by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Wednesday June 1st

U.S. equity index futures were lower this morning. S&P 500 futures were down 7 points in pre-opening trade.

Michael Kors gained $2.83 to $45.55 after reporting higher than consensus first quarter earnings.

Under Armour dropped $1.36 to $36.37 after lowering sales guidance. Susquehanna lowered its target price to $40 from $44.

Costco added $i.86 to $150.63 after Goldman Sachs upgraded the stock to Buy from Neutral.

Cracker Barrel gained $6.57 to $158.05 after releasing higher than consensus first quarter earnings and after increasing its dividend and announcing a special dividend.

Whole Foods gained $0.95 to $33.30 after Credit Suisse upgraded the stock to Outperform from Neutral.

Nike slipped $1.87 to $53.35 after Morgan Stanley downgraded the stock to equal weight from overweight.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/05/31/stock-market-outlook-for-june-1-2016/

Note the seasonality study for the S&P 500 Index during the month of June showing outperformance during first half of the month.

Globe and Mail Column published yesterday:

It’s time to rethink “Sell in May and Go Away”

Following is the link:

Authored by Don Vialoux

Interesting Charts

Nice breakout by the Russell 2000 Index above 1,156.07 to extend an intermediate uptrend.

Early signs of a technical recovery by the Shanghai Composite Index! Relative strength is showing an early improvement and short term momentum indicators are trending up. Watch for a response by base metal stocks!

The China ETF with heavy weights in the financial services sector paints a more a positive technical picture.

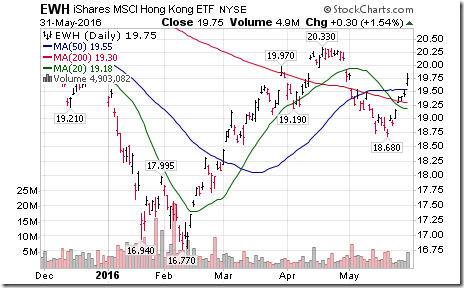

Ditto for the Hang Seng ETF!

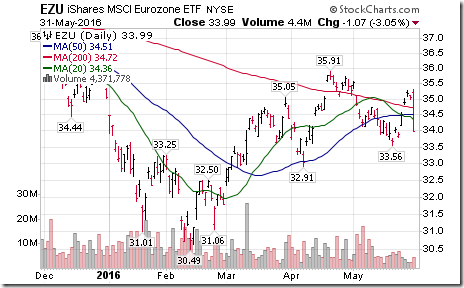

Concerns about “Brexit” hit big-cap European stocks in late trading yesterday

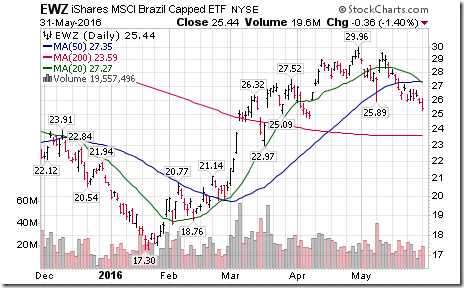

The Brazil ETF broke below short term support as the impeachment process reaches a climax

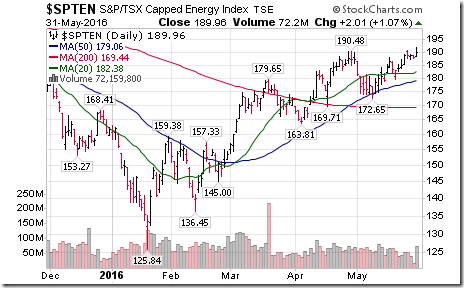

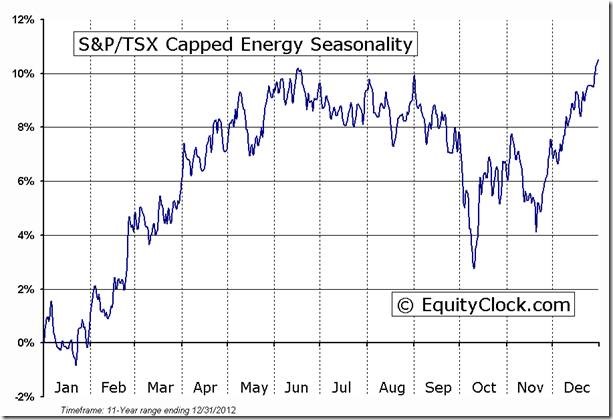

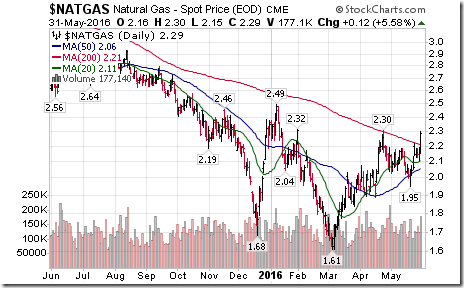

Nice breakout by the TSX Energy Index above 190.48 to extend an intermediate uptrend. Strength was related to a response to higher natural gas prices. Seasonal influences for the sector remain positive until mid-June.

StockTwits Released Yesterday

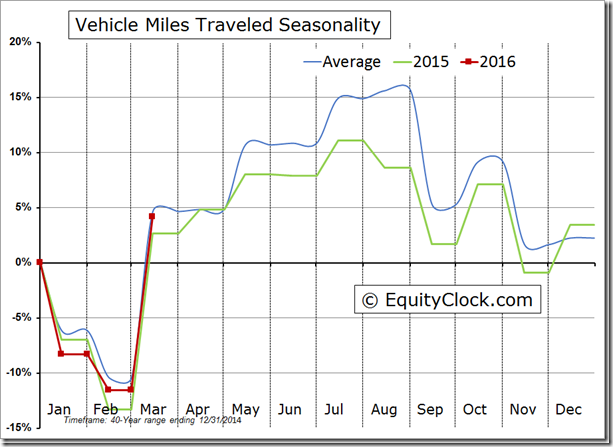

Driving season off to a strong start with vehicle miles travelled up 17.8% in March

Technical action by S&P 500 stocks to 10:15: Bullish. Breakouts: $TSCO, $DO, $HAL, $GPN, $BBT, $WFC, $BIIB, $VRTX. No breakdowns.

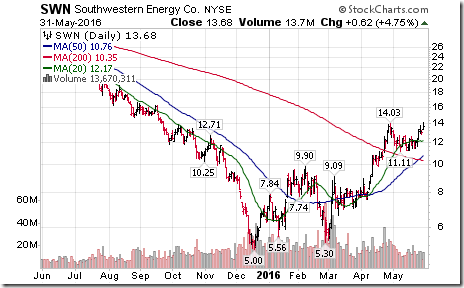

Editor’s Note: After 10:15 AM EDT, three more S&P 500 stocks broke above resistance: IBM, SWN and ADS

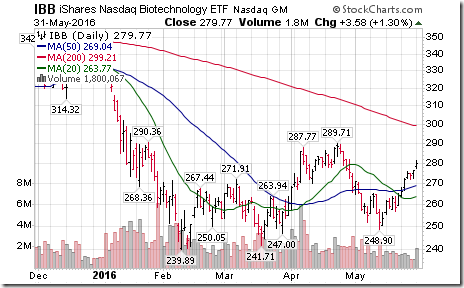

Biotech $IBB is leading markets on upside prior to ASCO conference in Chicago on June 3-7 where new cancer treatments released.

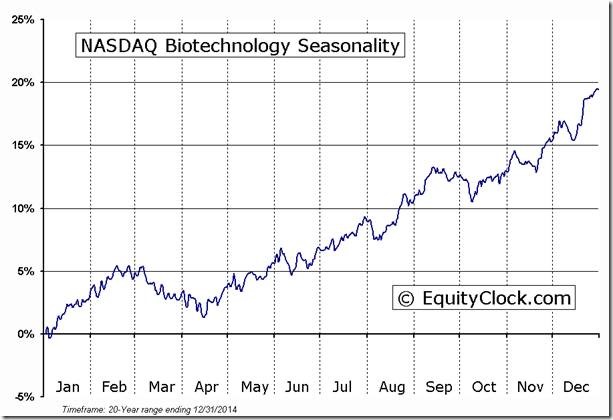

‘Tis the season for Biotech $IBB to move higher prior to the ASCO conference in Chicago on June 3-7

Nice breakout by Biogen $BIIB above $286.32 to extend an intermediate uptrend prior to ASCO conference.

‘Tis the season for Biogen $BIIB to move higher to early September!

Nice breakout by Vertex $VRTX above $91.78 to complete a reverse head & shoulders pattern prior to the ASCO conference.

Nice breakout by $IBM above $152.05 to a 10 month high extending an intermediate uptrend.

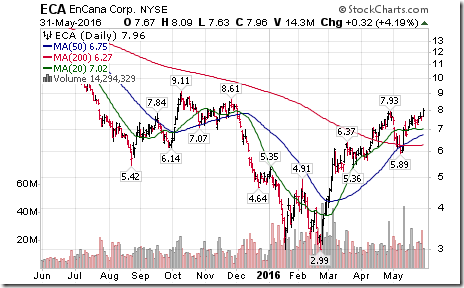

Nice breakout by $ECA above US$7.93 to extend an intermediate uptrend. Seasonals are positive to mid-June.

“Gassy” stocks are responding to a 5.5% increase in natural gas prices. Nice breakouts by $SWN and $ECA!

Editor’s Note: The U.S. “Gassy” ETF is testing its high at $25.05.

Another Tech stock breaking above a base pattern! $ADS moved above $221.82 to establish a new intermediate uptrend.

CSTA Events

The KWCC chapter of CSTA next meets in Kitchener at 7:30 PM EDT on June 2nd. Location is 4355 King St. E. in Kitchener. Register at www.csta.org

CSTA annual meeting will be held at noon on June 22nd at the Sheraton Hotel. Cost is $45 for members and $55 for non-members (includes lunch). Register at www.csta.org

Adrienne Toghraie’s “Trader’s Coach Column

|

|

The Importance of Good Communication

By Adrienne Toghraie, Trader’s Success Coach

There has been a lot of talk about how the lack of good communication is a major problem in our politics and in our lives. While we over communicate in the area of blogs, twitters and tweaks, face-to-face communication is becoming a thing of the past. In face-to-face communication people have to confront problems where they do not necessarily have the answers, or do not want to face the truth about what is happening. Perhaps the present day models of how people communicate have an effect on how we communicate with ourselves.

Let’s look at the importance of how a trader’s communication with himself can make the difference between success and failure.

Thoughts influencing action

While we do not think about how thoughts affect action on a regular basis, we think thoughts constantly. Very often those thoughts are repetitious and lead to taking unintended or undesired action. Thoughts such as:

· If I am wrong, I will have to answer to my spouse

· If I get in too soon or too late, I will miss my best opportunity

· What makes me think that I really know what I am doing?

· The last time it worked when I broke my rules

Change the conversation

Most of us monitor the conversation we put out to the world because we have experienced the consequences of not filtering our thoughts. If we do this for others, we should also consider doing it for ourselves in order to have a better outcome.

Here is an example of how you might consider speaking to yourself:

“I have improved on my technical skills and have worked on my psychology to get a better outcome. With my continued education, I should expect and enjoy better results.”

“I am a good trader who makes good choices because I follow my predetermined strategy. I learn from the actions I take every day.”

Or, more simply stated:

“Every day in every way I am becoming a better trader and better person.”

Change the conversation with others

If someone says to you that you are a gambler, you are throwing away money and that you will never be a trader, your answer should be:

“I appreciate your concern. I know that you have my best interest when you give me advice. Trading is a profession where people do earn a living when they incorporate the right principles and take the right action. I have a business plan where I intend to be risk adverse and take only calculated risk based on a tested strategy. If for some reason I do not earn money, I will do what is necessary to adjust my strategy, or take care of any self-sabotage before risking any more money.”

Or, more simply stated:

“I take calculated risk that has been tested to be profitable.”

Of course, you must consider that if you have not been producing profits, perhaps the well-meaning people in your life are justified in their comments to you.

Conclusion

Conversation has an influence on your taking action. When you take the time to listen to what is being said, you might realize that changing that conversation to be more positive would have a better influence on your producing higher profits in your trading.

Free Newsletter

More Articles by Adrienne Toghraie, Trader’s Success Coach

Sign Up at – www.TradingOnTarget.com

Trader’s Corner

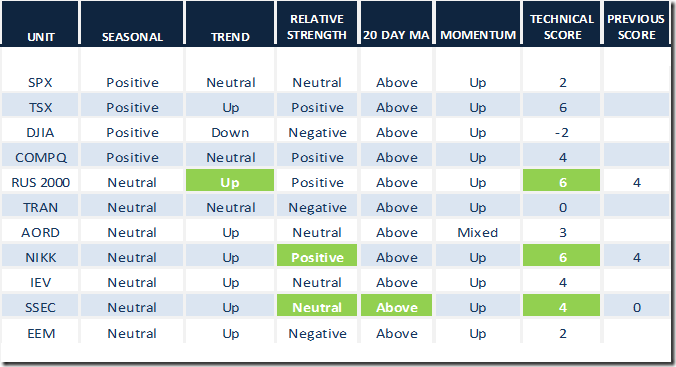

Daily Seasonal/Technical Equity Trends for May 31st 2016

Green: Increase from previous day

Red: Decrease from previous day

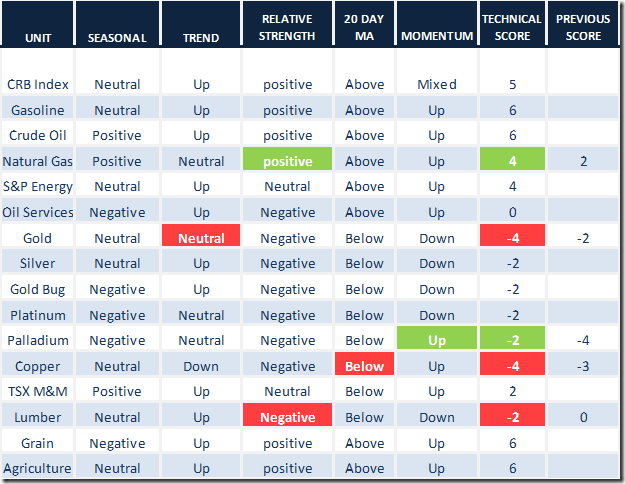

Daily Seasonal/Technical Commodities Trends for May 31st 2016

Green: Increase from previous day

Red: Decrease from previous day

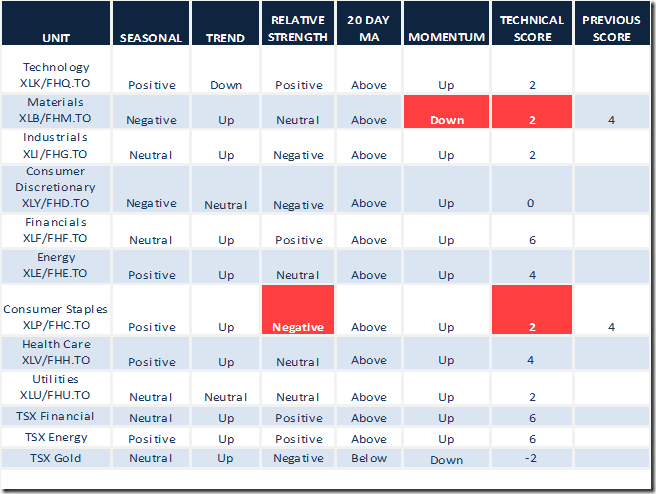

Daily Seasonal/Technical Sector Trends for March May 31st 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

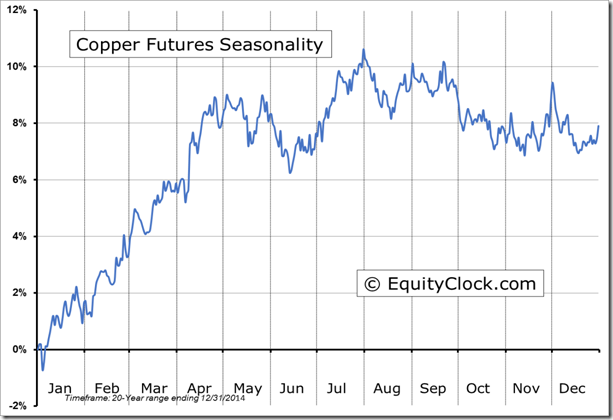

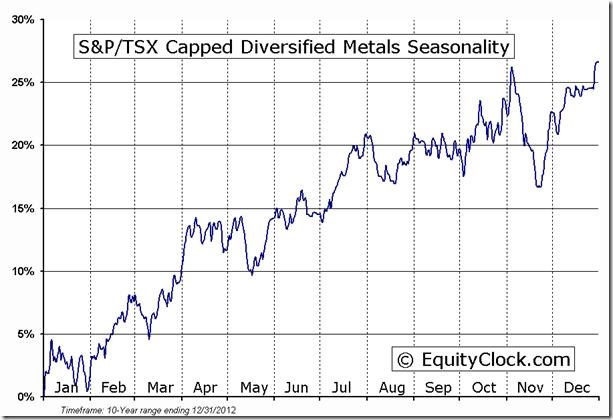

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following are examples:

Editor’s Note: Note the brief, but significant period of seasonal strength for both of the above charts from mid-June to the end of July. Seasonally, it’s too early to make the call, but the sector should be put on the radar screen. Technical signs of outperformance would be the trigger.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca