Looking for yield? Welcome to the USA

by Doug Drabik, Fixed Income, Raymond James

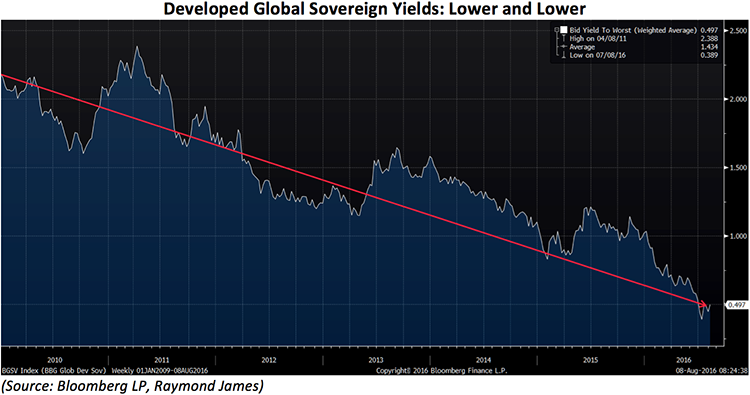

As everyone is (hopefully) well aware at this point, central bank accommodation is arguably the primary driver of the global bond markets, having left general economic data to play second fiddle since mid-2009 when the Great Recession ended. Although we’ve had strong data on the jobs front here in the US, the effects are being muted by the global “big picture”. More than seven years on, and central bank activity is seemingly ratcheting higher, not lower, and global yields are falling to their lowest levels on record according to both Bloomberg and YieldBook data.

Japan and the European Union are the major drivers of monetary stimulus (lower interest rates for longer) in the global marketplace, but recently the Bank of England (BOE) has stepped up its game by enacting its own accommodative monetary policy in the wake of the post-Brexit vote. In the last few weeks alone we’ve received updated from Japan, the BOE and the European Central Bank (ECB), all of which are in some form or fashion, helping keep a broad range of interest rates low. Keeping benchmark short-term rates low is run-of-the-mill at this point, so major central banks are now directly purchasing corporate bonds in addition to their ongoing support of low sovereign yields.

As the BOE put it, they will purchase £10 billion of sterling denominated bonds from investment grade (IG) issuers that make a “material contribution” to the UK economy. This is in addition to £60 billion in government bond purchases, thereby taking their balance sheet to £435 billion in the next six months. Direct purchases of credit are unique in the realm of central bank activity as they now directly affect more than just the nominal government yield (aka the base rate) but also the spread (the yield above the base rate) for corporate issuers. Simply put, central banks are large and atypical players in these markets and as they create money to purchase corporate debt they provide an unusual stimulus to the credit markets which should push spreads lower.

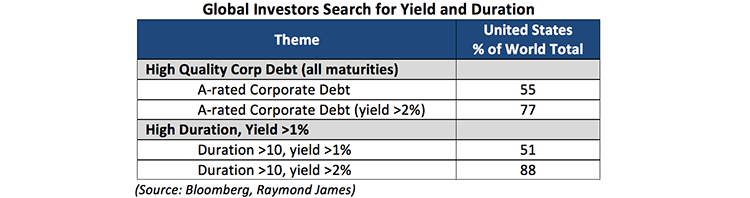

The marketplace now has low nominal/sovereign rates in many of the major economies overseas paired with likely lowered spreads for IG issuers. As we’ve written about before; overseas buyers continue to find value in both the US Treasury market and our credit markets thanks to our higher nominal yields. In effect, this should bode well for the US credit markets. As a reminder, 45% of global developed sovereign debt with a maturity <5 years have yields below zero while 35% of all maturities outstanding yield less than zero. This currently represents ~$9 trillion of assets and is expected to increase. According to Bloomberg and BofA index data, US IG credit (issuers domiciled here at home) now accounts for ~75% of all available yield worldwide.

This massive change in the landscape for positive yield is helping fuel a surging demand for US assets: overseas investors are purchasing record numbers of US bonds with a massive surge that begin in late 2012. A minor inflow/outflow of $30 billion was typical over a six month period prior to 2013. Nowadays, this figure is always positive (they are buying) and now sits anywhere from $30 to $180 billion. Given this backdrop, is it any wonder why US rates remain at/near all-time lows despite more positive economic data and the potential for a second rate hike from the Fed? The search for yield expands well beyond the US, and the global demand for yield does not appear to be abating anytime soon. So long as overseas central banks are providing stimulus and the US remains the largest, most liquid and highest yielding developed nation on the planet there will likely continue to be strong demand for US assets.

Copyright © Raymond James