Using Systematic Equity Strategies

by Dimitris Melas, Global Head of Equity Research, MSCI

Top-down managers assess the economic outlook and translate macro views into country and industry portfolio positions. In contrast, bottom-up managers select securities based on a set of common criteria, for example valuations, profitability, growth, quality, yield, as well as company-specific attributes. Many institutional equity investors combine top-down analysis and security selection. All types of managers, irrespective of their investment philosophy and process, need to understand their risk exposures, build efficient portfolios and differentiate themselves from their competitors.

Factor models help managers achieve these objectives by bringing transparency and structure to the portfolio management process. They reflect the top-down investment process through country and industry factors. They address the bottom-up investment process by incorporating style factors and specific returns into the model.

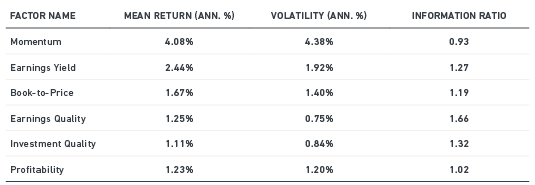

Country, industry and style factors help forecast and explain portfolio risk. Systematic Equity Strategy (SES) factors, a subset of style factors, have also earned positive long-term returns historically (see Exhibit 1).

Exhibit 1: Return and Risk Characteristics for Select SES Factors

These factors have been discussed in academic literature and have been used in quantitative alpha models and in fundamental security selection. Some of the most popular SES factors include value, momentum and quality. Each has its own set of descriptors (metrics) which help describe the factor (see Exhibit 2).

Exhibit 2: Style Factor Family Tree*

*This exhibit displays SES factors and their descriptors included in the new MSCI Long-Term Global Equity Model (GEMLT). Previously identified factors and descriptors are marked in blue; additions introduced in GEMLT are marked in red.

We have reviewed the role of SES factors in global portfolios and show how active managers can use these factors in an effort to differentiate and enhance their investment processes:

- We find that most active portfolios have significant exposure to SES factors, irrespective of the underlying investment process.

- We show how SES factors enable managers to monitor risk exposures in a more granular fashion and conduct more accurate performance attribution, helping them to differentiate their investment processes.

- Finally, we examine how SES factors may be used as inputs to enhance quantitative alpha models and fundamental security selection and may enable managers to improve portfolio performance.

Read the paper, “Using Systematic Equity Strategies: Managing Active Portfolios in the Global Equity Universe” by Imre Balint and Dimitris Melas.

The author thanks Imre Balint for his contribution to this post.

Copyright © MSCI