Earnings Trough?

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

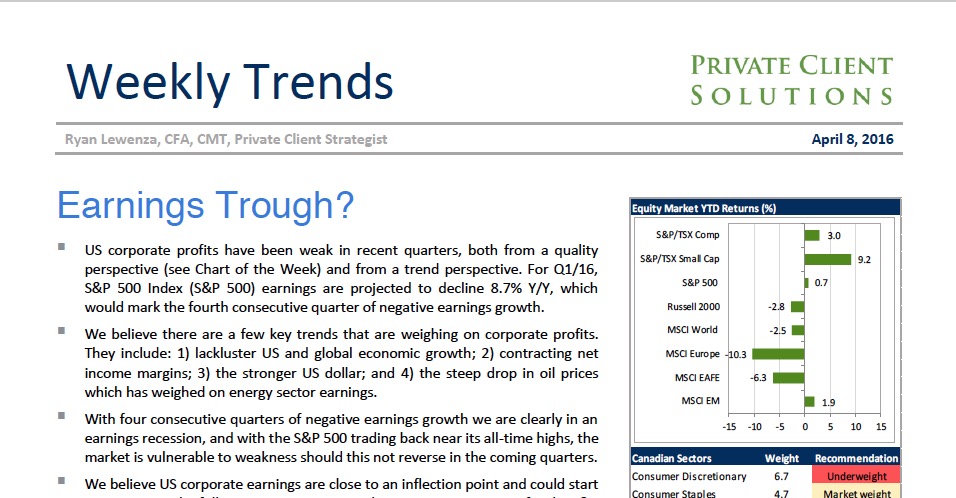

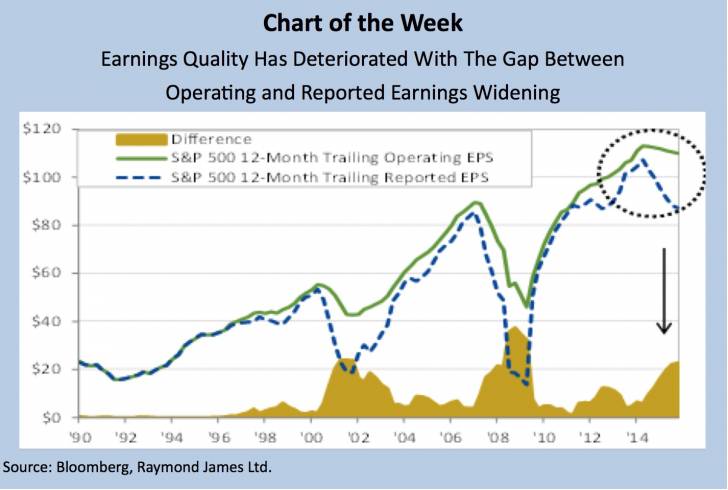

• US corporate profits have been weak in recent quarters, both from a quality perspective (see Chart of the Week) and from a trend perspective. For Q1/16, S&P 500 Index (S&P 500) earnings are projected to decline 8.7% Y/Y, which would mark the fourth consecutive quarter of negative earnings growth.

• We believe there are a few key trends that are weighing on corporate profits. They include: 1) lackluster US and global economic growth; 2) contracting net income margins; 3) the stronger US dollar; and 4) the steep drop in oil prices which has weighed on energy sector earnings.

• With four consecutive quarters of negative earnings growth we are clearly in an earnings recession, and with the S&P 500 trading back near its all-time highs, the market is vulnerable to weakness should this not reverse in the coming quarters.

• We believe US corporate earnings are close to an inflection point and could start to improve in the following quarters. Currently, consensus estimates for the S&P 500 point to a trough in earnings in Q1/16, with earnings growth turning positive in H2/16.

• Our expectation for stronger earnings in H2/16 is predicated on the following factors: 1) stronger economic growth; 2) higher oil prices; and 3) less of a headwind from the US dollar which we expect to trade in a range for the remainder of the year.

Read/Download the complete report below: