Canadian Growth Update

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

• This week the Bank of Canada (BoC) provided its updated economic outlook with the release of the April Monetary Policy Report (MPR). Following better-than-expected economic activity in Q1/16, the BoC revised its growth forecast for the Canadian economy higher, with the BoC now forecasting 2016 real GDP growth of 1.7%, from its earlier estimate of 1.4%.

• Recently we have seen an uptick in economic activity which led to the BoC upgrading their growth forecasts. This includes: 1) solid job gains in March; 2) stronger exports; and 3) a 0.6% M/M rise in GDP in March, the highest monthly gain since July 2013.

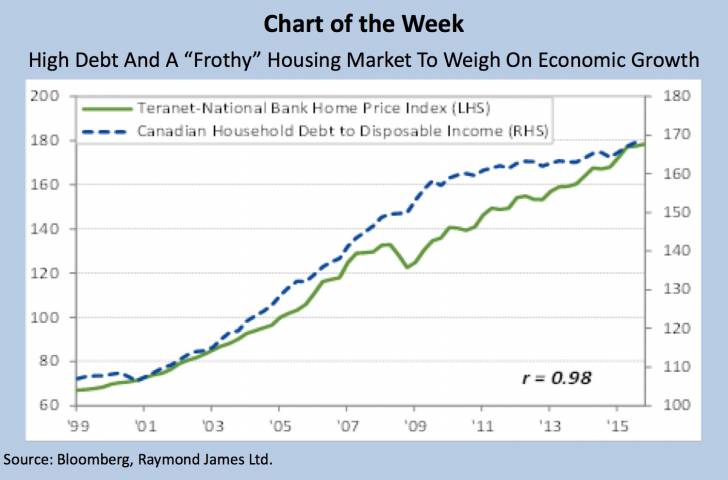

• Despite the recent improvement in data, we continue to expect modest growth over the next few years. Central to this is our belief that the Canadian housing market is due for a correction, possibly beginning in 2017 as the BoC hikes rates, and that consumer spending will be constrained as a result of a hangover from the debt binge that Canadians have been on (see Chart of the Week).

Read/Download the complete report below:

Copyright © Raymond James