Does Anyone Want to Own Stocks Anymore?

by LPL Research

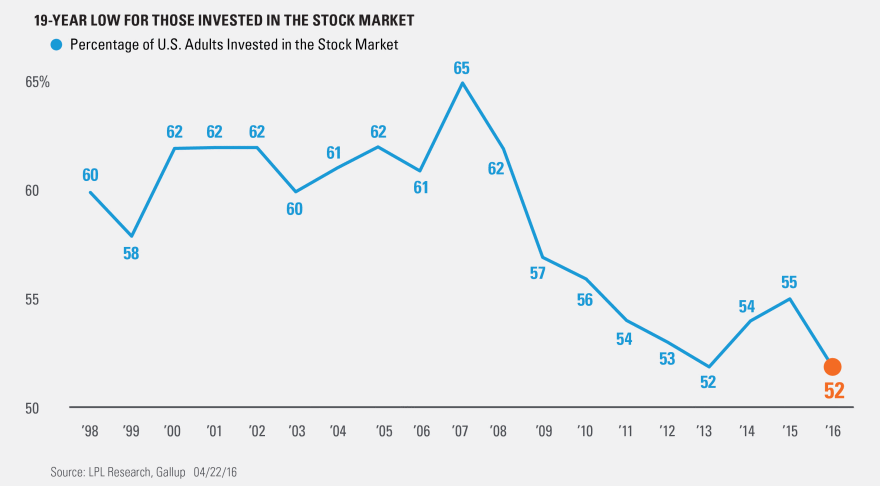

A recent Gallup poll showed that the percentage of U.S. adults invested in the stock market was at a 19-year low. With the S&P 500 2% away from a new all-time high (and already at a new high on a total return basis), this lack of participation in stocks is quite surprising. Or is it?

The poll asked respondents if they were invested in an individual equity, stock mutual fund, or a self-directed 401(k) or IRA. This same poll reflected that up to 65% of adults were invested in stocks in 2007, just ahead of the financial crisis. It has steadily trended lower ever since. The largest drops have been seen in the middle class and adults under 35. The poll also noted that young adults are more likely to save their money or invest in real estate.

We opened up this question to the LPL Research team. Here are our best reasons as to why investors are so reluctant to invest in stocks.

- Trust is a major issue. People don’t trust Wall Street and the banks. And they don’t trust the government when it says the economy is getting better.

- Some are disappointed with the direction the country is headed.

- Sometimes shocks are so big, they just don’t wear off that quickly. The financial crisis wasn’t the Great Depression, but it did hit some people hard.

- Not everyone stays informed on the daily moves of the stock market. There’s a good chance that many people are under the impression that the stock market is still down considerably. It’s possible that few realize it is only a few percent from a new high.

- A growing percentage of the adult population in recent years (new adults) don’t have the financial flexibility to invest like past generations did, due to student debt and lower paying, non-full-time jobs. Their money is just going elsewhere.

- Social media and too much noise also might play a role. More gloominess, more conspiracy theories, and more emotion around volatility are continually out there. It makes it hard to focus on the big picture.

In summary, this isn’t an easy question to answer. Two crashes in the past 16 years have left a lot of scars. And big market drops in summer 2015 and again in early 2016, the 1,000-point one-day sell-off on the Dow last August, and kicking off 2016 with the worst start to a year after 28 days for the S&P 500 have all done little to help investor psyche.

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

Stock investing involves risk including loss of principal.

The Dow Jones Industrial Average Index is comprised of U.S.-listed stocks of companies that produce other (non-transportation and non-utility) goods and services. The Dow Jones industrial averages are maintained by editors of The Wall Street Journal. While the stock selection process is somewhat subjective, a stock typically is added only if the company has an excellent reputation, demonstrates sustained growth, is of interest to a large number of investors, and accurately represents the market sectors covered by the average. The Dow Jones averages are unique in that they are price weighted; therefore, their component weightings are affected only by changes in the stocks’ prices.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking # 1-491006 (Exp. 04/17)

Copyright © LPL Research