by Don Vialoux, Timingthemarket.ca

Observations

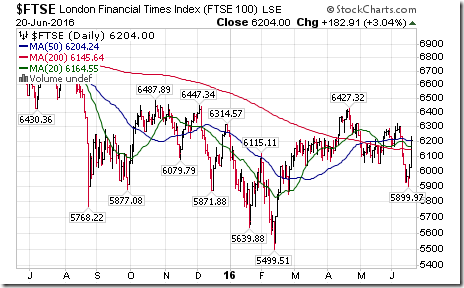

“Brexit” remains a focus for equity and currency markets. The British Pound and London FT Index spiked higher in anticipation of a “stay” vote on Thursday. The latest poll released after the close yesterday expanded the spread to 7 percentage points in favour of a “stay” vote

U.S. Treasury prices came under profit taking pressures prior to Janet Yellen’s Humphrey Hawkins testimony. Momentum indicators are now trending down.

StockTwits Released Yesterday

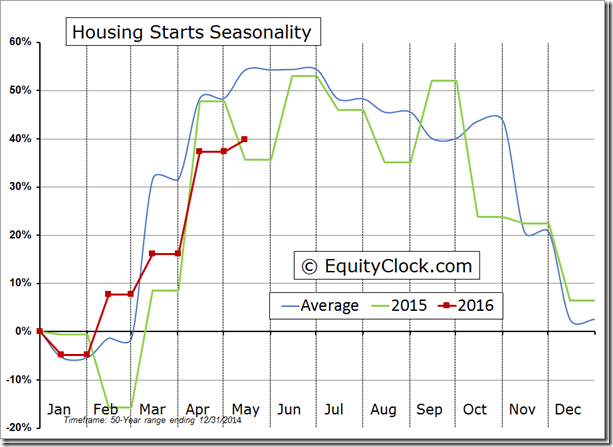

Below average increase in housing starts continues to constrain the supply of new homes.

Technical action by S&P 500 to 10:15: Bullish. Breakout: $PVH, $AFL, $HST, $FTR, $VZ, $AES

Editor’s Note: After 10:15 AM EDT, Harley Davidson (HOG), Kraft Heinz (KHC) and Westrock (WRK) broke resistance and Alexion Pharmaceutical broke support.

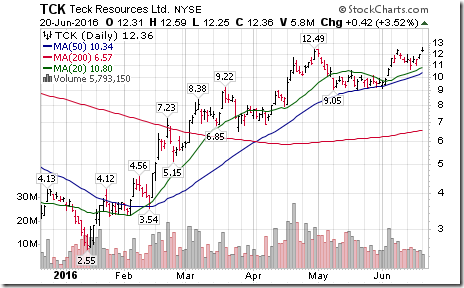

Nice breakout by $TEK above resistance at US$12.49 extending an intermediate uptrend.

Trader’s Corner

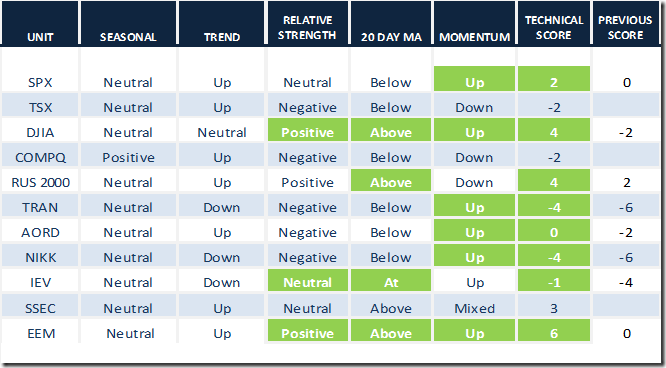

Technical scores improved significantly yesterday mainly because short term momentum indicators recovered from oversold levels.

Daily Seasonal/Technical Equity Trends for June 20th 2016

Green: Increase from previous day

Red: Decrease from previous day

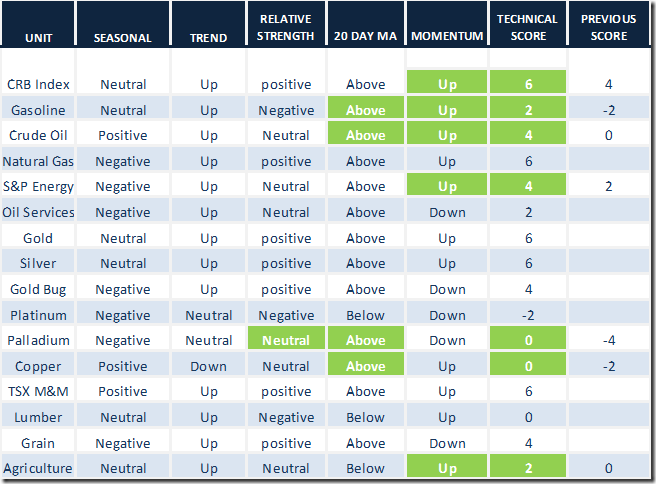

Daily Seasonal/Technical Commodities Trends for June 20th 2016

Green: Increase from previous day

Red: Decrease from previous day

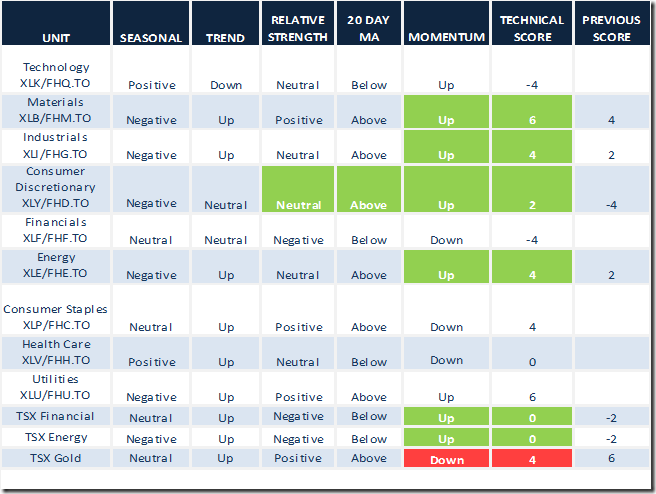

Daily Seasonal/Technical Sector Trends for March June 20th 2016

Green: Increase from previous day

Red: Decrease from previous day

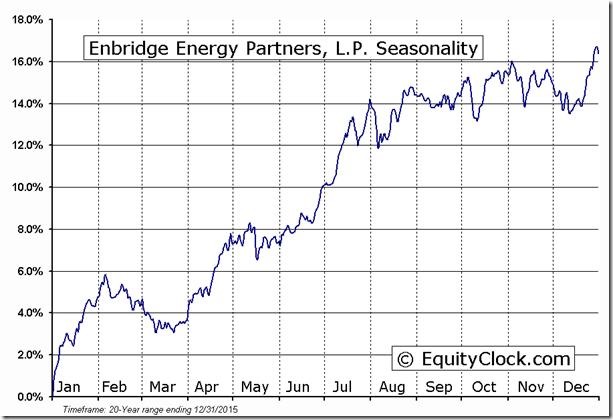

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts. Following is an example:

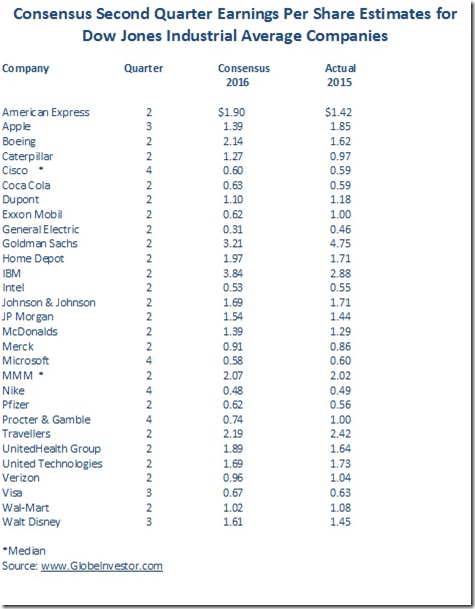

Consensus Second Quarter Earnings Per Share Estimates for Dow Jones Industrial Average Companies

Consensus for second quarter earnings per share by Dow Jones Industrial Average companies is mixed: 16 companies are expected to report higher earnings on a year-over-year basis and 14 companies are expected to report lower earnings. On average (median), earnings per share will increase 2.1%. Largest percentage gains are expected to be reported by American Express, Boeing, Caterpillar and IBM. Largest percentage losses are expected to be reported by Apple, Exxon Mobil, General Electric, Goldman Sachs and Procter & Gamble. Earnings reports released by Dow Jones Industrial Average companies are expected to compare favourably with reports by S&P 500 companies where year-over-year earnings are expected to decline 5.0%. Following is the data:

CSTA Event

Please join us at the Toronto Special Event June 22: Hall of Fame Luncheon Presentation with Don Vialoux and Annual Awards Ceremony. Register at www.csta.org to ensure your seat is held.

The CSTA is proud to announce this year’s class of inductees into the Canadian Technical Analysts Hall of Fame.

Larry Berman

Ron Miesels

Martin Pring

Don Vialoux

We will be honouring this year’s class of inductees with a keynote speech from Don Vialoux at our annual luncheon being held in Toronto at the Sheraton Centre starting at 11:30 am.

Also, at the luncheon we will be announcing the winners of this year’s inaugural CSTA awards. Thanks very much to our members for your support, nominations and participation in the voting.

We look forward to seeing you at this exciting event, a great opportunity to meet other technicians and to celebrate technical analysis before the summer.

S&P 500 Index Momentum Baromoter

The Barometer jumped 8.60 to 61.60 (16.23%) yesterday. The Barometer became more overbought and remains in an intermediate downtrend

TSX Composite Index Momentum Barometer

The Barometer jumped 11.26 to 69.26 (19.40%) yesterday. The Barometer became more overbought and remains in an intermediate downtrend

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca