Even bad strategies will perform well

by Corey Hoffstein, Newfound Research

Summary

- Following even the best practices in investing can go against us in the short run.

- Volatility in short-term performance is necessary for the long run outperformance opportunity to exist.

- However, the opposite also holds true: a strategy that will underperform over the long run should also go through fits of outperformance.

- Performance, therefore, can be a very misleading statistic when it comes to evaluating a strategy.

Asset management can be a frustrating business. What is supposed to work in the long run can often go wildly against you in the short run. Worse: what is supposed to not work in the long run can go through periods of exceptional performance, adding insult to injury when you’re underperforming.

Even deeply entrenched philosophies, like “buy cheap and sell expensive,” can go through periods like the dot-com bubble that can make the most devout follower question his religion.

As we’ve said before, we believe that knowing you will have to stomach short-term volatility is a pre-requisite for accessing long-term excess return opportunities.

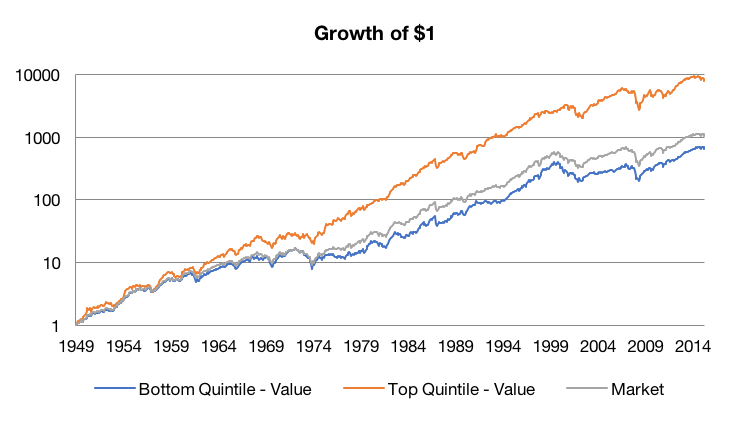

Consider value investing (here demonstrated with portfolios built on price-to-book). We can see that such an approach has handily beaten the market, while the opposite approach (buying when a stock is expensive) has significantly lagged.

Data Source: Kenneth French Data Library.

Data Source: Kenneth French Data Library.

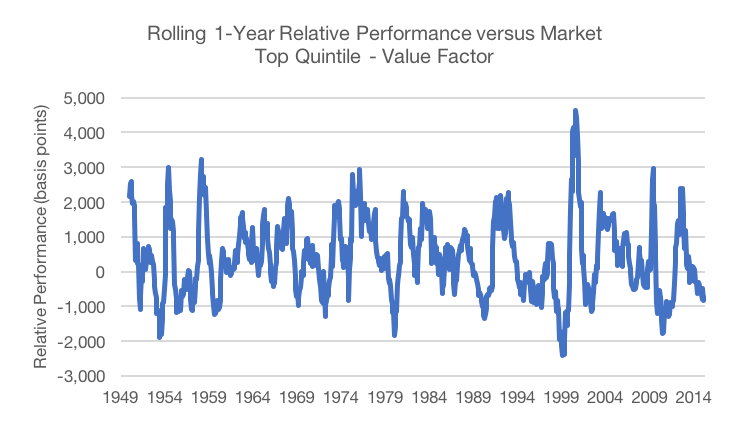

As we’ve shown before, being a value investor means suffering through prolonged and painful periods of relative underperformance. Below we plot the rolling 1-year performance of a value strategy versus the market.

Data Source: Kenneth French Data Library. Analysis by Newfound Research.

Data Source: Kenneth French Data Library. Analysis by Newfound Research.

While a value approach has, on average, outperformed the broad market by 340bp on an annualized basis, this strategy has lagged the overall market by more than 500 basis points (“bp”) over many, many 1-year periods. In fact, value goes through a 1-year period of underperforming the market by more than 500bp, on average, every 22 months.

We believe this short-term out/underperformance volatility is necessary for the long-term outperformance opportunity to exist.

Our hypothesis is simple: if any active approach is viewed as an easy way to outperform, then more investors will do it. More investors using the same approach means more capital will try to invest in the same opportunities, which will drive up valuations. As valuations increase, forward expected returns decrease, causing the opportunity to disappear.

It is worth pointing out that this same logic applies to investing in the market in general. For stocks to outperform short-term U.S. Treasuries over the long run (i.e. have an equity risk premium over the risk free rate), they have to be risky.

To demonstrate why, let’s pretend we wake up tomorrow and suddenly lived in a world where we can never lose money in the stock market. Any time we sell at a loss, money to cover the loss magically appears in our brokerage account.

In this fantasy world, we’d have an arbitrage on our hands because we have two risk-free investments with different rates of returns. On the one hand, we have short-term U.S. Treasuries and on the other we now have stocks. Investors could take advantage of this by short selling Treasuries and using the proceeds to buy stocks. Capital would pile into this trade until the price of stocks was driven so high that the expected return from stocks equaled the short-term Treasury rate. In line with our core theme here: for stocks to deliver a positive expected equity risk premium over the long run, there are times where they will be hard to hold in the short run.

So our hypothesis can be boiled down to a simple statement: for an investment approach to have long-term expected outperformance, it has to be hard to stick with.

The phrase, “if it were easy, everyone would do it” rings true.

The it in question, however, is not the process. On the contrary, the process is often easy, like “buy cheap stocks.” Rather it is the discipline required to continue to follow the process in the face of performance adversity that is difficult. Many investors can buy cheap stocks, but it takes discipline to hold them long enough to realize the value premium even if the cheap stocks become cheaper in the short-term.

We’ve covered this idea in commentaries in the past, but are writing this commentary to bring up a new, and interesting, corollary: the very same fact must also hold true forunderperforming strategies.

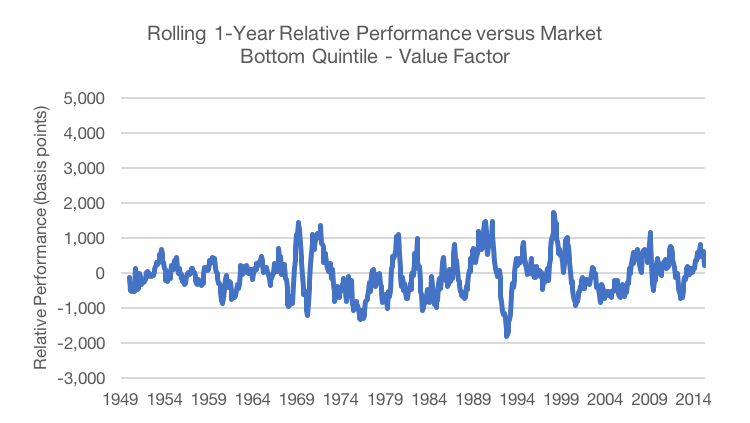

We often look at how volatile being a value investor is, but what is the ride like for those people only buying expensive stocks: the anti-value investors?

Data Source: Kenneth French Data Library. Analysis by Newfound Research.

Data Source: Kenneth French Data Library. Analysis by Newfound Research.

What we see is similar, albeit slightly less volatile, relative behavior. There are periods where the anti-value investor looks like a genius and periods where he looks like a fool.

We know buying expensive stuff shouldn’t work in the long run (and it hasn’t, historically underperforming the market by about -80bp annualized) but why can it outperform in the short run? Why are investors being rewarded for bad behavior?

Ignoring fees and transaction costs, an approach cannot consistently do worse than the market for the same reason an approach cannot consistently do better. If an approach consistently does worse, then the inverse of the strategy must consistently do better.

Consider what would happen if expensive stocks always underperformed. If that were the case, we could simply short those stocks and we’d now have an outperforming strategy. As we discussed above, if outperforming is that easy, it will attract capital inflow. In the case of a consistently underperforming strategy, it will attract more short-sellers, which will drive valuations down, driving up forward expected returns for the stock buyers. Eventually, forward expected returns will be driven up so much that they will equal the market, and the opportunity will disappear.

So just as a strategy with positive expected long-term relative performance (like buying cheap stocks) must sometimes underperform, a strategy with negative expected long-term relative performance (like buying expensive stocks) must sometimes outperform.

The takeaway here is that performance, even over multi-year periods, can be misleading.

Imagine two managers pitching you a strategy in July 2000. Both launched funds exactly a year earlier.

The first manager is holding a tattered copy of Security Analysis by Graham & Dodd. He discusses the long-term benefits of fundamental analysis and buying good companies at cheap prices. His fund is lagging the market by -15% over the last year.

The second manager spins a mesmerizing narrative about how the new internet era requires a new way of analyzing companies, and that traditional, fundamental metrics will fail to adequately capture the true potential of these companies. He is beating the market by 10% over the last year.

How many of us would put our money with the underperforming manager? We’d likely convince ourselves that his significant underperformance is evidence that his approach doesn’t work.

Yet a year later, the star performer has now lagged the market by -9% and the laggard has now outperformed by 46%.

The key takeaway here is, without a doubt, a frustrating one: good strategies must underperform from time-to-time and bad strategies must outperform from time-to-time.

For investors evaluating new strategies, a qualitative understanding of how a strategy should work will likely trump most quantitative metrics of how it has performed for forming long-term expectations.