To Hike, Or Not To Hike

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

§ Federal Reserve (Fed) Chair, Janet Yellen, presented to the Economic Club of New York this week where she provided a more “dovish” outlook for the economy and interest rates, citing a mixed US economic picture and heightened “external” risks.

§ At the beginning of the year the Fed forecasted four 25 bps hikes in 2016. We felt this was overly optimistic, in large part due to our expectations of lower economic growth, relative to the Fed’s growth outlook. The Fed, however, reduced their expectations for rate hikes at their March meeting; the Fed’s median projection is now at 0.875% for the Fed Funds rate by year-end. Their current projections imply two 25 bps hikes in 2016, which is now in line with our forecast.

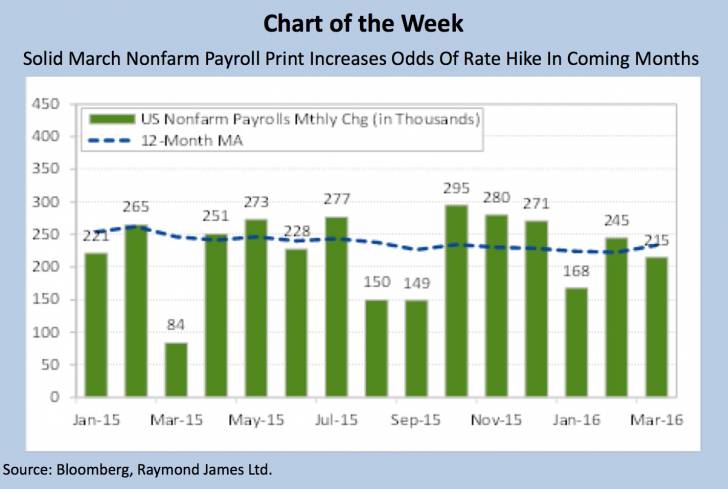

§ In our Market Outlook report we stated that “we believe the Fed will be gradual in hiking rates, with just a few 25 bps hikes in 2016”. We are sticking with this forecast, and continue to call for one 25 bps hike in H1/16 (likely June meeting) and another 25 bps hike in H2/16 (likely after the US election in November). Our forecast is based on the following factors: 1) we see continued strong job growth (see Chart of the Week); 2) we believe the US manufacturing sector may have bottomed which should provide a boost to economic growth this year; and 3) we believe inflation will continue to rise in large part driven by higher oil prices and wages.