by Don Vialoux, Timingthemarket.ca

Thank You

Thank you to the Canadian Society of Technical Analysts. The Society presented awards at its annual meeting on Wednesday to individuals and organizations that have supported the Society and have encouraged the use of technical analysis in Canada through the years. Four members were selected as the 2016 inductees into the CSTA Hall of Fame:

Ron Meisels

Martin Pring

Larry Berman

Don Vialoux

Observations

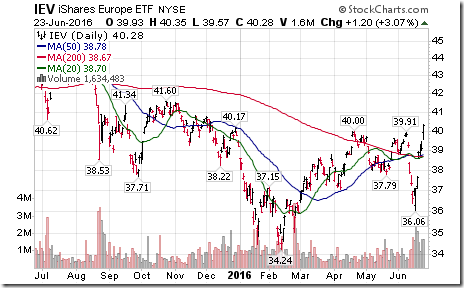

European equity markets and related ETFs fully anticipated a “remain” vote on the Brexit referendum. ETF representing top European stocks broke to a new high.

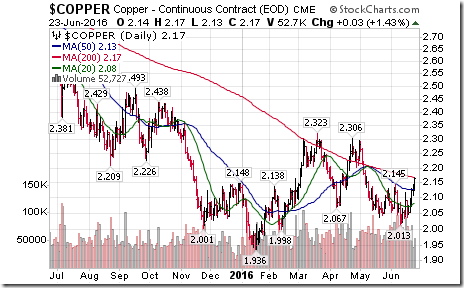

Weakness in the U.S. Dollar yesterday prompted industrial commodity prices to move higher.

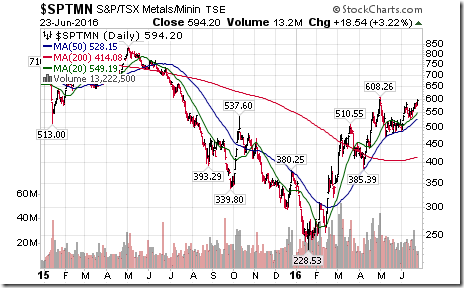

Base metal stocks responded accordingly. The TSX Metals and Mining Index is testing a 12 month high at 608.26. Seasonal influences remain positive until late July.

StockTwits Released Yesterday @EquityClock

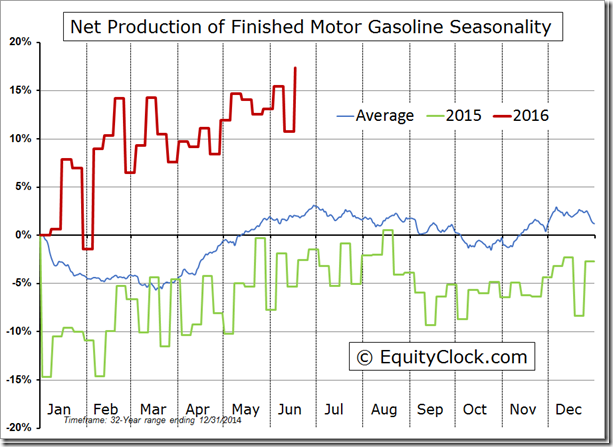

Production of gasoline hits the highest level in history.

Technical action by S&P 500 stocks to Noon: Bullish. Breakouts: $GPC,$HOT,$M, $MAR,$CL, $OXY, $BRKB, $HST, $L, $PFG, $TMK, $ISRG, $HOLX, $MU, $LKQ.

Editor’s Note: After noon, breakouts included TGT, MTB, EFX, YUM and CB. Breakdown: ANTM

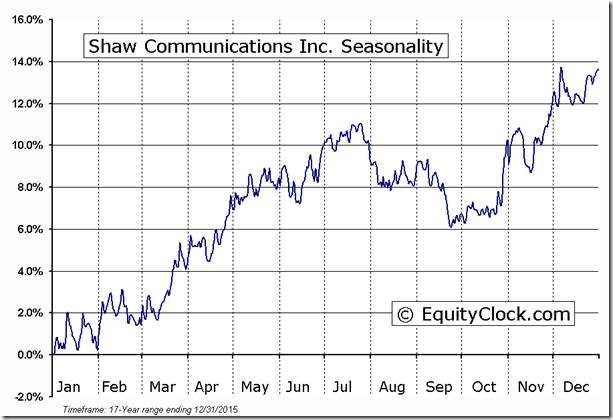

Nice breakout by Shaw Communications $SJR.B.CA above resistance at $Cdn 25.12 extending uptrend

Editor’s Note: The stock originally was supported with a price chart and seasonality chart on June 8th.

‘Tis the season for strength in $SJR until mid-July!

Trader’s Corner

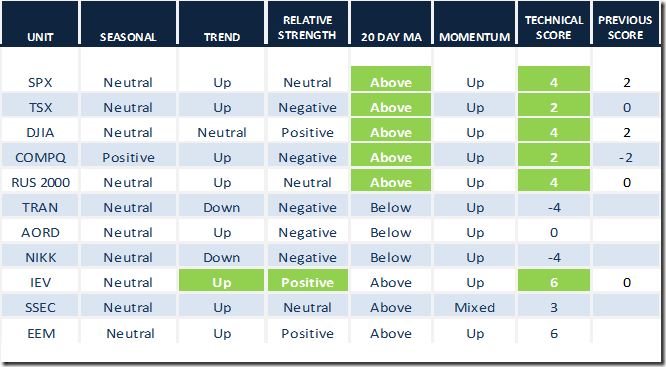

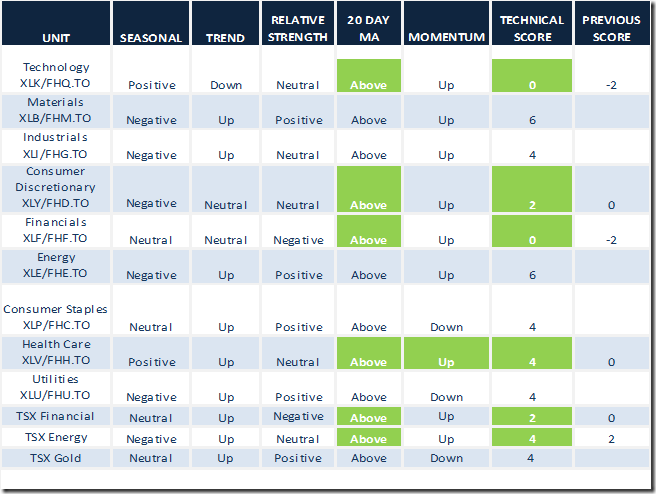

Technical scores moved higher thanks mainly to units moving above their 20 day moving average.

Daily Seasonal/Technical Equity Trends for June 23rd 2016

Green: Increase from previous day

Red: Decrease from previous day

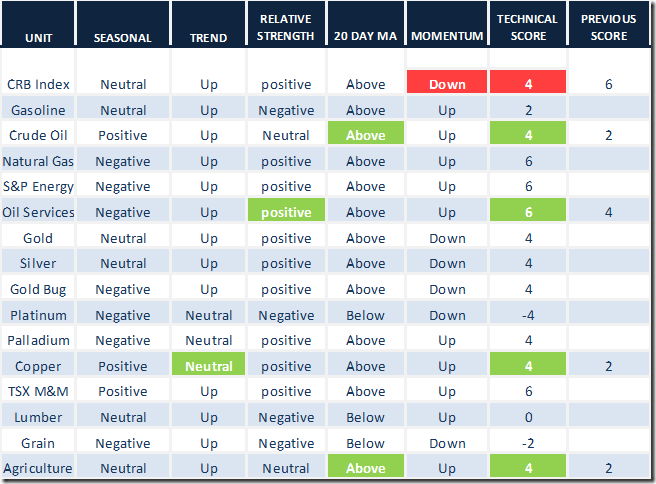

Daily Seasonal/Technical Commodities Trends for June 23rd 2016

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Sector Trends for March June 23rd 2016

Green: Increase from previous day

Red: Decrease from previous day

Adrienne Toghraie’s “Trader’s Coach” Column

|

|

Anatomy of a Trading Loss

By Adrienne Toghraie, Trader’s Success Coach

In every performance based endeavor there is the chance that loss will occur. This is certainly true for those who are traders. In trading, it is more accurate to say when loss occurs, not that there is a chance that loss will occur. While a loss can feel devastating when it occurs, what you do after will determine whether you let the loss defeat you, or you treat it as part of the overall win towards your desired goal.

Let’s look at several scenarios that a trader can experience when a loss occurs.

First phase

· A well defined and tested strategy before a loss occurs

· See an opportunity based on a strategy

· Know the monetary risk involved for this particular trade

· Feel good about the prospects of the outcome of the trade

· Take the trade with a pre-determined stop in place

· Stopped out with a loss

A loss that occurs because the rules of a strategy have been violated, or there is no predetermined tested strategy:

· Get into a trade on a whim

· Get in too late

· Miscalculate the risk when getting into a trade

· Get out too early

· Clerical error

· Have no stops, change the stop

Second phase

· You have taken the loss and now you (On the positive side):

· Look for the next opportunity

· Take a predetermined break that you have established in your business plan for when you take a loss, and then begin looking for the next opportunity

You have taken the loss and now you (On the negative side):

· Get mentally and sometimes physically upset looping a story in your mind about the loss

· Take responsibility for the loss and condemn yourself

· Blame someone else and direct all your bad feelings towards him or her

Third phase

· Handling the mental aspect (On the positive side)

· Know that losses are a part of the overall win and look for another opportunity

· Learn a lesson that you will not repeat and keep trading

· Realize that you must have a tested strategy and stop trading to put together a plan

Handling the mental aspect (On the negative side):

· Go to a dark place inside of yourself where you have placed losses of the past, and then get emotionally upset out of proportion

· Stay in a loop of upset, and then try to get back at the markets

· Continue trading in ignorance creating more losses

· Stop trading altogether

Facing losses from the beginning

Sandra knew from the start that losses would be the largest hurdle that she would face in becoming a trader. She made it a priority to speak to other traders about it and worked with a coach before she took her first trade. As part of her trading business plan she created every scenario for contingencies in dealing with loss.

Sandra’s father, who was an avid baseball fan, kept reminding her that seventy percent of the best baseball players lose and still have great performance records. With her father’s encouragement and her own due diligence, Sandra started her trading career with the best preparation for taking losses.

Conclusion

Losses are a part of what a trader must face in order to become successful. How a trader handles those losses will determine how long it takes him to get there.

Adrienne’s Free Webinars

Adrienne presents free webinars on the psychology of trading

Email Adrienne@TradingOnTarget.com

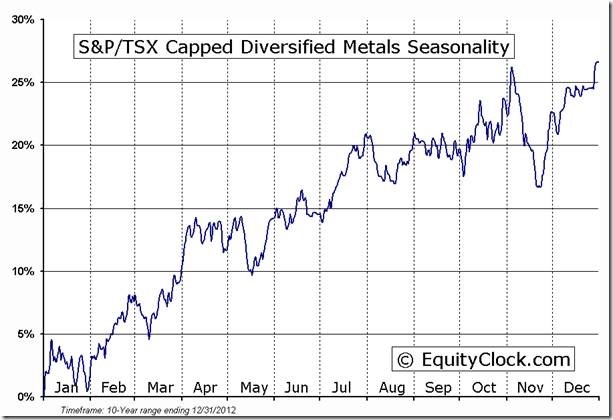

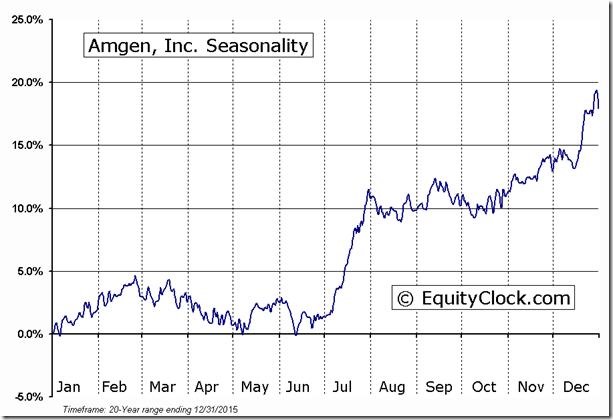

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts. Following is an example:

S&P 500 Momentum Barometer

The Barometer rose 13.40 (22.41%) yesterday. It became more intermediate overbought.

TSX Momentum Barometer

The Barometer added 3.46 (5.37%) yesterday. It remains intermediate overbought.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca