identify the right recordkeeper? Please share your thoughts with us below!

Commonwealth Financial Network is the nation’s largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm’s corporate blog.

Copyright © Commonwealth Financial Network