Major Asset Classes | May 2016 | Performance Review

U.S. REITs Came Out on Top Last Month

by James Picerno, The Capital Spectator

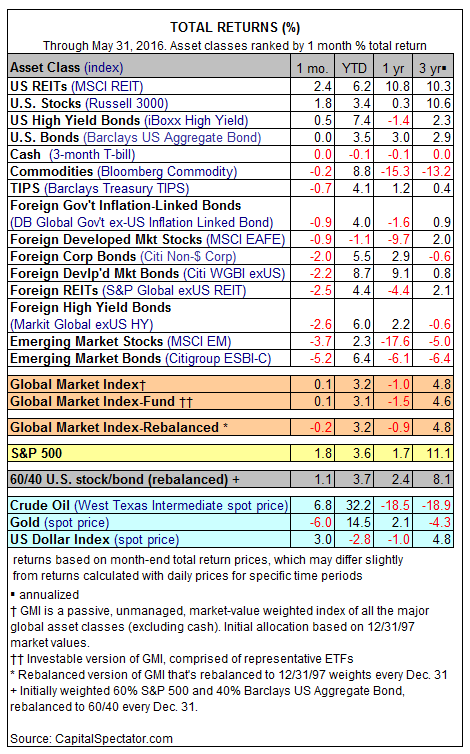

The recent rebound in global markets stumbled in May. Other than gains in US REITs, US equities, and US high-yield bonds, the rest of the field for the major asset classes suffered losses last month.

The big winner in May: real estate investment trusts in the US (MSCI REIT), which posted a 2.4% total return last month. For the year so far, US securitized real estate is ahead by a solid 6.2%. Note, however, that 2016’s current year-to-date leader is broadly defined commodities: the Bloomberg Commodity Index is higher by 8.8% so far this year.

The main loser last month: bonds in emerging markets (Citigroup ESBI-C), which shed 5.2%. Emerging-market stocks were the runner-up for red ink in May via a 3.7% loss.

The negative bias in markets last month kept a lid on the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. The index posted only a fractional gain of 0.1% in May. For the year so far, however, GMI is still ahead by a respectable 3.2%.

Note, too, that GMI’s trailing 3-year annualized total return inched up to 4.8% through last month (vs. 4.4% in April). That’s still near the weakest 3-year rolling return for GMI in several years. On the other hand, a 3-year return that’s close to 5% looks encouraging relative to the subdued long-run risk-premia forecasts for GMI of late.

Copyright © The Capital Spectator