by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Friday August 12th

U.S. equity index futures were slightly lower this morning. S&P 500 futures were down 2 points in pre-opening trade.

Index futures moved slightly lower, Treasury prices moved higher, the U.S. Dollar Index moved lower and Gold moved higher following release of economic news at 8:30 AM EDT. Consensus for July Retail Sales was an increase of 0.4% versus an upwardly revised gain of 0.8% in June. Actual was unchanged. Excluding auto sales, consensus for July Retail Sales was an increase of 0.2% versus an upwardly revised 0.9% in June. Actual was down 0.3%. Consensus for July Producer Prices was unchanged versus a gain of 0.5% in June. Actual was down 0.4%. Excluding food and energy, consensus for July Producer Prices was an increase of 0.2% versus a gain of 0.4% in June. Actual was a decline of 0.2%.

Nvidia added $1.85 to $61.55 after RBC Capital upgraded the stock to Outperform from Sector Perform and raised its target price to $72 from $47.

Nordstrom gained $4.92 to $52.48 after reporting higher than consensus quarterly results. Stifel Nicolaus raised its target price on the stock to $58 from $44.

Dick’s Sports Goods (DKS $54.60) is expected to open higher after Stifel Nicolaus raised its target price to $60 from $50.

Blackberry gained US$0.22 to $8.10 after Raymond James upgraded the stock to Outperform from Market Perform. Target is $10.50.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/08/11/stock-market-outlook-for-august-12-2016/

Note seasonality charts on Crude Oil, Natural Gas, Natural Gas Storage and Initial Jobless Claims

Observations

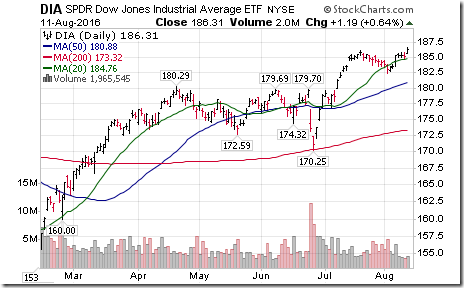

The S&P 500 Index, Dow Jones Industrial Average and NASDAQ Composite Index simultaneously closed at an all-time high for the first time since December 1999.

Strength for U.S. equity markets was attributed mostly to a move by retail merchandiser stocks triggered by a 17% gain by Macy’s

Ironically, Macy’s moved on news that the company plans to close 100 of its 728 traditional department stores in the U.S.

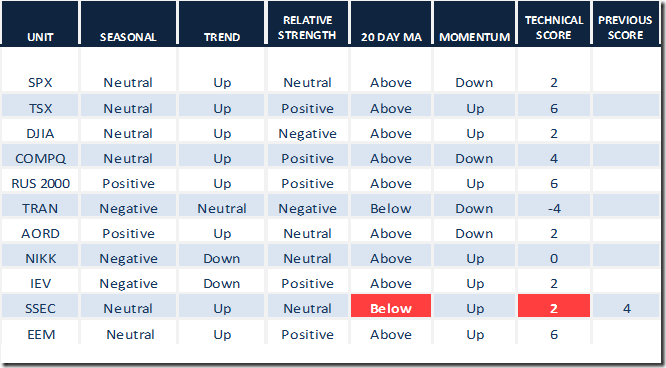

Technical scores for sectors and commodities improved on moves above their 20 day moving average.

StockTwits Released Yesterday

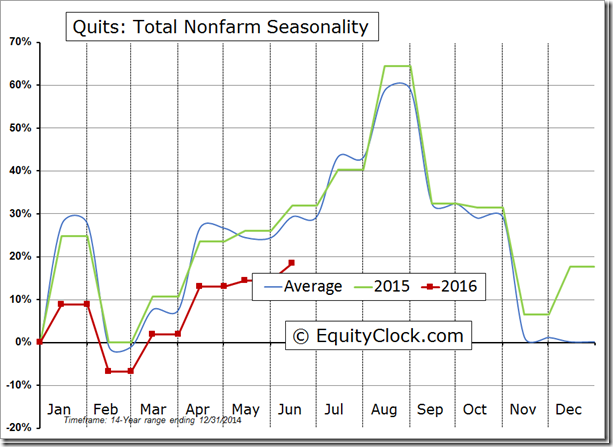

Quit rate continues to trend below average, warning of a lack of employee confidence.

Quiet technicals for S&P 500 stocks to Noon despite $DIA reaching all-time high! Breakouts: $PCH, $URBN. Breakdown: $NUE.

Editor’s Note: After Noon, technical action by S&P 500 stocks remained mixed. Breakouts: Lockheed Martin, Amphenol, Roper Technologies. Breakdowns: Kimco Realty, KLA Tencor

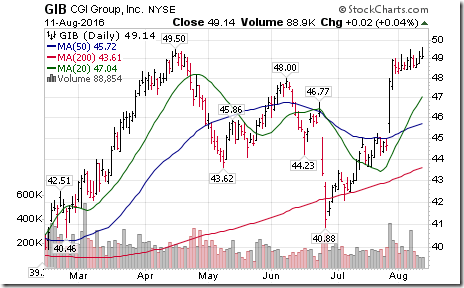

Nice breakout by $GIB above resistance at US$49.50 reaching an all-time high extending intermediate uptrend!

Trader’s Corner

Daily Seasonal/Technical Equity Trends for August 11th 2016

Green: Increase from previous day

Red: Decrease from previous day

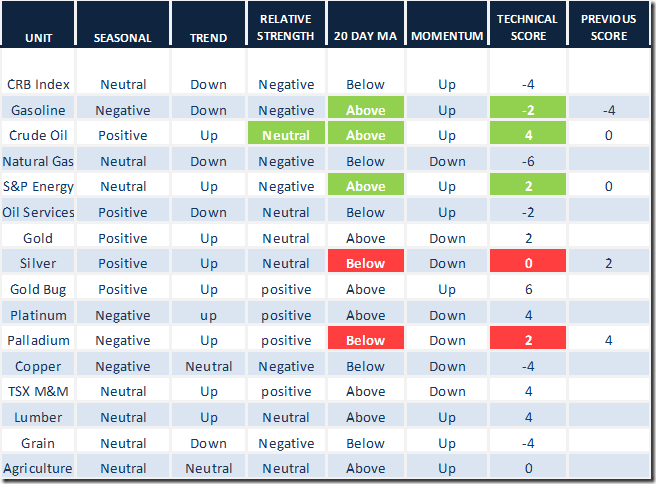

Daily Seasonal/Technical Commodities Trends for August 11th 2016

Green: Increase from previous day

Red: Decrease from previous day

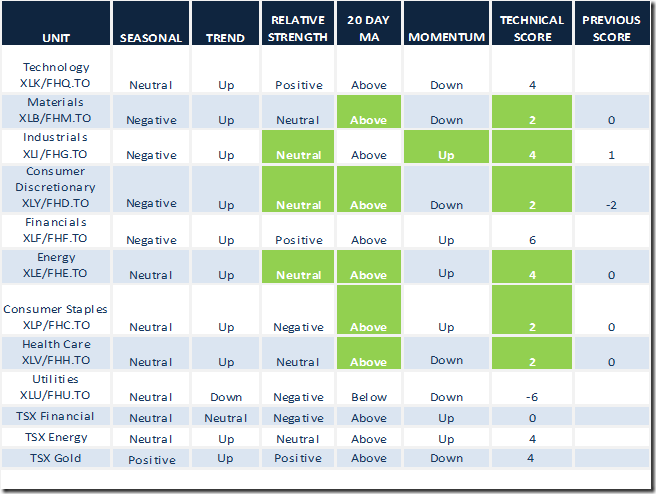

Daily Seasonal/Technical Sector Trends for August 11th 2016

Green: Increase from previous day

Red: Decrease from previous day

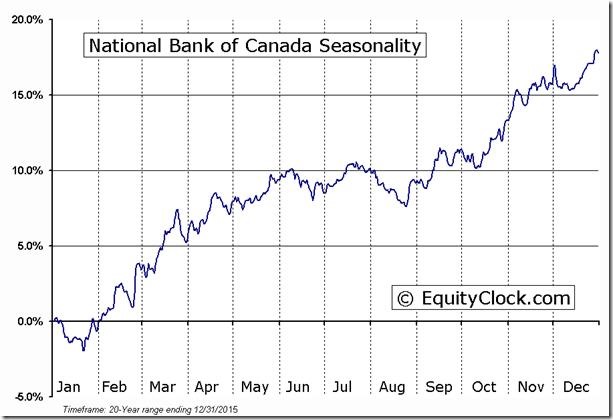

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts. Following is an example:

Accountability Report

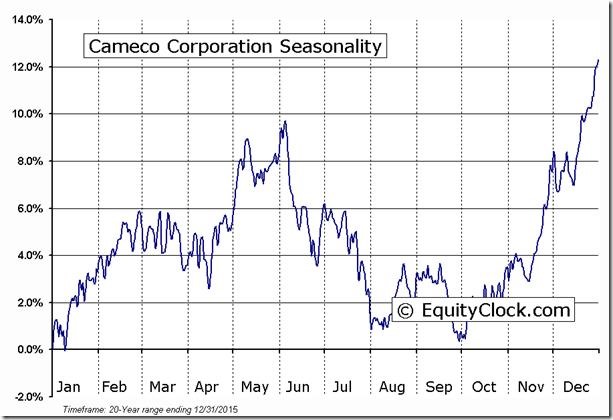

Sale/Short Sale of Cameco (CCO.TO $12.71) originally was supported in a StockTwit on June 14th and reported in Tech Talk on June 15th. At the time the stock at $14.51 broke support during a period of seasonal weakness. Subsequently, the strategy was supported in Tech Talk on July 26th on another break through support. Now, seasonal influences are turning neutral and technical parameters (momentum, relative strength) are turning higher. Sale/short sale no longer is supported. Note that seasonal influences do not turn positive until the end of September. Therefore, buying the stock for a seasonal trade is not supported at this time.

S&P 500 Momentum Barometer

The Barometer added 3.40 to 72.40% yesterday. It remains intermediate overbought and trending down

TSX Composite Momentum Barometer

The Barometer slipped 1.28 to 71.79 yesterday. It remains intermediate overbought and rolling over.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca