Market Update

S&P 500 Gains Driven by P/E Expansion, not Earnings Growth

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

• Global equities have been on a tear since mid-February. Both the S&P 500 Index (S&P 500) and S&P/TSX Composite Index (S&P/TSX) are up 15% since the February low. In our view, the rebound has been driven by an improvement in economic data which has allayed concerns of a US/global recession.

• In the US we’ve seen a rebound in the labour market and manufacturing. Canada has benefited from a surge in exports, higher oil prices, and stronger job growth. China’s economy slowed further in Q1/16, but experienced a notable improvement in industrial production, manufacturing, and exports.

• While the economic data has improved as of late, this has not yet translated into stronger corporate fundamentals. The 15% gain in the S&P 500 since the February low has been driven by multiple expansion rather than an increase in corporate earnings. For example, the S&P 500 forward P/E has jumped from 15.2x at the February low to 16.9x currently.

• In our view, for the equity markets to move higher from current levels we will need to see an improvement in the underlying fundamentals, notably corporate profits. On that front we believe earnings growth is set to trough this quarter, and strengthen in H2/16.

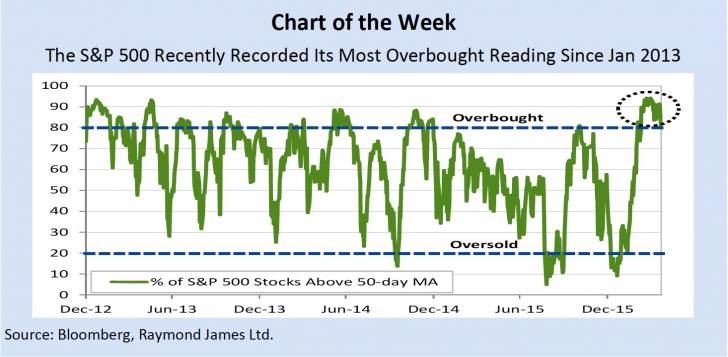

• While we maintain our bullish stance over the next 6 to 9 months, we do believe the equity markets are due for a breather following the strong rally. With the S&P 500 technically overbought (see Chart of the Week), at resistance, and approaching the weak seasonal period of May to October, we see the potential for market weakness through the summer which could then set us up for strength into year-end with the equity markets delivering decent gains this year.

Read/Download the complete report below:

Copyright © Raymond James