Are You Prepared for a Summer Hike?

by Fixed Income AllianceBernstein

Janet Yellen and other Fed officials spent the last few weeks cautioning investors that a rate increase could be imminent owing to favorable economic data. Then came a weak jobs report. Will they or won’t they? Investors are left wondering how to weather the volatility that lies ahead.

Since mid-May, Federal Reserve officials have sought to reset market expectations for additional Fed rate increases—perhaps as soon as June 15. The Fed was evidently concerned that investors had become complacent about monetary policy risk since the Fed’s single rate increase in December.

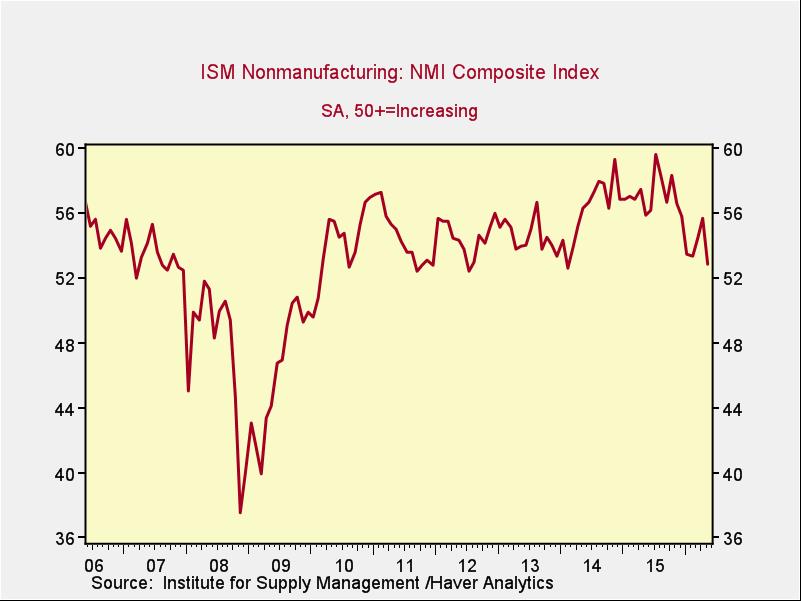

With Fed chatter increasing, market expectations for a June hike rose rapidly, from 4% to 28% by the end of May, as yields climbed and bond prices fell. Expectations of a rate hike subsided again with the release of disappointing employment data in early June.

But even if the Fed holds off on raising rates in June—or in July—and waters remain muddy about when the next hike will occur, what is clear is that Treasury volatility is going to pick up for US investors.

Caught in a US Trap

That may not come as real news: volatility has already been trending higher over the last two years. But what is especially worrisome is that traditional US core fixed-income portfolios are more exposed to Treasury volatility than they were prior to the global financial crisis.

First, the composition of the benchmark—the Barclays US Aggregate Index—has changed dramatically since 2007. As a sector, Treasuries have grown from 22% in 2007 to 37% of the benchmark today. And in combination, Treasuries, agencies and agency mortgage-backed securities—in other words, the portion of the index that’s most sensitive to Treasury volatility and rate hikes—now constitute two-thirds of the US core benchmark.

Second, volatility has a greater impact when yields are low, as they are today. It’s important to trade off volatility against yield, either by reducing volatility or by raising portfolio yield, or some combination of the two.

Investors heavily exposed to the US Treasury market with little to no flexibility in getting out may find themselves caught in a trap.

Time to Shift into Other Bond Markets

One way out of that trap is by adopting a currency-hedged global approach to core bond investing. Although US monetary policy will resume tightening at some point this year, other countries and regions around the globe are either easing or keeping rates stable, including Australia, Canada, the euro area, Japan, Norway, Sweden and the UK.

Furthermore, hedged global bonds have historically experienced lower volatility than US bonds—while offering roughly comparable returns. Over the past 20 years, the Sharpe ratio, which measures return per unit of risk, has been 1.1 for hedged global bonds, compared to US bonds at 0.8.

A large reason for this is the diversification effect of different economic and monetary policy cycles at play around the world. We’ve snapshotted this effect over the last quarter-century in what’s called up-capture/down-capture. When the average quarterly return on the US Aggregate was positive, the Global Aggregate Index returned 96% of the US index’s return. But when the US Aggregate was negative, the Global Aggregate declined only 65% as much.

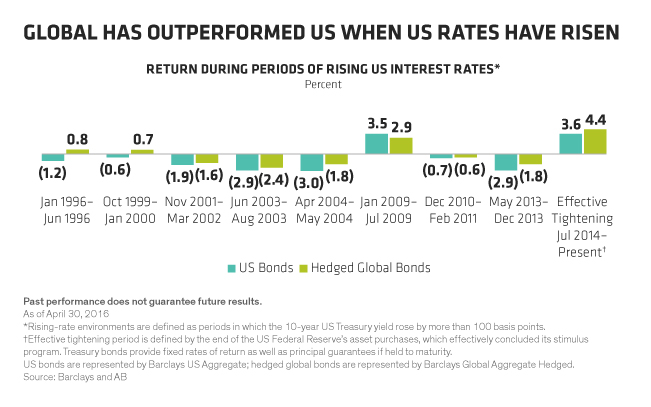

To really see this effect in action, we’ve broken out, in the Display below, periods of rising US rates, as defined by the 10-year Treasury yield increasing more than 100 basis points.

Over the last 20 years, the wider opportunity set of the global benchmark beat the US core benchmark during these periods in all but one instance.

That’s a lot of downside protection.

Flexibility Is Key

We agree with the Fed that investors shouldn’t get complacent about the potential for rates to rise here at home. The problem is that some investors may be trapped in a US core mandate and unable to shift into global exposure. Others with exposure to international bonds may nonetheless have fixed exposure to US interest rates when it’s least desirable.

But investors concerned about rising rates in the US need to build flexibility into their portfolios by adopting a dynamic, global approach to investing. The advantages to being able to move out of rising-rate environments are numerous.

And clearly, now is the time to look to the global bond markets for relief as US rates—and US volatility—rise.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Director—Global Fixed Income and Canada Fixed Income

Scott DiMaggio is Senior Vice President and Director of both Global Fixed Income and Canada Fixed Income at AB. In this capacity, he leads both the Global Fixed Income and Canada Fixed Income portfolio-management teams, and is ultimately responsible for all investment activities in both the Global and Canada Multi-Sector Fixed Income Strategies. DiMaggio is also a member of the Multi-Sector Research Review team and the Rates and Currencies Research Review team. Prior to joining the Fixed Income team, he performed quantitative investment analysis, including asset-liability, asset-allocation, return attribution and risk analysis. Before joining the firm in 1999, DiMaggio was a risk management market analyst at Santander Investment Securities. He also held positions as a senior consultant at Ernst & Young and Andersen Consulting. DiMaggio holds a BS in business administration from the State University of New York, Albany, and an MS in finance from Baruch College. He is a member of the Global Association of Risk Professionals and a CFA charterholder. Location: New York

Senior Managing Director—Global Fixed Income Business Development

Alison M. Martier is a Senior Managing Director for Global Fixed Income Business Development and a Partner at AB. She previously served as senior portfolio manager and director of the Fixed Income senior portfolio manager team. Martier was director of the firm’s US Multi-Sector service from 2002 to 2007. She joined the firm in 1993 from Equitable Capital, where she began as a trader in 1979 and was named portfolio manager in 1983. She is the co-author of “LDI: Reducing Downside Risk with Global Bonds,” published in The Journal of Investing. Martier holds a BA in economics from Northwestern University and an MBA from New York University’s Stern School of Business, and is a CFA charterholder. Location: New York

Related Posts

Copyright © AllianceBernstein