by Jim McDonald, Northern Trust

OUTLOOK

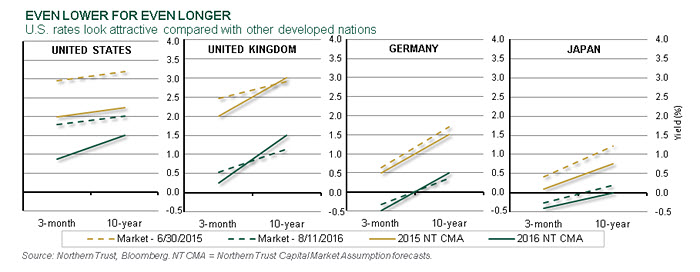

Risk assets advanced further during the last month, amid a relatively quiet fundamental backdrop. A strong July U.S. payroll report, following an even stronger June reading, helped quell concerns over the pace of recovery in the world’s largest economy. Asset flows provided another reminder of the globalization of financial markets, as capital continues to flow into relatively higher yielding markets like the United States and emerging markets. A central tenet of our interest rate outlook has been the relative attractiveness of U.S. bonds to foreign investors, as highlighted in the accompanying chart below. Looking out five years, the market expects the U.S. 10-year yield to be 2.00% — compared to Germany at just 0.50% and Japan at 0%. In addition to affecting investor flows, these dynamics increasingly appear to be encroaching into major central bank policy deliberations.

While most central banks have had the luxury of wearing blinders to focus on domestic conditions, today’s globalized markets make this much more difficult. In recent years the Federal Reserve has been forced to pull back from tightening due to international volatility. Going forward, we expect this to continue and also think it will be constrained by the overall low level of interest rates in Europe and Japan. Our expectations for interest rates have been reduced again in this year’s new Capital Markets Assumptions. Whereas we had been expecting the 10-year Treasury to reach 2.25% five years out, we have now cut that to 1.50% in the wake of Brexit and slower global growth. This change supports a constructive view on bond returns during this period and, importantly, should support continued investor appetite for risk assets.

Our new Capital Markets Assumptions document highlights the likelihood of “Slow Growth Angst,” but we also expect “Market Cycles in a Cycle-Less Economy.” These themes encapsulate our view that slow growth will beget slow growth, but market cycles will be more significant than actual economic cycles. We’ve been witnessing these trends so far this year, as market values have been more volatile than the underlying economic fundamentals. Current trends in the U.S. election may demonstrate some level of “ceiling” over populist candidates, as the most populist Democratic candidate is out of the race and the Republican candidate is starting to lag in national polls.

U.S. EQUITY

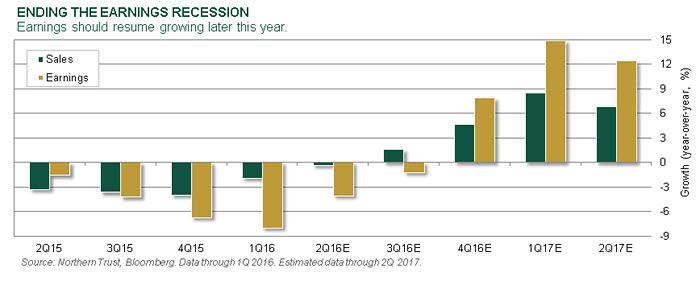

- The U.S. profit recession appears poised to end later this year.

- The resumption of growth should drive additional upside in U.S. equities.

With second-quarter earnings season nearly complete, sales are flat compared to last year and earnings are down 4% — beating lowered expectations. Excluding the 80% drop in energy profits, earnings are roughly flat, and overall earnings are expected to resume growing in the fourth quarter given the stabilization in oil prices and the weakening of the U.S. dollar. While we believe the consensus expectations for growth are too aggressive, as usual, we believe the end of the U.S. profit recession to be important to equities markets. A portion of the recent upside has no doubt been in anticipation of a resumption of growth later this year. However, we think the current market multiple is justified by the rate environment and current channel growth, allowing earnings growth to support additional upside in U.S. equities.

EUROPEAN EQUITY

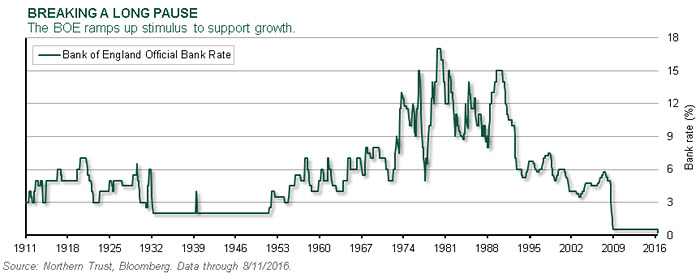

- The Bank of England (BOE) ended a seven-year flat rate environment by cutting the bank rate.

- Further quantitative easing measures and bank lending supports followed the rate cut.

The BOE took decisive action in the wake of the Brexit vote to leave the European Union. The central bank believes the resulting pressures, specifically on the currency, will flow through to inflation in the near term and weaken the growth outlook in the medium term. Coupling a rate cut with asset purchases and funding programs should provide support for the economy by lowering borrowing costs for both individuals and corporate entities. We believe the BOE ultimately will be successful in reducing the cost of funds, although whether that flows through into gross domestic product growth will be the ultimate litmus test of success. We expect the Brexit negotiations to remain a headwind to growth for the foreseeable future.

ASIA PACIFIC EQUITY

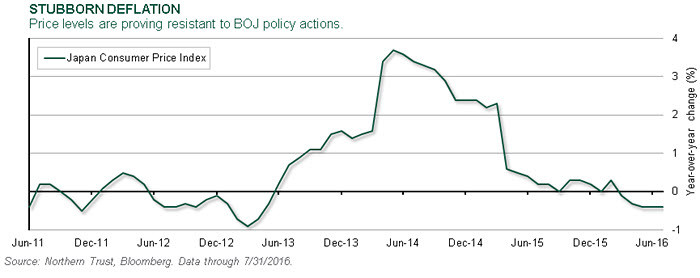

- June consumer prices data showed deflation accelerating to -0.4% year over year.

- The Bank of Japan (BOJ) increased monetary stimulus in late July.

After seeing deflation worsen at the end of the second quarter, the BOJ decided to increase its monetary policy commitment to easing. The new easing involved an increase in equity exchange-traded fund (ETF) purchases from ¥3.3 trillion to ¥6 trillion. The BOJ had already moved interest rates into negative territory in February with mixed results in the lending environment. It’s unclear to us whether the incremental equity purchases by the BOJ will have any significant impact on the Japanese economy, especially considering the strength of the yen vs. trading partners’ currencies. Japan’s most recent economic data shows a somewhat resilient consumer being offset by weakening trade — a trend that will only continue if the yen retains its current strength.

EMERGING MARKET EQUITY

- Emerging-market assets have generated renewed interest this year.

- Importing lower interest rates reduces some fiscal pressure.

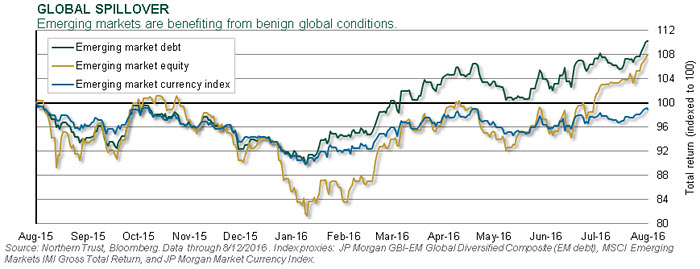

This year emerging markets have benefited from renewed investor interest, leading to a rebound in currencies, bonds and stocks. Economic momentum doesn’t appear to be the major driver, as economic data in the major developed economies has been on an uptrend since February while emerging-market data has been more mixed. Rather, investors have been turning their attention to emerging-market assets as the developed markets are presenting less opportunity. With central banks from Australia to the United Kingdom unveiling fresh rate cuts, emerging-market debt has become increasingly attractive. This has a virtuous impact as it reduces investor concern over fiscal pressures, and momentum can beget further momentum. With technical factors improving the outlook for emerging-market equities, our equal weighting of this asset makes sense. Going overweight will likely require more confidence in improving momentum in the real economies.

REAL ASSETS

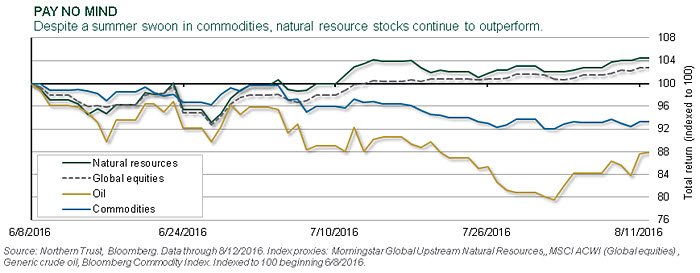

- Natural resource stocks remain one of the best performers in 2016.

- Many elements are in place to support natural resources going forward.

Generally, we would expect the return of natural resource stocks to be anchored to the change in price of underlying commodities, but there are instances where other factors are at play. Despite recent commodity price weakness, equity-based natural resources have continued their march upward, driven by improved market sentiment. Investors are realizing commodities still play an important role in the global economy, and there’s still a reason to own companies that produce them. We increased our natural resources allocation to an equal-weight position last month and remain invested that way. We don’t believe commodities are off to the races, but do believe that the current environment — including attractive valuations, improved market sentiment, easy monetary policy and positive economic growth — supports being fully invested.

U.S. HIGH YIELD

- High yield returns are often driven by flows into and out of the asset class.

- More stable, actively managed flows have provided support to the market.

High yield fund flows often drive significant changes in valuation. Large outflows in December 2015 pushed the market lower, while March 2016 inflows supported a recovery rally. Flows during the past several months have been mixed. However, a significant portion of total fund flows have come from ETFs rather than from actively managed accounts. ETFs generate daily price volatility but have a less significant impact on valuation. In addition, some actively managed funds use ETFs as a cash buffer to avoid being forced to trade in an illiquid market, which results in increased price volatility. The modest moves in actively managed flows have been supportive of the market, and the overall fund flows haven’t been a significant concern.

U.S FIXED INCOME

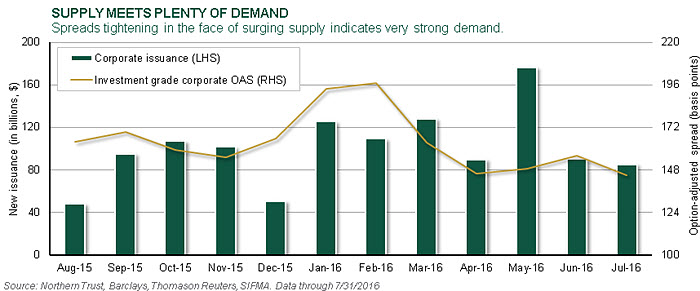

- Global demand has led to tighter corporate bond spreads.

- We believe corporate bonds remain attractive.

U.S. investment-grade bonds have generated attractive returns this year as interest rates have fallen and credit spreads have contracted. As more debt across the globe trades at negative yields, investors have poured money into the United States in search of yield, safety and liquidity. The contraction in credit spreads has occurred despite heavy new issuance. In fact, issuance in May was the highest ever in a single month. The market’s ability to absorb all of the new supply, while credit spreads actually contract, speaks to the insatiable demand for yield around the world. With global economic growth slow and central bank bond purchase programs continuing, we believe credit spreads are headed somewhat lower and expect the market to easily handle new supply during the remainder of the year.

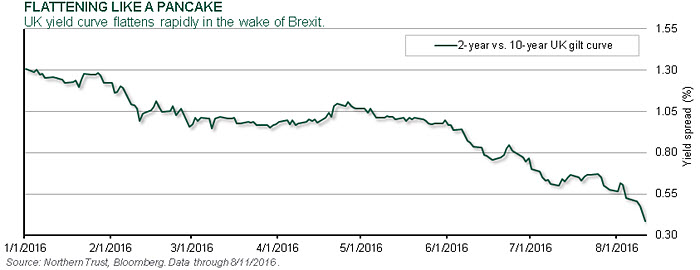

EUROPEAN FIXED INCOME

- The BOE attempted to quell Brexit fears with a broad stimulus package.

- European banking sector concerns return with a focus on low interest rates.

The BOE held little back at its August meeting, announcing a rate cut for the first time since 2009, an expansion of asset purchases including a new corporate bond program and a term-lending scheme all justified by lower growth forecasts in the face of Brexit risks. Markets reacted positively with risk assets rallying and shrugging off any referendum concerns, while 10-year Gilt yields fell to an all-time low. Despite better European bank earnings, investor concerns regarding nonperforming assets and low interest rates have resurfaced. Italy has been at the forefront. Regardless of a private-sector rescue for Banca Monte dei Paschi di Siena and satisfactory results from the European Banking Authority’s European Bank stress tests, banks will remain under pressure so long as negative yields prevail.

ASIA-PACIFIC FIXED INCOME

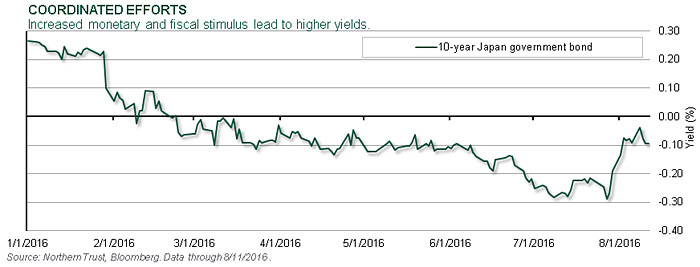

- Japanese authorities combine efforts to reignite inflation.

- The Reserve Bank of Australia cuts rates for the second time this year.

Amid growing concerns around currency strength and the limited impact of monetary stimulus, the resurrection of Abenomics, with a new ¥28 trillion fiscal stimulus, is welcome. This was followed by the BOJ’s decision to increase its ETF purchases to ¥6 trillion. As a result, Japanese bond yields have since moved sharply higher. Even though moving away from the sole reliance on monetary policy is positive, the history of realized government expenditures suggests it’s premature to expect these coordinated efforts to end Japan’s economic woes. The Reserve Bank of Australia took interest rates to a new record low with a second 0.25% rate cut this year. The upcoming quarterly statement on monetary policy may provide clues to the potential for further stimulus, but the benign inflationary pressures from the stronger currency open the door for further cuts.

CONCLUSION

Markets continued their post-Brexit rebound during the last month, as the global economy slowly advances and policymakers marginally ease monetary and fiscal conditions. There have been numerous items to be worried about this year, from the state of the Chinese financial system to the U.S. economic expansion to the most recent worries about Brexit. We continue to believe that the durable expansion in the global economy will be matched by a persistently low-interest-rate environment. In addition, investor sentiment has improved in recent months — but only to a neutral level overall. We’re far from the type of exuberance typically seen at the end of bull markets.

One takeaway from our asset allocation discussions this month was the relative stickiness of our fundamental inputs — with no real changes during the last month. In this type of environment, it pays to be patient, especially after a relatively busy first seven months of the year. We maintain our recommendation for a modest overweight to risk assets, including U.S. equities and high yield. The most important changes to our strategy this year have included removing underweights to emerging-market equities and natural resources and paring back our significant high yield overweight. The increases to emerging markets and natural resources reflect the significant underperformance of these two groups in recent years, and the constructive impact of a more patient Fed. The reduction to high yield is a result of significant recent outperformance, along with an improved liquidity environment that facilitates trading.

While we continue to see constrained channel growth across the global economy, we feel central banks have now become “trapped” with low rates and little flexibility to increase them among global uncertainties. Without an acceleration of growth or inflation, future Fed hikes may just serve to lower long-term interest rates — a development the Fed will do its best to avoid. Our primary risk case of populist politics has been refined to suggest that it might need to impact U.S. or Chinese growth to be material enough to affect global risk taking. The risk of this in the United States will be known by the November 8 election, with the congressional elections being a key to the checks and balances on the Executive Branch. Even though the risk of populism hitting China seems low, it’s a risk that would likely surface without warning and therefore catch the markets by surprise.