The Buyback Binge: Is It Good for Shareowners?

by Paul McCaffrey, CFA, CFA Institute

Share buybacks haven’t been getting the best press of late.

They’ve been dismissed as “self-cannibalization,” “corporate cocaine,” a recipe for conflict of interest, and a form of stock price manipulation — not to mention shortsighted and counterproductive.

Yet share buybacks are incredibly popular. Since 2009, S&P 500 companies have spent more than $2 trillion on repurchases. From 2005 through late 2015, IBM spent $125 billion on them. In the first three quarters of 2015 alone, Apple bought back $30.2 billion worth. Indeed, much of the credit for the post-financial crisis bull market of the last seven years can be attributed to the ubiquity of share buybacks.

At bottom, repurchases are a way of rewarding shareowners. By buying up shares, a company raises the value of those remaining with its stockholders, which in turn will tend to boost earnings per share (EPS). At the same time, buybacks are more tax efficient for shareowners, than, say, spending the capital on taxable dividends. Share buybacks, proponents maintain, are also a good use of excess cash when business circumstances make the timing for other outlays, whether acquisitions, new research, expansion, etc., less than ideal.

Critics argue that whatever the upsides of buybacks, they tend to be short-lived, adding no real value over the long term. Every dollar spent on buybacks is one less that could otherwise be used on research and development, acquisitions, etc. Management surely could find a a more productive use of capital. And sometimes the repurchases are financed by issuing debt. The timing can also be problematic. Repurchases may make sense if a stock is undervalued, but if a stock is priced higher than its intrinsic worth, any buyback is a net loss.

Buybacks can create a degree of moral hazard for management as well, skeptics claim. Pay packages are often tied to EPS, so executives may be incentivized to implement buybacks and sacrifice the firm’s future viability for a short-term boost in EPS. Similarly, if compensation is in any way a function of share price, executives might be inclined to use share repurchases to meet their targets. Buybacks can likewise be employed to facilitate share options programs for management, effectively transferring value from shareowner to executives..

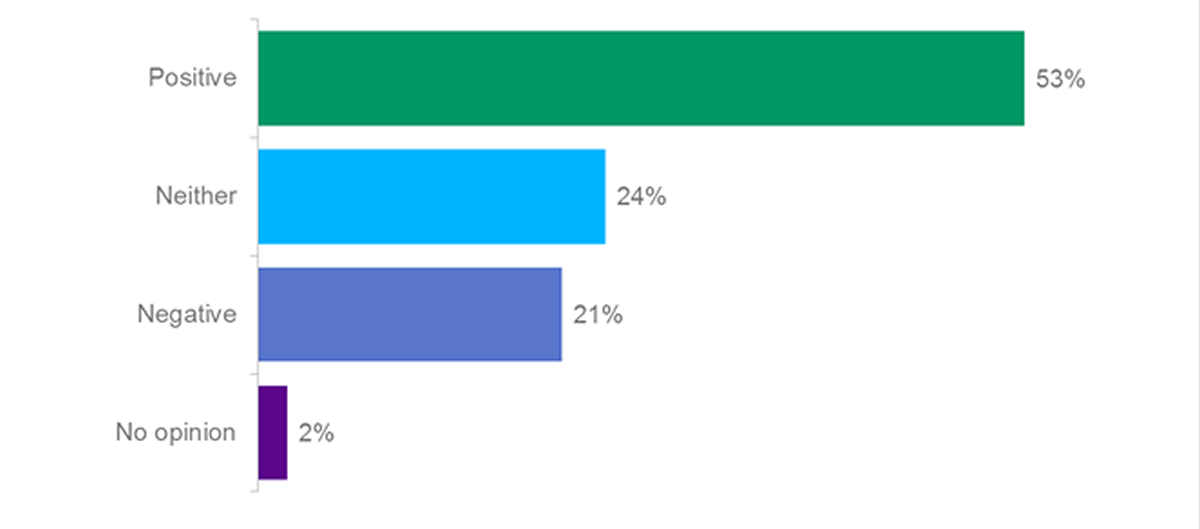

To get a sense of how investment professionals view share buybacks, we polled readers of CFA Institute Financial NewsBrief. Specifically, we asked them whether share buybacks were good for shareowners.

Are share buybacks a net positive or negative for shareowners?

A majority (53%) of the 814 respondents said that, on the whole, share buybacks constituted a net benefit to shareowners. Another 24% declared that they were neither positive nor negative, while 21% felt they were detrimental.

Of course the poll question and the results have a number of enigmas embedded in them. The degree of variation encapsulated in the word “shareowner” necessarily complicates the matter. Each shareowner is unique, with different inclinations and incentives. Certainly, share buybacks might benefit the shareowners anxious to unload their stakes. But those with a longer time horizon might have a vastly different take on things. It also brings up the whole concept of shareholder value and, by extension, shareholder value maximization and whether that it or isn’t a dumb idea.

And what about the larger implications of share buybacks? Ultimately, the poll focuses on only one kind of stakeholder. Whether repurchases are beneficial to a company’s long-term health, its employees, the markets, and the larger economy are entirely different issues, and well worth further exploration.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Paul McCaffrey is an editor at CFA Institute. Previously, he served as an editor at the H.W. Wilson Company. His writing has appeared in Financial Planning and DailyFinance, among other publications. He holds a BA in English from Vassar College and an MA in journalism from the City University of New York (CUNY) Graduate School of Journalism.

Copyright © CFA Institute