Are The Bulls Back?

by Lance Roberts, Real Investment Advice

This past week, the markets rallied sharply from last week’s lows sending the “bulls” stampeding into the market with claims the market is back. To wit:

“Hold on to your hats, folks.

According to Andrew Adams, a market strategist at Raymond James, there exists a perfect mix of conditions that could send stocks on a ride up, up, and up.

In a note out Thursday, Adams noted that there was a significant shift of investors from the stock market to ‘safer’ assets. Eventually this move to the sidelines will have to change.“

The problem is that Adams is incorrect about the “cash on the sidelines” theory. As Cliff Asness penned previously:

“Every time someone says, ‘There is a lot of cash on the sidelines,’ a tiny part of my soul dies. There are no sidelines. Those saying this seem to envision a seller of stocks moving her money to cash and awaiting a chance to return. But they always ignore that this seller sold to somebody, who presumably moved a precisely equal amount of cash off the sidelines.

Even though I’ve thrown people who use this phrase a lifeline, I believe that they really do think there are sidelines.

There aren’t. Like any equilibrium concept (a powerful way of thinking that is amazingly underused), there can be a sideline for any subset of investors, but someone else has to be doing the opposite.

Add us all up and there are no sidelines.”

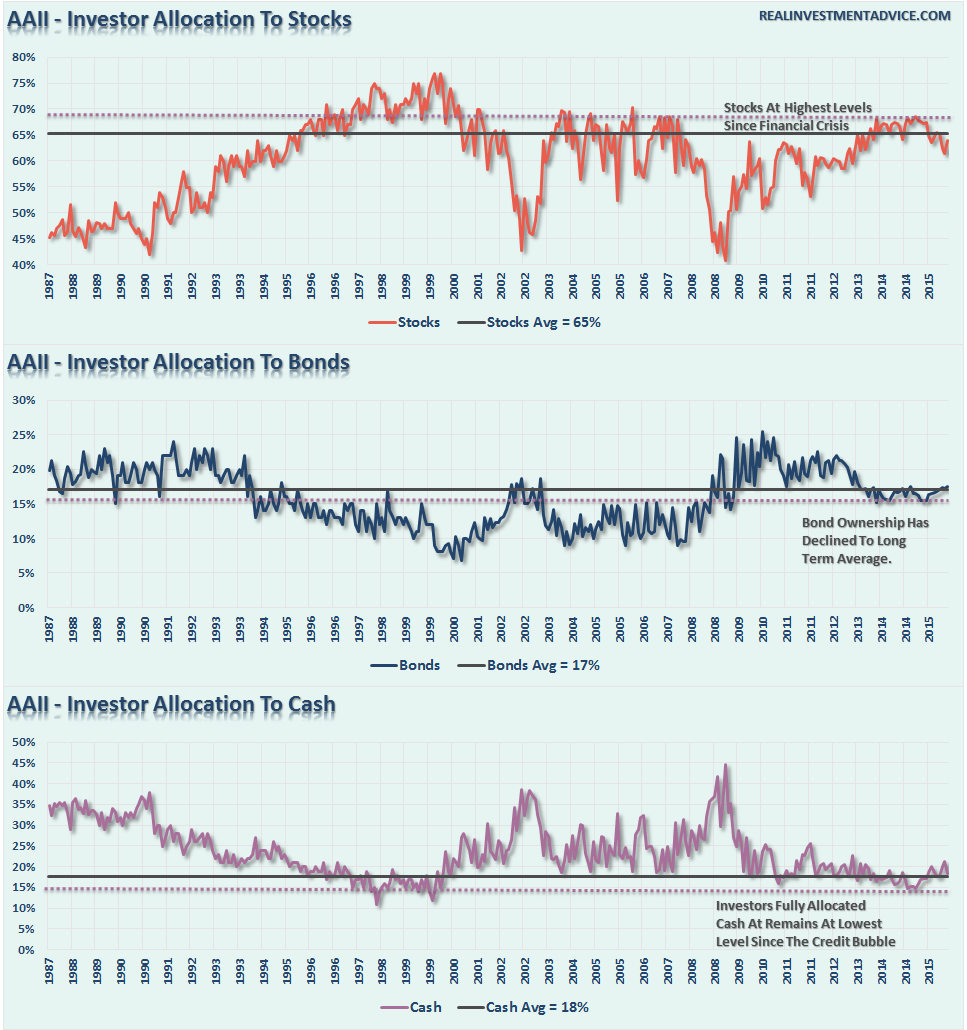

Adams comment would also suggest that investors are sitting primarily in cash and bonds rather than equities. Again, they aren’t.

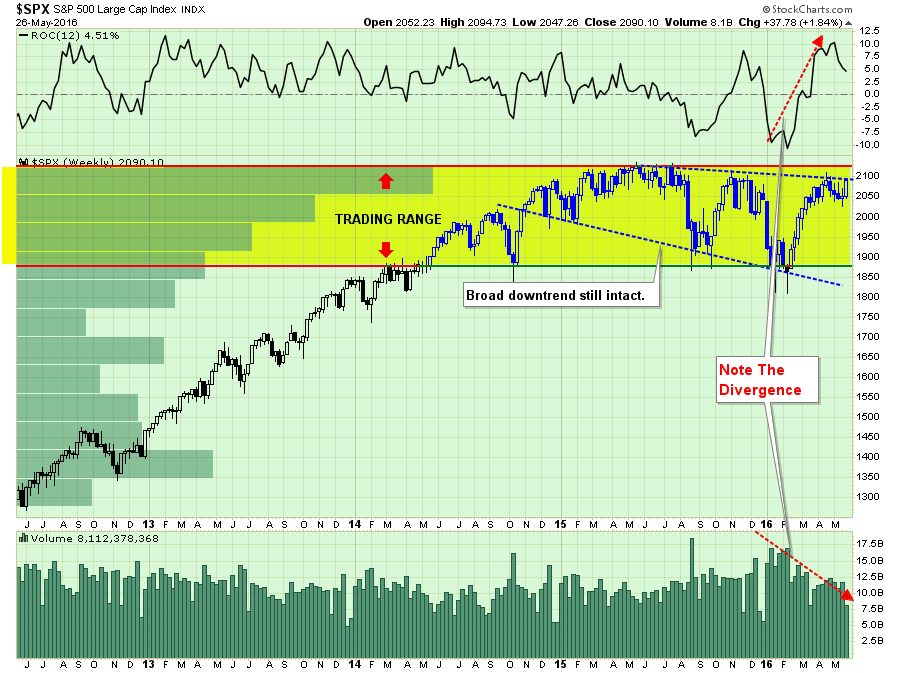

All that really happened last week, as shown in the chart below was an oversold bounce on deteriorating volume confined to an overall market downtrend.

This isn’t a rally that should embolden investors to take on more risk, but rather considering “selling into it” as we head into the seasonally weak period of the year.

But that’s just me.

One note though. The markets have not made a new high within the past year. What does history suggest happens next? 77% of the time it has evolved into a bear market.

On second thought, maybe that should be you too.

Here is your reading list for the weekend.

CENTRAL BANKING

- World Running On Monetary Fumes by Benn Steil & Emma Smith via PBS Newshour

- The Fed Is Cooking Up A Surpise Move by Jeff Cox via CNBC

- The Quest For Robo-Yellen by Chris Condon via Bloomberg

- Why The Fed Must Raise Rates by John Crudele via New York Post

- Who Needs The Fed by John Tamny via The Federalist

- 5 Reasons Market Is Ignoring The Fed by Caroline Baum via MarketWatch

THE MARKET & ECONOMY

- Orders For Capital Goods Fall Again by Shobhana Chandra via Bloomberg

- 7 Unmistakable Bear Market Signs by Jeff Reeves via MarketWatch

- Is This The End Of The Road? by Chris Vermeulen via TheStreet

- Summers Is Wrong On Secular Stagnation by Dr. Thorton via HedgEye

- Selling Into Panic? Not A Bad Idea by Mark Hulbert via USA Today

- Why Market Is Going Nowhere Fast by Aaron Task via Fortune

- Stock Buybacks Are Out Of Favor by Jon C Ogg via 24/7 WallStreet

- Poised For A Collapse by Ken Goldberg via The Street

- Bears Want You Believe End Is Coming by Avi Gilburt via MarketWatch

- Stock Market Has Stability Of Graveyard by Anthony Hilton via Evening Standard

- This Hasn’t Happened In 20-Years by Alex Rosenberg via CNBC

- Why Oil Prices Are Headed Back To $20 by Ivan Martchev via MarketWatch

- Can $50 Oil Make U.S. Great Again? by Chris Matthews via Fortune

- What Gundlach Needs To See From The Market by Mark Decambre via MarketWatch

- Global Economy Better Than We Think? by Joe Calhoun via Alhambra Partners

BEST 6 MINUTES YOU WILL SPEND

Gross Trying To Short Credit Against Instinct by John Gittelsohn via Bloomberg

INTERESTING READS

- Fed Is Losing Ground by David Stockman via Stockman’s Corner

- 12 Articles Every Economist Should Read by Steven Horwitz via ValueWalk

- Dirty Secret Of Passive Investing by Michael Aked via RA Insights

- Coming Fed-Induced Pension Bust by John Hussman via Hussman Funds

- Former McDonalds CEO Crushes Minimum Wage Lie by Tyler Durden via Zero Hedge

- Peak Stupidity – Abolish Grades Below “C” by Becca Stanek via The Week

- Schrodinger’s Market by Macro Man

- 10-Reasons To Be Bearish by Tyler Durden via Zero Hedge

- Bulls Make Important Stand by Dana Lyons via Tumblr

- Most Extreme Euphoria Ever Seen by Jesse Felder via The Felder Report

- Dear Prof. Siegel: AYFKM? by Jesse Felder via The Felder Report

Questions, comments, suggestions – please email me.

Lance Roberts

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of “The Lance Roberts Show” and Chief Editor of the “Real Investment Advice” website and author of “Real Investment Daily” blog and “Real Investment Report”. Follow Lance on Facebook, Twitter, and Linked-In

Copyright © Real Investment Advice