by Don Vialoux, Timingthemarket.ca

StockTwits Released Yesterday @equityclock

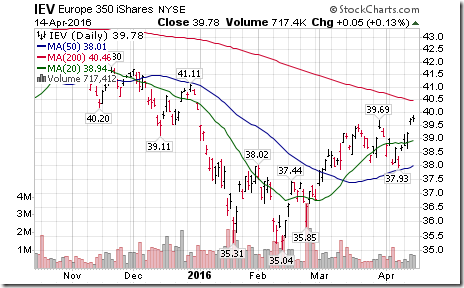

Head and shoulders pattern on charts of European benchmarks present upside potential of around 12%.

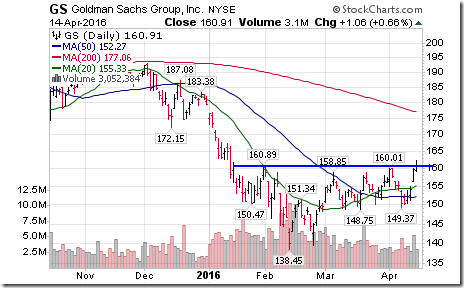

Technical action by S&P 500 stocks to Noon: Bullish. Breakouts: $BAC,$BEN,$COF,$GS,$KEY,$L,$LUK,$PBCT,$PFG,$RF,$UNM,$ZION,$EMR,$IR,$SNA

Editor’s Note: After Noon, Tyco and Eli Lilly broke above resistance. None broke support.

Financials dominate S&P 500 breakouts this morning. Nice reverse head & shoulders pattern by Goldman Sachs $GS.

Added to the list of Canadian banks breaking to new highs is National Bank $NA.CA

Agrium $AGU.CA joined $POT.CA by breaking to new lows.

Editor’s Note: Several investment firms downgraded the fertilizer sector including Agrium and Potash Corp.

CSTA Events

The Toronto chapter is sponsoring a Traders Technical Workshop: Identifying Turning Points in the Markets. Date and time: 10:00 AM EDT on Saturday April 23rd. Presenter is Edmond Wong. Location is Richmond Hill Public Library Central Branch. Register at www.csta.org Bring your notebook computer!

The Winnipeg chapter is sponsoring Winnipeg Technicians Day on Saturday April 30th. Speakers include Don Vialoux, Colin Cieszynksi, Harold Davis, Allen Hosey and Greg Schnell. Cost is $97 per participant. Register at www.csta.org.

Trader’s Corner

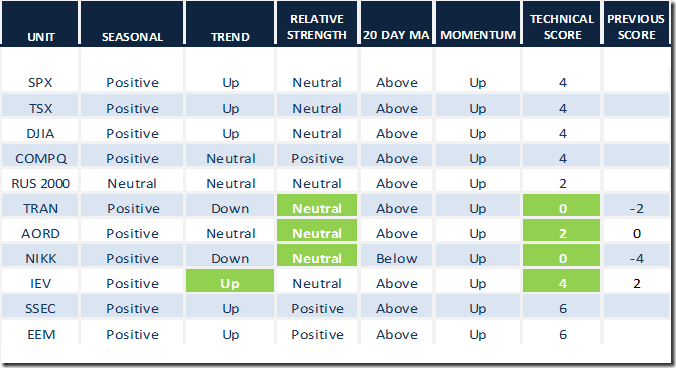

Daily Seasonal/Technical Equity Trends for April 14th 2016

Green: Increase from previous day

Red: Decrease from previous day

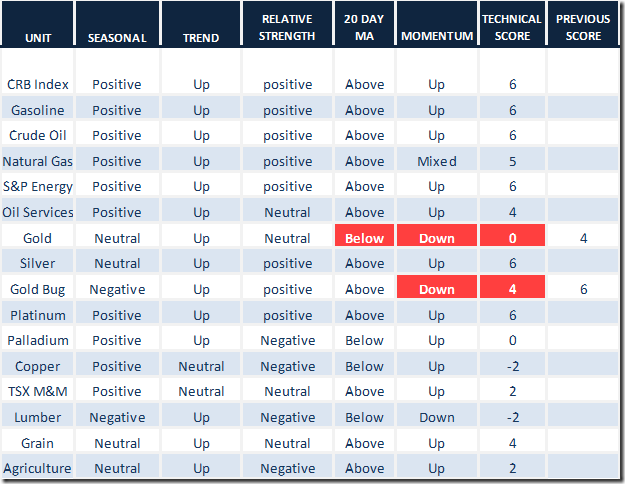

Daily Seasonal/Technical Commodities Trends for April 13th 2016

Green: Increase from previous day

Red: Decrease from previous day

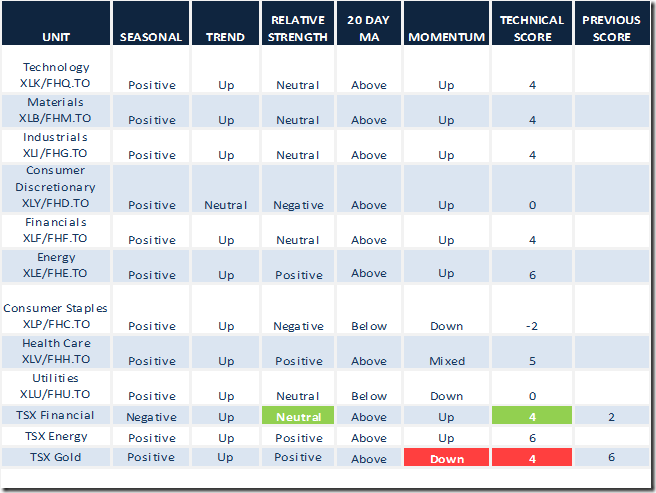

Daily Seasonal/Technical Sector Trends for March April 14th 2016

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 and TSX Equity Market Barometer

Based on Percent of Stocks trading above their 50 day moving average

S&P 500 Percent is intermediate overbought and showing early signs of rolling over

TSX Percent is intermediate overbought and showing early signs of rolling over

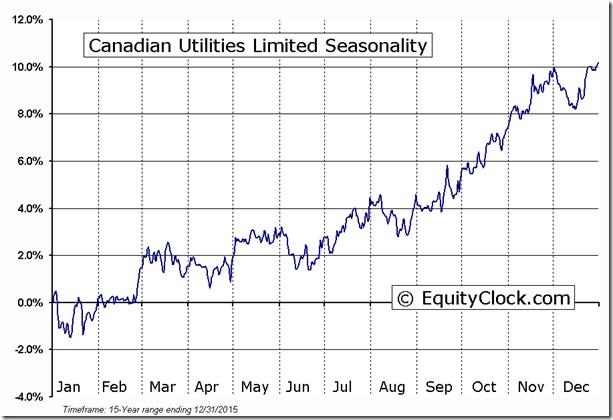

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Interesting Chart

Europe 350 iShares established an intermediate uptrend on a move above $39.69. Several European equity indices and related ETFs have started to outperform the S&P 500 Index and are in early stages of forming potential reverse head & shoulders patterns.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca