Inside the S&P 500: The Real Estate Sector

by David Blitzer, Chairman of the Index Committee, S&P Dow Jones Indices

Part of the power of the S&P 500 is analyzing the market and gaining insights into which stocks rising or falling. The key to these analyses is GICS - the Global Industry Classification Standard - which is used to define the sectors and industries in the index. GICS is jointly maintained by S&P Dow Jones Indices and MSCI. The classifications are used across the S&P indices so that analysts have a consistent picture whether they look at large cap versus small cap or foreign versus domestic.

GICS goes back to 1999 and divides the world of equities into 10 sectors, 24 industry groups, 68 industries and 157 sub-industries. Because lots has changed since 1999, GICS is reviewed each year to assure that it remains relevant. Among those changes is the increasing interest in investing in real estate through equities and the growing popularity of real estate investment trusts (REITs). REITs are taxed differently from most corporations and are required to distribute a large portion of their income. REITs are seen as attractive income oriented dividend paying investments.

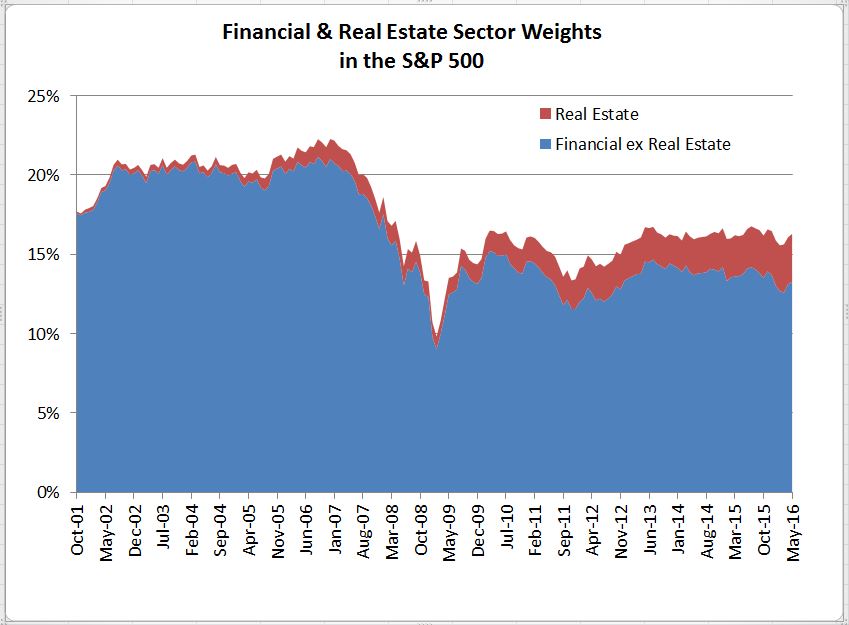

When GICS was introduced in 1999, REITs were considered alternative investments and rarely found in mainstream indices. The initial recognition step came in 2001 when S&P Dow Jones Indices, after a market consultation, decided that REITs would be eligible for inclusion in the S&P 500. At that time REITs and other real estate development companies were grouped together with the financials under GICS. Periodically investors would suggest that real estate or REITs were lost amidst the banks and brokers and should stand on their own. Over the last few years, as S&P Dow Jones Indices and MSCI reviewed GICS, we heard more and more about real estate and REITs. (The chart shows the increasing real estate share in the S&P 500's market value compared to financials excluding real estate.) Based on comments from investors, the real estate industry and others, S&P Dow Jones Indices and MSCI announced in March 2015 that real estate would leave the financial sector and become its own 11th sector in GICS. The move for GICS is at the end of August, the shift in S&P Dow Jones Indices will be the rebalance on September 16th.

This is not just rearranging the place cards on the table. The GICS sectors are widely used to gauge how asset allocations align with markets. With real estate added to the top line of sectors, investors will notice where real estate is and whether they are over or under weighted. Analyses of market movements and fundamentals will focus on real estate the same way they focus on industrials or technology. With real estate removed from the financials, the reported dividend yield for financials will drop a bit as real estate moves to be among the higher yielding sector in the 11, along with telecommunication services and utilities.

With the change to GICS, real estate and REITs will garner more discussion and ink. Already analysts, ETF issuers and the media are paying increasing attention to the new sector-to-be. Those who thought the financial crisis ended real estate investing were wrong; real estate and REITs are an important part of the market. With the new GICS sector, REITs will get increased attention. Greater attention is not a guarantee of investment results.

Copyright (c) S&P Dow Jones Indices