John H. Cochrane for President

by Jeffrey Saut, Chief Investment Strategist, Raymond James

May 9, 2016

“John H. Cochrane for President” is my “call” after reading his article in last week’s Wall Street Journal (read it here: Slow Growth). Mr. Cochrane is a senior fellow at Stanford University’s Hoover Institution and in my opinion a really smart, and pragmatic, guy. The first paragraph of the article reads:

Sclerotic growth is America’s overriding economic problem. From 1950 to 2000, the U.S. economy grew at an average rate of 3.5% annually. Since 2000, it has grown at half that rate – 1.76%. Even in the years since the bottom of the great recession in 2009, which should have been a time of fast catch-up growth, the economy has only grown at 2%. Last week’s +0.5% GDP report is merely the latest Ground-hog Day repetition of dashed hopes.

The erudite professor goes on to note that while the differences between 3.5% growth and 2% may seem small, the resultant consequences are large. For example, by 2008 Americans were three times better off than they were in 1952. He writes, “Real GDP per person rose from $16,000 [per year] to $49,000.” However, if growth in the 1950 to 2000 timeframe was only 2%, instead of 3.5%, the per capita income metrics for that same timeframe would have been just $23,000, not $49,000.

If incomes could increase to their long-term average growth rate, the U.S. would be able to pay for Social Security, Medicare, defense, environmental concerns, and the U.S. debt. Presciently he writes, “Doubling income per capita would help the less well-off far more than any imaginable transfer [of wealth] scheme.” So why has economic growth slowed? Hereto the professor offers three responses. From camp one comes the idea that we have just run out of ideas. Camp two believes the U.S. is in “secular stagnation.” However, camp three (Cochrane’s camp) thinks the U.S. economy is overrun “by an out-of-control and increasingly politicized regulatory state.” He holds:

It takes years to get the permits to start projects and mountains of paper to hire people, if every step risks a new criminal investigation people don’t invest, hire, or innovate. The U.S. needs simple, common-sense, Adam Smith polices. America is middle-aged and overweight. The first camp says, well, that’s nature, stop complaining. The second camp looks for the latest miracle diet – try the 10-day detox cleanse! The third camp says get back to tried, true and sometimes painful: eat right and exercise.

In the article Mr. Cochrane shows an interesting chart titled “Ease of Doing Business and Per Capita Income.” The chart basically plots various countries’ 2014 income per capita against the World Bank’s “Distance to Frontier” ease of doing business for the year 2014. The higher the score on the chart, the higher the country’s per capita income. While the U.S. scores well there is still plenty of room for improvement. As the article states:

If America could improve on the best seen in other countries by 10%, a 110 score would generate $400,000 income per capita, a 650% improvement, or 15% additional growth for 20 years. If you think these numbers are absurd, consider China. Between 2000 and 2014, China averaged 15% growth and a 700% improvement in income per capita. This growth did not follow from some grand stimulus or central plan; Mao tried that in the 1960s, producing famine, not steel. China just turned an awful business climate into a moderately bad one.

Toward the end of the article the good professor concludes, “Parties argue over tax rates, but what’s really needed is deep tax reform, cleaning out the insane complexity and cronyism.” So, I titled this letter, “John H. Cochrane for President.”

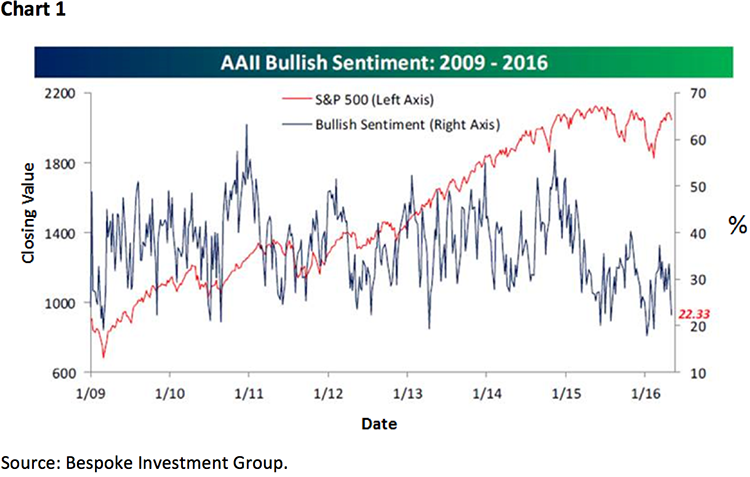

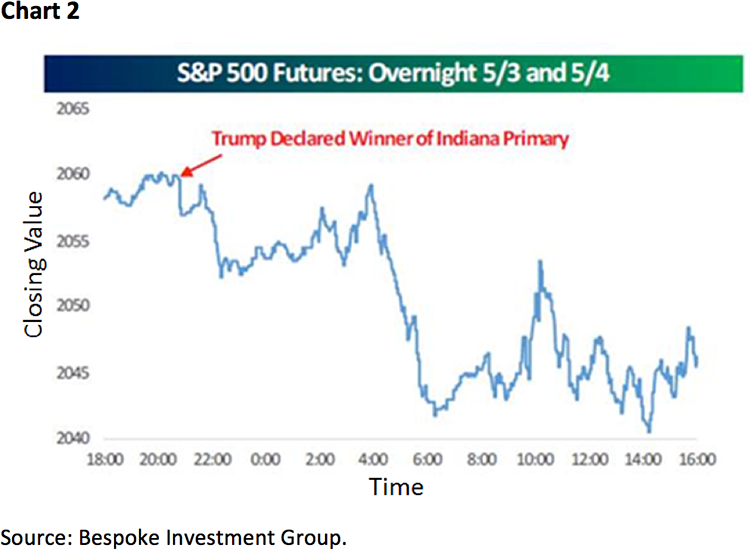

Professor Cochrane holds out hope for the U.S. suggesting, “While the current presidential front-runners are not championing economic growth, House Speaker Paul Ryan and other House members are.” Of course that “foots” with my theme of the past three years that “We are going to elect smarter policymakers and therefore will get smarter policies.” My sense is this is one of the things that has helped fuel the secular bull market since March of 2009 (we were bullish at those March 6, 2009 lows). Recently, however, that secular bullish view has been questioned. Indeed, I have received numerous emails about certain pundits predicting a “market crash” for the equity markets. I would remind investors that these negative nabobs are the same folks who have been predicting Armageddon for years. I debated one such “permabear” at The MoneyShow recently and he hung his hat on the fact that he predicted the 2008 – 2009 debacle. I would note, however, I have known him for over twenty years and he has always been bearish, except on gold. I would also remind you that Dow Theory registered a “sell signal” on November 21, 2007, as well as a “buy signal” near the bottom in 2009. So, if we are going into a bear market (I doubt it) Dow Theory should tell us. Additionally, last week’s weakness brought the S&P 500 (SPX/2057.14) back down to its 2040 – 2050 support zone and left the McClellan Oscillator oversold. Moreover, from the February 11, 2016 low to the April 20, 2016 high the SPX gained roughly 16%, yet sentiment hardly improved. Since that high the SPX has given back a mere 2% and the bearish sentiment has gotten even worse; and, actually accelerated to the downside last week (chart 1). Speaking to my “Trump Tumble” note of last Friday, the good folks at Bespoke also noticed the concurrent stock weakness since the Trump victory (chart 2) as things get curiouser and curiouser. And that’s the way it is on session 60 of the current “buying stampede.”

The call for this week: We have targeted this week as an all-important week according to our models. The ideal pattern would have been for an upside blow-off into mid-May to new all-time highs, but two weeks ago we had to admit that was not going to play out. Therefore, our alternative strategy called for a mild sell-off into mid-May that should re-energize the equity markets’ internal energy and sink a meaningful low. The ideal pattern this week for that to happen would be for an early week decline with the maximum downside at the 1990 – 2000 level. This morning, however, it does not look like that is the pattern we are going to get despite China’s weak import/export data, the falling yen, the burgeoning Panama Papers, North Korea’s expanding nuke program, and Greece’s “gotcha” as the preopening S&P 500 futures are better by 6 points at 5:00 a.m.

Copyright © Raymond James