Random gleanings over a holiday weekend after an unusual week

by Jeffrey Saut, Chief Investment Strategist, Raymond James

July 5, 2016

Well, you can only control what you can control. I think whatever your view of the world is, you have to invest. You can’t put the money in the mattress and in this day and age of low interest rates, you can’t put it in the money market fund or a bank CD, so invest, you must. Now, you might want to invest regularly. For people that are investing regularly, I would say for god’s sake don’t stop investing now. I know the market is not doing much this year, just about where it started a little bit down, but not much and bond yields are still very low, actually lower than they were at the beginning of the year, but you have to put your money to work. The alternative is – I mean, the only way to guarantee you will have nothing at retirement is to invest nothing along the way. So, you have to take your chances.

. . . John Bogle

As I read that quote from John Bogle I was reminded of another quote I used a few weeks ago from my friend Frederick “Shad” Rowe, proprietor of Greenbrier Partners the esteemed Dallas-based money management firm. To wit (as paraphrased):

Looking at each 20-year period on a rolling basis over the past 50 years, that is, we’ll look at 20 years, starting in 1965, then 20 years starting in 1966, and so on, returns on investment in the S&P 500 stock index for each period have fluctuated between 8% and 12% [per year]. Each period contained some bad years, but there were always more good years and they outweighed the bad results for every 20-year stretch. While the actuarially assumed rate of return for most public pension systems is approximately 7.5%, the stock market has managed to climb the proverbial wall of worry and offer superior returns, compared to virtually all available alternatives – if you stayed fully invested in the index for the full 20 years. Here is a prediction. A gigantic market move to the upside is coming, as investment committees assess their costs and reach the conclusion that the stock market is their best and only hope to meet their obligations.

Now let’s reflect on a few quips we’ve heard this year. Somewhere near the February “lows” a couple of bulge-bracket investment banks told investors to dramatically reduce their exposure to stocks; and one foreign-based investment bank actually said to “sell everything.” Certainly such advice is at odds with Shad’s wisdom. While there are many other examples of such disingenuous market advice, fast forward to the Friday morning following the Brexit vote. Hereto, in their “rush to instantly inform,” many pundits gave disingenuous and even wrong advice. Our advice was to take a deep breath and do nothing that Friday. Better to analyze things over the weekend, with clearer thoughts hopefully arriving Monday morning. Comes Monday and whispers of a “crash” were circling Wall Street, and as we suggested some stocks for your “buy lists,” stocks slid. To allay those crash fears we noted that nowhere in our exhaustive studies has there ever been a crash with the S&P 500 so close to all-time highs. Turning Tuesday (+269 points) arrived on time followed by Wednesday’s “win” (+284) making the two day two-step a back-to-back 90% Upside Volume skein, which is a pretty bullish occurrence, but left the equity markets overbought in the short term. That’s why we wrote in Thursday’s Morning Tack that a pause/pullback was likely at hand, but the upside should still be favored. Well, that proved to be disingenuous advice because the D-J Industrials rallied another 285 points that day. The pause finally arrived on Friday (+19), which brings us to today.

While Andrew Adams and I attempt to “call” the short-term moves in the various markets, we have never wavered in the belief the equity markets remain in a secular bull market that has years left to run. Last week CNBC asked me, in a preappearance interview, to list some reason why I am bullish. Here the list:

- The Brexit vote is not all that impactful for the U.S. since ~70% of U.S. companies’ revenues are domestic.

- Brexit may not happen.

- S&P’s earnings estimate for 2017 is $134.01 meaning at the recent low (1991) the forward P/E was 14.8x.

- The Global Earnings Revision Ratio has improved for the fourth straight month (analysts are raising earnings estimates).

- Interest rates are going to stay low for longer than most expect.

- The Advance/Decline line during the pullback acted great.

- Unlike in a financial crisis, the funding markets didn’t show any signs of stress (credit spreads).

- The S&P 500 recaptured its 20-month moving average quickly (read: bullish).

- As Jim Paulsen (Wells Capital) states, “It’s not like the U.K. is going to remove itself from the world economy and not trade with anyone. Once the emotion of this event fades, investors may get back to the fundamentals, which at least in the U.S. are looking better.” Or this from Guardian Capital’s Steve Bates, “Capitalism is a resilient and flexible organism and companies adapt quickly to new circumstances. This is why economies usually muddle through crises even in the absence of good leadership.”

Some of the other gleanings from a pretty unusual week include:

- Forget Brexit, the U.K. will emerge with a good trade, just like Switzerland.

- Share of world GDP in 2015: England 3.9%, Germany 4.6%, France 3.3%, U.S. 24.4%.

- Britain’s credit downgrade by S&P was the first sovereign downgrade from AAA by two notches ever.

- Brexit is giving the EU the potential to morph the continent’s countries into a super-state.

- Mexico urges North America toward integration after Brexit.

- Judge Posner sees no value in the U.S. constitution because our forefathers couldn’t have foreseen today.

- Gateway Pundit report states latest Reuters’ poll shows 52% of respondents were Democrats and 35% Republicans.

- Restaurant visit growth has stalled the last three months.

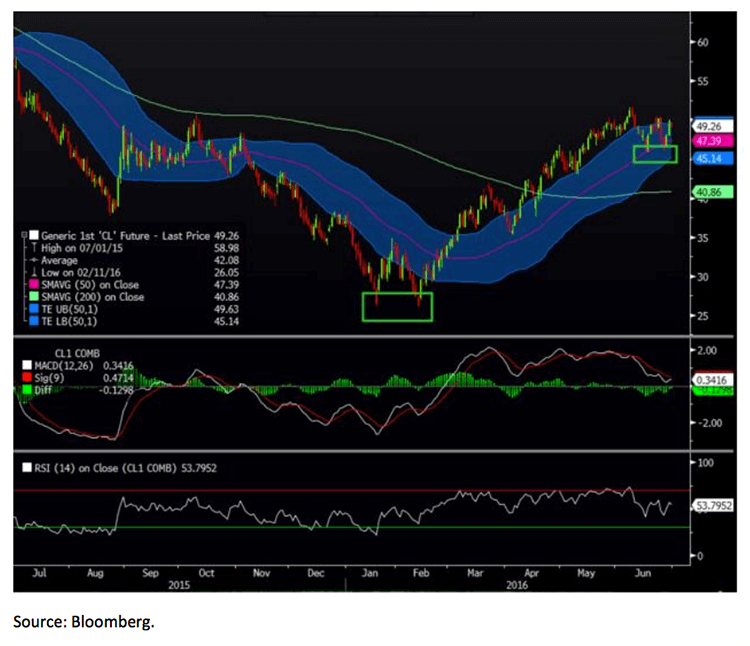

- Crude oil looks like it has made a double-bottom like it did last January/February (see chart on page 3).

- Norway oil workers avoid a strike.

- Does the failed auction of 1109-carat diamond signal the top in tangible assets?

- The move to eliminate the U.S. $100 bill fails.

- Amazon will give shoppers another chance at Black Friday on July 12.

- To be continued.

The call for this week: There is plenty of internal energy for an upside breakout to new all-time highs. Indeed, the Brexit decline has not changed our view that the February lows represented a major bottom, sinking the footings for a move to new all-time highs. Last week we experienced not only back-to-back 90% Upside Volume days, but back-to-back “buying climaxes” where 80%+ of issues traded advanced on the day. This is a rare event and last happened in December 2011 and January 2012 right before the S&P 500 (SPX/2102.95) gained ~24% (a tip of the hat to First Republic’s Jon Bull). Moreover, according to Fundstrat’s Thomas Lee (as paraphrased):

The S&P 500 fell 5% in two days. Of the 50 times that has happened since 1940, 16 occurred when the S&P 500 was above either its 50-day or 200-day moving average like now (in a bull trend), the median returns [going forward] have been impressive.

Not to be outdone, last Thursday my friend Jason Goepfert wrote, “Stocks jumped again, triggering the 3rd large up day in a row. Back-to-back-to-back gains of 1% have been rare, especially coming out of a multi-month low. When it has done so, the S&P 500 has been higher three months later every time, though the sample size is small.”

Well, the anticipated “pause” arrived on Friday and at 5:30 a.m. today it looks like the “pullback” is here with the preopening S&P 500 futures off about 12-points as the burgeoning Italian banking crisis takes center stage. We wrote last week that not only is it fears that Italy’s banking problems will spread to other countries, but that Italy is the linchpin for the EU. With an Italian referendum looming, if Italy pulls a Brexit the EU is in trouble. Nevertheless, we remain bullish.

Copyright © Raymond James