Tug of War

by William Smead, Smead Capital Management

Many a spring and summer outdoor celebration culminates in a tug of war. It is where an equal number of folks hold onto each end of a long rope and seek to pull the other side across the midpoint line. We believe a tug of war has existed in the US stock market over the last year between two forces which have been pretty equal in force while pulling in opposite directions.

On the negative side of the rope are the macro-economic forces around the world, dictating extremely low interest rates and struggling with sub-par worldwide growth in Gross Domestic Product (GDP). On the positive side are forces which could dictate a far better economy in the US and provide a pathway to above average returns in the stock market. Which of these powerful forces will win?

We don’t have any guarantees, but by looking at where investors are currently invested, we believe existing psychological behavior is set to benefit us as contrarians in the US stock market. We like to know where money is currently invested to get a feel for the securities which are popular, and to understand where logical micro- economics would lead us among securities which are unpopular.

On the international front, let us run through the litany of some of the negatives bogging down US investors and pulling on that end of the rope:

- China’s growth bubble burst and they haven’t been willing to admit that they are suffering a bad business cycle coming from too much borrowed money. In our opinion, their major state-owned banks are loaded with loans that will never be paid back. Therefore, China’s economic miracle isn’t likely to pull the rest of the world out of its funk.

- Emerging markets were strong because Chinese demand drove commodities up in price. Some, like India,are rebounding, but Brazil, Russia, Australia, Canada and “remarkable” Indonesia aren’t looking very remarkable. This is a big drag on the global outlook and a strong pull on the negative end of the rope.

- Britain is leaving the European Union and has thrown stock markets around the world into uncertainty. Economic growth, already questionable in Europe, is pulling hard on the negative side of the rope. Germany likely isn’t going to sell as many status symbol Mercedes and BMWs as they did when China was rocking and rolling. Switzerland probably won’t sell as many $10,000 watches as they did back then either.Europe’s banks have been slow to cleanse in comparison to what the American banks did. Confessing sins seems to be easier in the US for some reason. Therefore, Europe needs to “be fruitful and multiply” if it wants to grow its way out of anemic GDP numbers. It could happen, but a couple of recent trips to Europe have shown me that American tourists matter more to the economy of European countries than household formation does.

- Interest rates are minuscule and represent very low expectations around the world. They also make US bond yields look juicy, just because they are less tiny. Major bond pundits like Bill Gross from Janus and Jeff Gundlach from Doubleline Capital are happy to tell you how bad that isand how long rates will stay down. One can almost feel the heavy tug on the rope these heavyweights produce!

- Our culture in the US has changed enough that many are pulling on the negative end of the rope out of fearthat Millennials will be the first generation to not replace themselves with new little humans. If the hippies of the 1960s and the disco boomers of the late 1970s reproduced, we feel confident that the “Seth Rogen” generation of craft beer drinking, Chipotle burrito eating and Apple device buying Millennials will procreate as well. Whether thatis true in numbers big enough to be material is yet to be determined. Since it hasn’t happened yet, it is a big pull to the negative side of the tug of war.

- Debt levels are high around the world and monetary authorities seem to have run out of tools to stimulate the economies which are deflating.

- Investors are putting massive hope in revenue growth stories because they have no faith in overall prosperity. This hurts investor confidence but re-inflates already inflated “FANG” stocks.

On the positive side of the rope:

- Stocks are under-owned by institutional investors and individuals are arguably as negative as they have ever been. This is contrary, but it pulls the positive end.

- The US economy is very fully cleansed of bad lending practices, under-capitalized banks, low or negative savings rates, use of home equity as a cash machine and all the tomfoolery of the prior housing bubble.

- Housing is cheap from a historical standpoint and very cheap in relation to rent. A mountain of 86 million Millennials are expected to discover the virtue of “owning your own piece of land” and locking in housing costs. In the movie, “It’s a Wonderful Life,” Mr. Potter wanted to keep people in his slums, but George Bailey and the “Bailey Building and Loan” made plans for Bailey Park. Americais made up today of millions of Mr. Martini’s, who could be having a house warming in a development near you soon.

- The Federal Reserve Board’s household debt service ratio is at 36-year lows, which means Americans can take on house and car payments. It is temporarily low because of how much later in life folks marry, have babies and buy houses. We won’t stay virtuous forever on indebtedness.

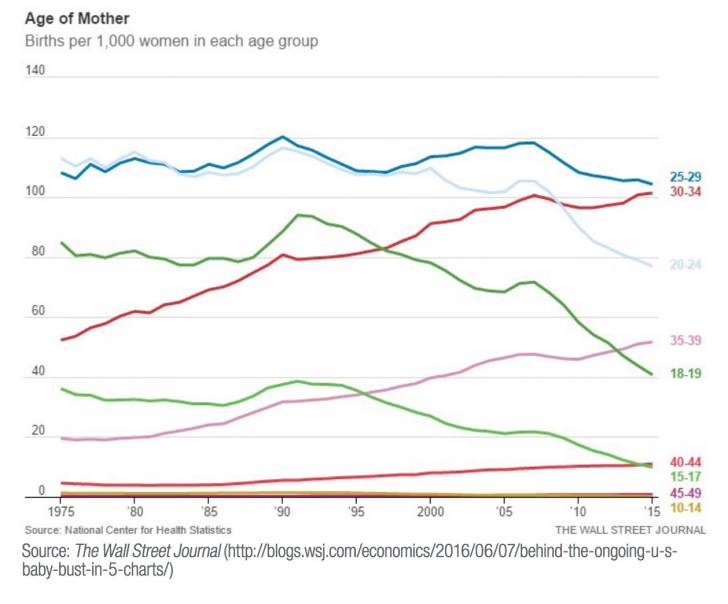

- There is already evidence that birth rates among US women ages 30-45 are soaring and that the economics of housing could cause a boom. See chart below:

- The stock market is a snapshot in the short-run and a weighing machine in the long-run. Every academic study we’ve seen shows that cheap stocks outperform over the long-run. Our portfolio has the largest discount to the S&P 500 Index it has had in at least five years. It is not as cheap on an absolute basis as four to six years ago. This tells you more about relative performance than absolute returns.

- Ben Inker's research at GMO shows that companies with strong balance sheets, high and sustainable profitability and low earnings volatility add alpha over long stretches of time. We emphasize these characteristics via our eight criteria for stock selection.

The challenge in outperforming the S&P 500 over the next ten years and winning the tug of war is not much different than it has ever been. First, valuation matters dearly. We must build a portfolio which we believe is a bargain relative to the indexes. Common stocks which are cheap in comparison to earnings, free cash flow and intrinsic value have proven to outperform over the long term.

Second, we must keep our activity down. Buffett likes to say that excitement and expenses are the enemy of a portfolio. We must never be envious of those who prosper in glamorous, exciting and trendy securities. Instead, we should focus on patiently holding meritorious businesses and skip paying expenses associated with trading costs. There are many ways to skin a cat and pull on the rope, but we must stick to our discipline.

Third, we must have high quality securities for sitting through the rough patches, particularly when it seems like we are being pulled into the mud. If we add our screening for qualitative factors with an effort to buy at bargain prices, we give our portfolio an academic double whammy. It’s like having everyone on our end of the rope on steroids. The history of our discipline indicates that above-average quality common stocks purchased and owned at below-average prices will be rewarded in long- duration time frames.

Lastly, we must have a vision of the best micro-economic opportunities we see in the next five years and avoid the risks which aren’t recognized by crowds pulling on the other end of the rope. Portfolio construction dictates that we should build our portfolio weightings around companies which meet our eight criteria and fit that vision. This could make them pull very hard on the rope with strength and authority.

In all truth, we can never know whether the U.S. stock market will get pulled into the mud or not. A bear stock market historically happens about once every five years. However, we have a great deal of confidence that our portfolio will do well over the next ten years, as we pull on our end of the rope for you. Thank you for your confidence and trust.

The information contained herein represents the opinion of Smead Capital Management and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Copyright © Smead Capital Management