by Don Vialoux, Timingthemarket.ca

Mr. Vialoux on BNN Yesterday

Following is a link:

http://www.bnn.ca/Video/player.aspx?vid=841861

StockTwits Released Yesterday

Commodity prices under pressure as U.S. Dollar Index tests trend channel support.

Technical action by S&P 500 stocks to 10:15 AM: Bullish. Intermediate breakouts: $DRI, $HSY, $DNR, $HUM, $FDX, $CTXS. No breakdowns.

Editor’s Note: After 10:15 AM, two more S&P 500 stocks broke resistance: St. Jude Medical and Anthem.

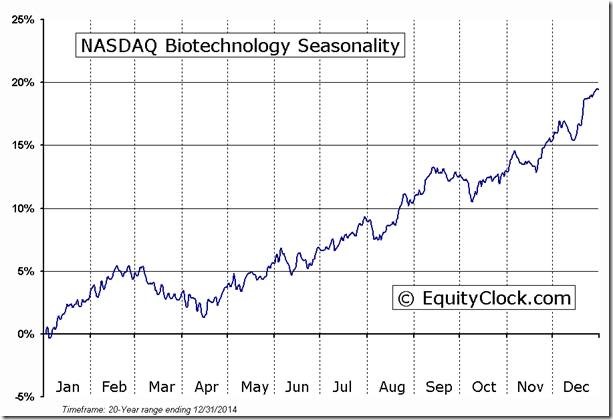

Nice breakout by Biotech iShares $IBB above resistance at $271.91 to complete a double bottom pattern.

‘Tis the season for NASDAQ Biotech Index $IBB to move higher prior to the annual ASCO conference in Chicago June 3-7th

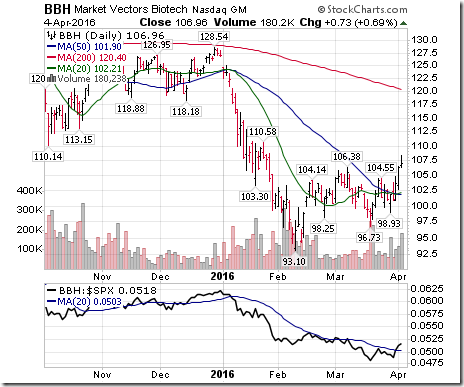

Editor’s Note: Nice breakout also by Market Vectors Biotech ETF: BBH with additional exposure to biotech stocks not listed on the NASDAQ.

Editor’s Note: Nice breakout also by Market Vectors Biotech ETF: BBH with additional exposure to biotech stocks not listed on the NASDAQ.

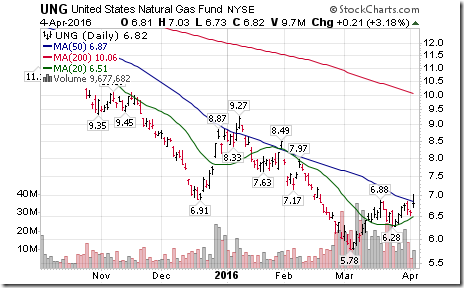

Early signs of a bottoming in natural gas ETF $UNG on a move above resistance at $6.88!

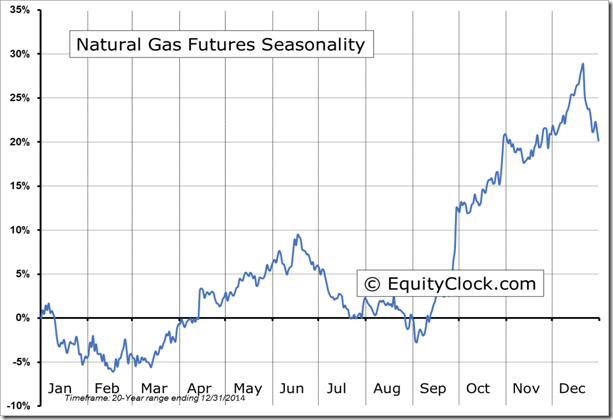

‘Tis the season for natural gas prices to move higher from mid-March to mid-June!

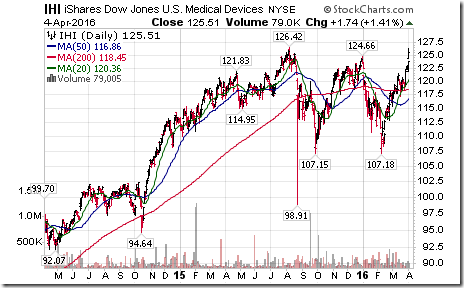

U.S. Medical Devices iShares $IHI finally moving above an 18 month trading range on a move above $124.66!

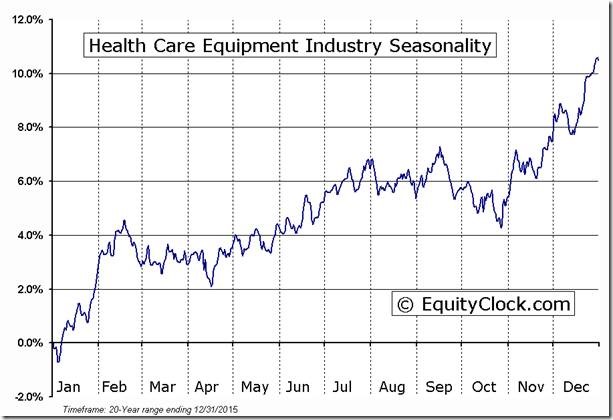

‘Tis the season for strength in U.S. Health Care Equipment $IHI from mid-April to the end of July!

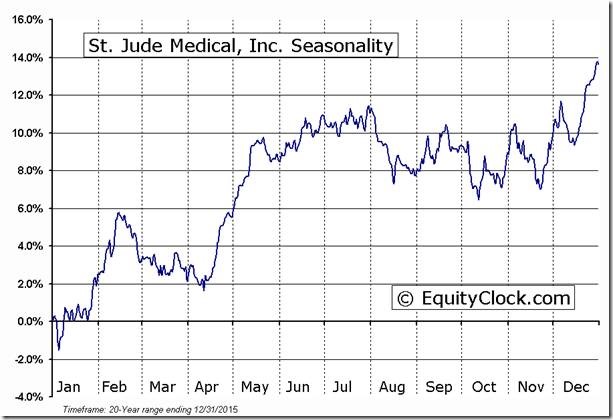

Nice breakout by St. Jude Medical $STJ above $56.38 to complete a reverse head and shoulders pattern!

‘Tis the season for strength in St. Jude Medical from mid-April to end of July.

Trader’s Corner

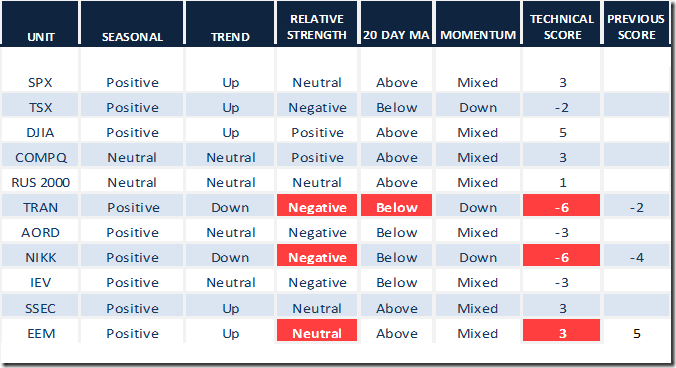

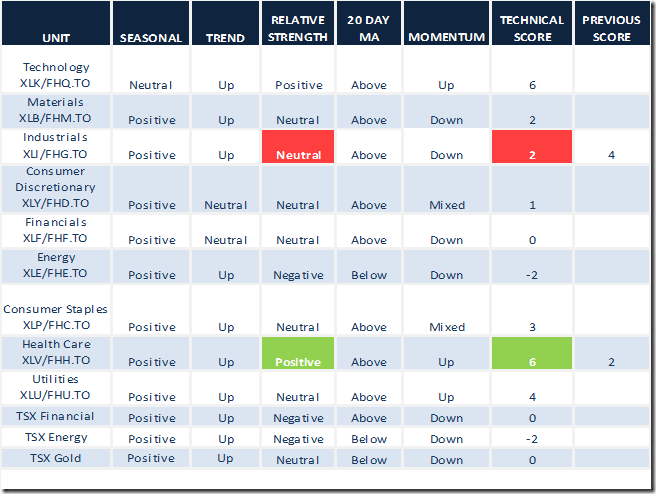

Daily Seasonal/Technical Equity Trends for April 4th 2016

Green: Increase from previous day

Red: Decrease from previous day

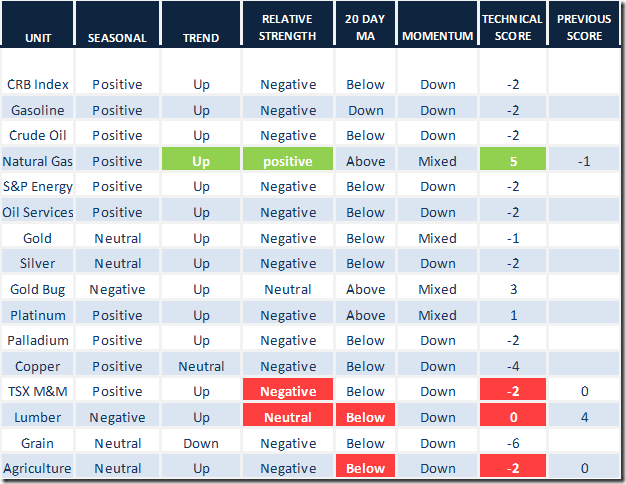

Daily Seasonal/Technical Commodities Trends for April 4th 2016

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Sector Trends for March April 4th 2016

Green: Increase from previous day

Red: Decrease from previous day

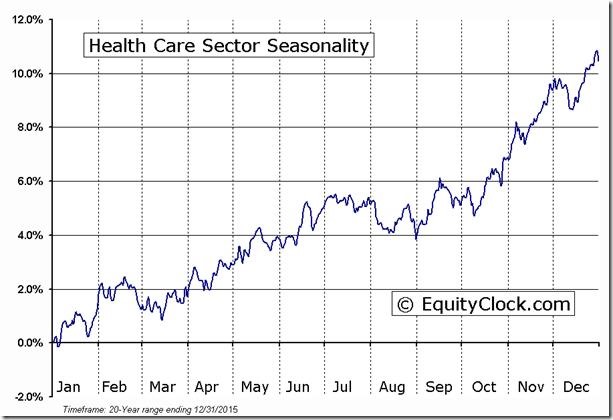

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Editor’s Note: Strength in biotech and medical supply stocks yesterday triggered completion of a reverse head and shoulders pattern by Health Care SPDRs and a change in relative strength to Positive.

Accountability Report

Waste Management (WM $58.68) was supported on February 17th on StockTwits at $54.53. Relative strength has turned negative and short term momentum indicators are trending down. The stock no longer is supported.

Republic Services (RSG $46.27) was supported on February 17th on StockTwits at $45.05. Relative strength has turned negative, short term momentum indicators are trending down and its 20 day moving average was broken (yesterday).

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca