by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Wednesday June 8th

U.S. equity index futures were higher this morning. S&P 500 futures were up 4 points in pre-opening trade.

Dover (DOV $70.50) is expected to open higher after RW Baird upgraded the stock to Outperform from Neutral.

Lululemon added $1.31 to $69.45 after raising sales guidance.

UnitedHealth Group (UNH $136.94) is expected to open higher after the company increased its quarterly dividend by 25%.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/06/07/stock-market-outlook-for-june-8-2016/

Note seasonality charts on the VIX Index and Consumer Credit.

Observations

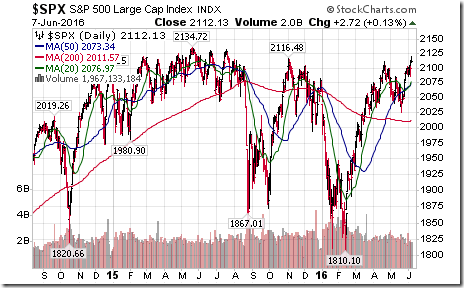

The S&P 500 Index, Russell 2000 Index and NASDAQ Composite Index moved smartly higher in early trading yesterday and briefly reached multi-month highs. However, gains were not sustained and indices closed virtually unchanged. Overhead resistance by the S&P 500 Index below its all-time high at 2,134.72 remains apparent.

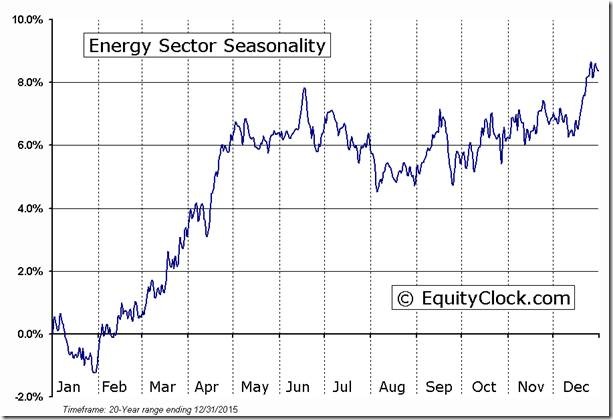

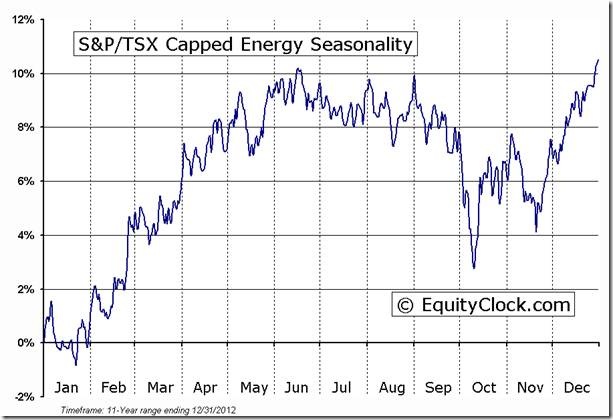

Energy stocks and ETFs on both sides of the border led advancing stocks. Seasonal influences for the U.S. and Canadian energy sectors remain positive until mid-June.

StockTwits Released Yesterday @equityclock

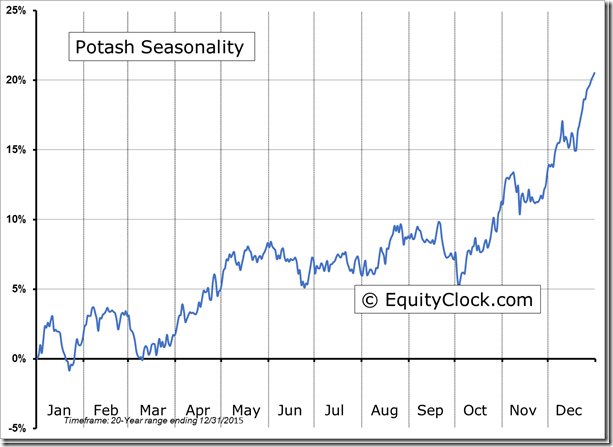

Fertilizer stocks catch a bid as period of seasonal strength nears.

Technical action by S&P 500 stocks to 11:15: Bullish. Breakouts: $PCLN,$APC,$HP,$NOV,$CVX,$SYF,$MRK,$SRCL,$WM,$AES

Editor’s note: After 11:15 AM EDT, another 10 S&P 500 stocks broke resistance: BCR, COG, EOG, FE, MHK, NWL, PHM, T, VZ, WYNN

Energy stocks on both sides of the border dominate breakouts: $APC, $HP, $NOV, $CVX, $IMO.CA, $ENB.CA.

Nice breakout by S&P Energy Index (and related ETFs $XLE) to extend an intermediate uptrend!

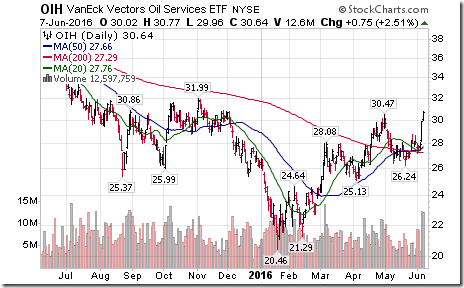

Strength in S&P Energy Index led by breakouts by oil services ETFs and stocks: $OIH, $HP, $NOV.

Nice breakout by Merck $MRK above $57.40 to extend an intermediate uptrend.

Nice breakout by National Bank $NA.CA above $45.91 to extend an intermediate uptrend.

Valeant Pharmaceutical $VRX.CA broke support at Cdn.$30.22 to reach a 5 year low.

Nice breakout by S&P 500 Index $SPX above 2,116.48 to reach a 10 month high.

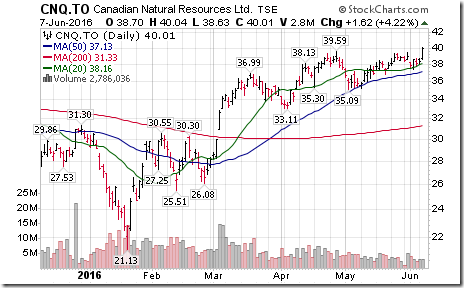

Another major Cdn. oil stock breakout. $CNQ.CA moved above $39.59 extending an intermediate uptrend.

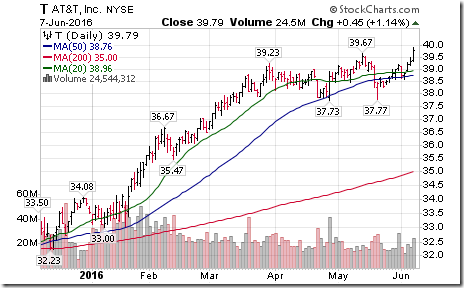

Another Dow Jones Industrial Average stock breaks out. $T moved above $39.67 to reach an all-time high.

Trader’s Corner

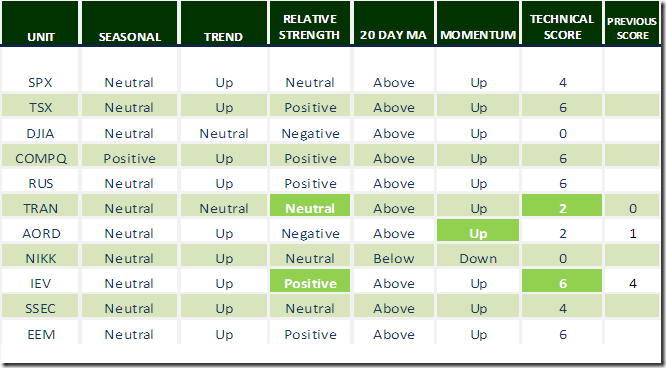

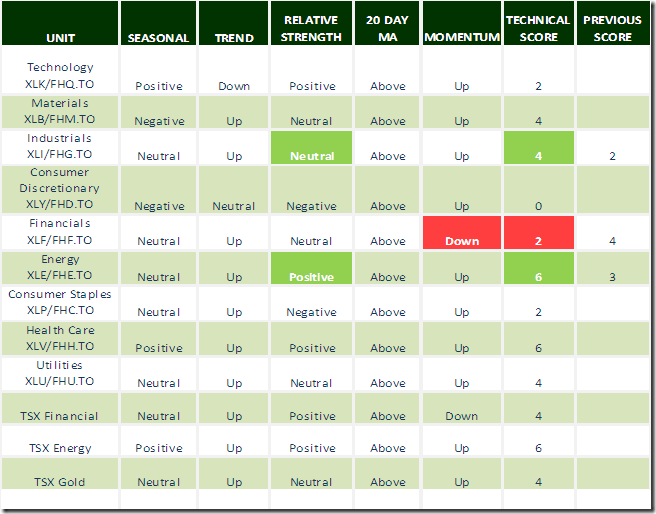

Daily Seasonal/Technical Equity Trends for June 7th 2016

Green: Increase from previous day

Red: Decrease from previous day

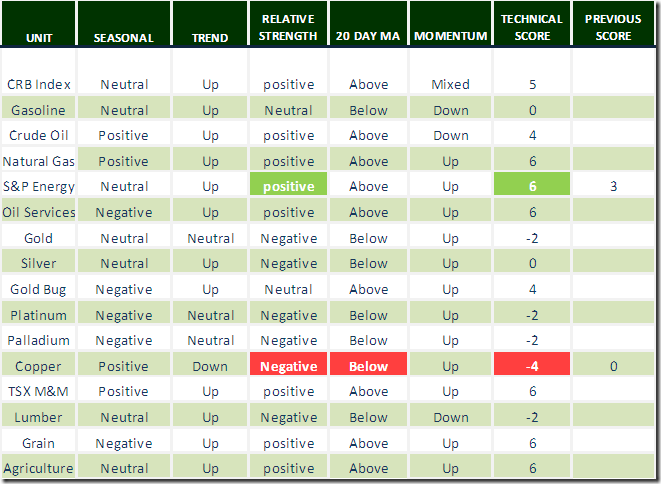

Daily Seasonal/Technical Commodities Trends for June 7th 2016

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Sector Trends for March June 7th 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Accountability Report

Biogen was supported on StockTwits on May 31st at $290.11. Yesterday, the company announced a set-back on clinical trials for its multiple sclerosis drug. Consequently, the stock fell sharply and broke support level at $256.42. The stock no longer is supported.

Other securities currently on the Accountability list:

XEG.TO

FBT

FHQ.TO

FTS.TO

FFIV

FDY.TO

FXL

CRM

BCE.TO

QCOM

IBB

S&P 500 Momentum Barometer

The Barometer added another 3.20 to 73.80 yesteday. The Barometer remains intermediate overbought, but has yet to show short term signs of peaking.

TSX Composite Momentum Barometer

The Barometer slipped -.37 to 84.48 yesterday. The Barometer remains intermediate overbought, but has yet to show significant short term signs of peaking.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca