A Tale of Two Halves

by Anthony Valeri, Chief Investment Strategist, LPL Financial

The first quarter of 2016 is in the record books and for most, including bond investors, it was a tale of two halves. During the first six weeks of the year, domestic economic concerns, worries over the state of China’s economy, and a near 30% decline in the price of oil sparked a strong Treasury rally that drove high-quality bond yields lower—not just in the U.S., but globally as well. Then the last six weeks of the quarter saw a shift for lower-rated bonds, thanks to improving economic data and market-friendly central bank actions. Through all the ups and downs, it was a strong quarter for bond performance; however, we don’t expect this strength to repeat over the remainder of the year.

The decline in the 10-year Treasury yield over the first six weeks of 2016 was one of the largest for such a short time period. The 10-year Treasury yield touched 1.7%, the low end of a broad 1.4% to 3.0% yield range since 2012.

More economically sensitive sectors, such as corporate bonds and emerging markets debt (EMD), weakened as investors focused on high-quality bonds. The rise in average corporate bond yield spreads shows how risk premiums increased and then subsequently fell as recession and default fears faded [Figure 1].

The final six weeks of the first quarter witnessed a significant change for lower-rated bonds. Domestic economic data improved, the Federal Reserve (Fed) suggested it may slow the pace of interest rate hikes, and more bold policy from the European Central Bank (ECB) gave bonds a push globally. While high-quality bond prices were ultimately unchanged over this period as growth expectations improved, economically sensitive sectors were the beneficiaries.

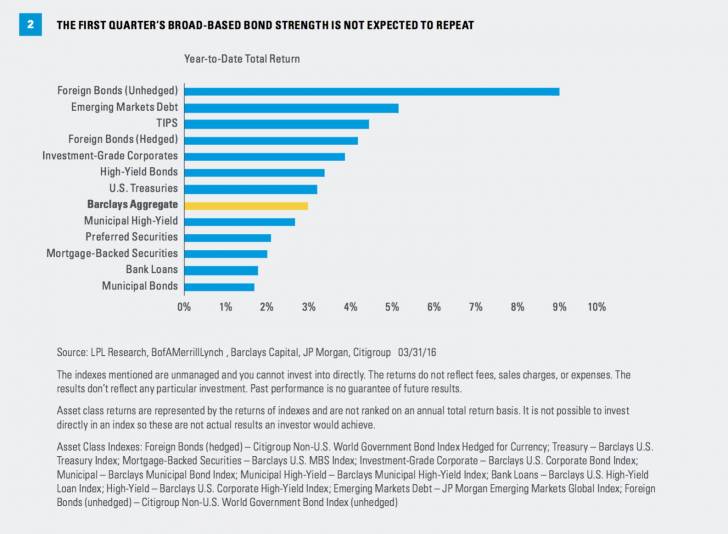

Despite the ups and downs, the first quarter of 2016 was a strong one for bond performance as prices increased broadly [Figure 2]. Longer-term bonds outperformed as the threat of Fed rate hikes, even if reduced, limited gains among shorter-term bonds.

The flip side of a strong first quarter of 2016 is that valuations are now higher across the board, presenting investors with a new challenge. Since 2008, the Barclays Aggregate has returned over 3% in only four quarters, and it has not done so since 2011. Surprisingly, following these four quarters, the gains in high-quality bonds slowed, but remained positive, with an average return of 1.0% in the following quarter and 1.6% over the following six months (according to the Barclays Aggregate). As mentioned in the Bond Market Perspectives, “How Extreme It Is,” extreme strength in the Treasury market usually fades, but does not necessarily reverse, in the short term.

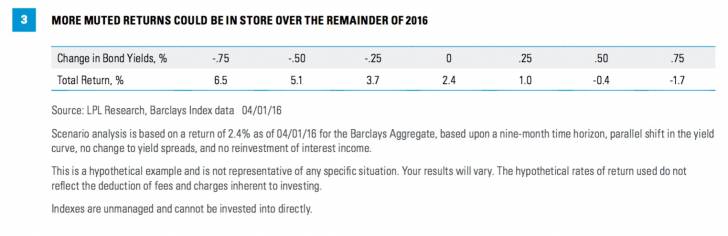

Today’s lower-yielding environment suggests that while prices may hold steady, investors should prepare for lower returns compared to these prior periods. A “coupon-clipping” environment, where investors merely receive ongoing interest payments, still has the potential to add to performance but at a slower pace. Figure 3 shows total return estimates based on a nine-month time horizon for a given change in the 10-year Treasury yield. If bond prices remain range bound with stable prices, investors may reap an additional 2.4% over the remainder of 2016.

However, we expect interest rates to rise slightly as economic growth improves over the remainder of 2016, continuing the improvement witnessed over the past six weeks. Figure 3 also illustrates that if the 10-year Treasury yield rises by 0.5% over the remainder of the year, total return may be negative for high-quality intermediate bonds. Given the still sluggish pace of global growth and central banks’ market-friendly approach, an increase of more than 0.5% may be unlikely, in our view.

KEY THEMES

Two important factors that may determine the path for bond yields are:

· Central banks. Market-friendly central bank policy was a key driver of bond performance, but it appears unlikely central banks will be able to deliver more good news. The ECB and the Bank of Japan already maintain interest rates below 0%, and fed fund futures already reflect a very benign Fed with only one interest rate hike priced in for all of 2016. While central banks may maintain market-friendly policies, and help support bond prices in the process, additional bond price gains may be unlikely absent renewed deterioration in economic data.

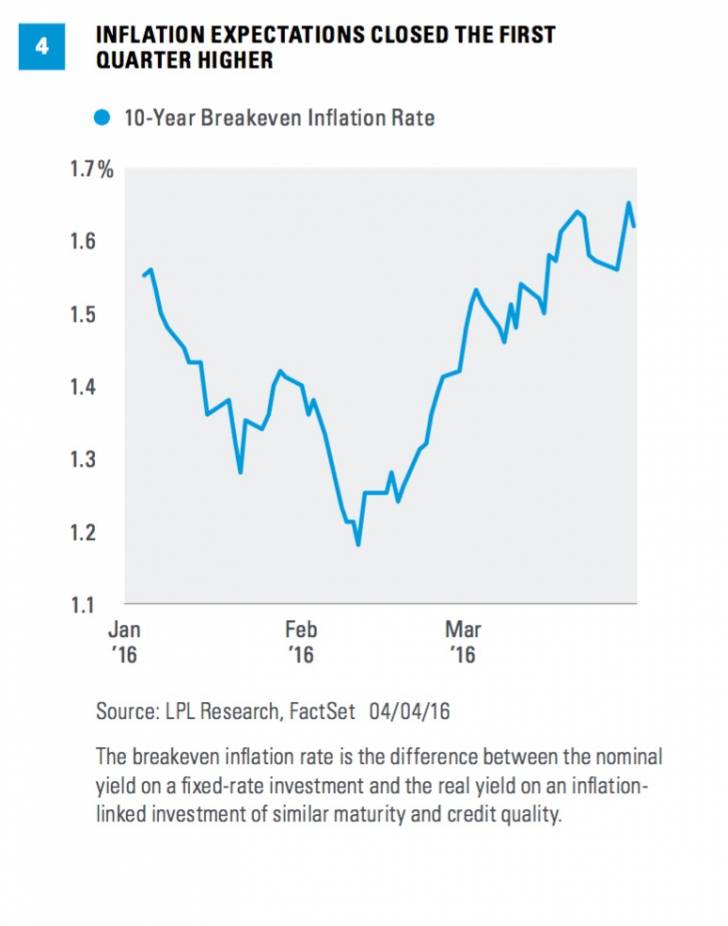

· Inflation. Fed Chair Janet Yellen recently dismissed the increase in inflation as temporary (a change in tune) but doubts remain. Market inflation expectations continue to rise, and if Yellen and company are wrong about any softening in inflation, bond prices may weaken as investors demand higher yields to offset rising inflation risks. Inflation expectations finished the first quarter of 2016 higher [Figure 4].

Global economic growth will be a focal point as always and has an influence on Treasury yields. The Treasury yield curve, as measured by the yield differential between 2- and 10-year Treasuries, steepened slightly over the last six weeks of the first quarter but still resides at a level that continues to reflect a sluggish growth environment. Bond investors await more proof from the global economy before pushing yields materially higher.

In the meantime, central banks and inflation remain focal themes. The Fed may be in a pickle and forced to take a slow path in raising rates as more rate hikes could push the U.S. dollar higher, which, in turn, may adversely impact exports and manufacturing. But a go-slow approach potentially risks higher inflation. For now, remaining calm on inflation remains the lesser risk for the economy.

TIPS

If inflation does not revert lower, and the Fed allows modest stagflation to develop, Treasury Inflation-Protected Securities (TIPS) may continue to benefit. However, like other segments of the fixed income markets, we do not expect a repeat of a strong first quarter. Still, in a low-return environment, the inflation compensation of TIPS could provide an extra boost for high-quality bond investors as inflation expectations remain very low in a historical context.

HIGH-YIELD

The average yield spread of high-yield bonds dropped to 6.9% at the end of the first quarter—a fair valuation given rising defaults. However, although defaults are increasing, they are still largely concentrated in energy and metals and mining. Even at valuations we find fair, the average yield of high-yield bonds, near 8%, stands out and may be an important source of return in a coupon-clipping environment. High-yield bonds have not shaken their sensitivity to oil prices and the pace of defaults remains an important variable. Despite the potential for some renewed volatility, we believe longer-term investors may be rewarded with a small allocation to high-yield bonds and compensated for risks.

CONCLUSION

The strength in fixed income markets witnessed during the first quarter of 2016 is not expected to repeat. Although recent history shows a significant reversal is unlikely, the remainder of the year may be muted, with the best 2016 has to offer for bonds potentially behind us absent a recession. The Fed and inflation will be key themes to monitor in a coupon-clipping environment where TIPS and high-yield bonds may add incremental value to suitable bond portfolios.

Read/Download the complete report below:

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

High-yield/junk bonds (grade BB or below) are not investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Treasury Inflation-Protected Securities (TIPS) help eliminate inflation risk to your portfolio, as the principal is adjusted semiannually for inflation based on the Consumer Price Index (CPI), while providing a real rate of return guaranteed by the U.S. government. TIPS are subject to market risk and significant interest rate risk as their longer duration makes them more sensitive to price declines associated with higher interest rates. TIPS do not pay the inflation-adjusted balance until maturity, and the accrued principal on TIPS could decline, if there is deflation.

Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate, and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

Investing in foreign fixed income securities involves special additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with foreign market settlement. Investing in emerging markets may accentuate these risks.

INDEX DESCRIPTIONS

The Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS (agency and non-agency).

Barclays U.S. High Yield Loan Index tracks the market for dollar-denominated floating-rate leveraged loans. Instead of individual securities, the U.S. High Yield Loan Index is composed of loan tranches that may contain multiple contracts at the borrower level.

The Barclays U.S. Corporate High Yield Index measures the market of USD-denominated, noninvestment-grade, fixed-rate, taxable corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below, excluding emerging market debt.

The Barclays U.S. Corporate Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate, taxable corporate bond market.

The Barclays U.S. Mortgage Backed Securities (MBS) Index tracks agency mortgage backed pass-through securities (both fixed rate and hybrid ARM) guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC)

The Barclays U.S. Municipal Index covers the USD-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds.

The Barclays Municipal High Yield Bond Index is comprised of bonds with maturities greater than one-year, having a par value of at least $3 million issued as part of a transaction size greater than $20 million, and rated no higher than ‘BB+’ or equivalent by any of the three principal rating agencies.

The Barclays U.S. Treasury Index is an unmanaged index of public debt obligations of the U.S. Treasury with a remaining maturity of one year or more. The index does not include T-bills (due to the maturity constraint), zero coupon bonds (strips), or Treasury Inflation-Protected Securities (TIPS).

The Citi World Government Bond Index (WGBI) measures the performance of fixed-rate, local currency, investment-grade sovereign bonds. The WGBI is a widely used benchmark that currently comprises sovereign debt from over 20 countries, denominated in a variety of currencies, and has more than 25 years of history available. The WGBI provides a broad benchmark for the global sovereign fixed income market. Subindexes are available in any combination of currency, maturity, or rating.

The JP Morgan Emerging Markets Bond Index is a benchmark index for measuring the total return performance of international government bonds issued by emerging markets countries that are considered sovereign (issued in something other than local currency) and that meet specific liquidity and structural requirements.