Echo: Are Stocks Getting Back in Cycle?

by Liz Ann Sonders, Senior Vice President, Chief Investment Strategist, Charles Schwab & Co., Inc.

Key Points

- The stock market tends to move in and out of four distinct phases of a full cycle

- The current cycle has largely followed these phases, with a notable hiccup this year.

- Barring an economic recession, corrective phases during this cycle should be limited.

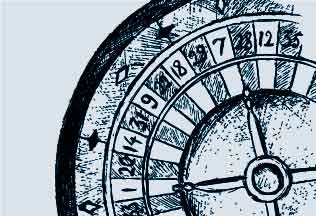

The stock market has familiar cycles dating back to at least the 1960s. The visual below (and the accompanying detailed set of tables below that) highlights these cycles and their direction. Each box in the graphic below shows the median return and duration for the seven of these cycles we’ve seen since 1968; but also the return and duration for the most recent phase of the current cycle. The cycles utilize the bull and bear market definitions pioneered by Ned Davis Research (NDR), which are more nuanced than the simple +20%/-20% traditional definition.

Results based on the Dow Jones Industrial Average (DJIA). Recession bear=cyclical bear market overlapped by a recession. Bear markets classified as recession bears when National Bureau of Economic Research (NBER) declares a recession, which can be several months after the bear market has started. Until then, all bear markets classified as Echo Bears. Post recession bull=cyclical bull immediately following a recession bear. Echo bear=cyclical bear market during a non-recessionary period. Post echo bull=cyclical bull immediately following an echo bear. Cyclical bull market=30% rise in DJIA after 50 calendar days or 13% rise after 155 calendar days. Cyclical bear market=30% drop in DJIA after 50 calendar days or 13% decline after 145 calendar days. **Corresponding end date is date of high/low from trough or peak. Dotted lines indicate occasional occurrences. Source: Ned Davis Research (NDR), Inc. Further distribution prohibited without prior permission. Copyright 2016(c) Ned Davis Research, Inc. All rights reserved.

Recession Bear

Let’s start at the top with the Recession Bear—the typically-grizzly, ugly bear market accompanied by an economic recession—which ends one cycle and ushers in the next. Typically lasting a median 539 days and offering a decline of an average 30%; the most recent Recession Bear (October 2007 to March 2009) was in line with the median duration at 517 days; but trounced the median decline by falling nearly 54%.

Post-Recession Bull

After the bear’s mauling, the market then moves into its next phase in the cycle—the Post-Recession Bull—generating a median return of over 65% and lasting a median 474 days. The most recent Post-Recession Bull spanned from the market’s low in March 2009 to its first cyclical peak in April 2011. Both the return and duration in that phase significantly bested the historic medians—likely due to the magnitude of the preceding decline (the “rubber band effect”).

Before I get to the next phase, do note that there was one experience—in 1981—when the market turned on a dime and went back into a Recession Bear, following the Post Recession Bull. That of course was a function of another recession hitting the U.S. economy in short-order (the now famous double-dip recession of the early 1980s).

Echo “Bear”

Aside from that exception, normally Post Recession Bulls are followed by Echo “Bears”—or better put perhaps, No Recession “Bears” (using quotes because they don’t typically meet the traditional -20% definition). Another way to think about this phase is as the pause that refreshes. It’s currently most relevant because it’s the phase in which we officially sit presently—in fact, this is the second time we’ve been in this phase in the current cycle.

We first entered an Echo “Bear” in April 2011, when the market began its 17% slide into October 2011; after which it moved to the next phase—the Post-Echo Bull (which I’ll get to in a moment). But since the all-time high reached in May 2015, the market was down 15% by the February 2016 low—enough to put us back into an Echo “Bear”—from which it hasn’t yet sufficiently recovered for a move out of that phase.

This is the second time since the late-1960s that the market moved counter-clockwise from a Post-Echo Bull back to an Echo “Bear”—the other time was in 1987 courtesy of The Crash in October that year. As you can see in the median duration and return, these are perhaps better described as severe corrections; largely thanks to the absence of economic recessions.

Post-Echo Bull

When the Echo “Bear” ended in October 2011, we moved into a Post-Echo Bull, which lasted until May 2015, as noted above. Both its duration and return were meaningfully higher than the historic medians. But since last May, the market has suffered two relatively severe corrections; and the recovery since the February low has not been sufficient enough to move us back into a Post-Echo Bull.

So, the burning question is where we go from here. The short and accurate answer of course is I don’t know. However, given the low risk of an economic recession (in my humble opinion), I think the better bet is that this market will recover enough to bring us back in the Post-Echo Bull phase.

See the tables below for more detail on the history of each of these phases. The “%GPA” column shows gain-per-annum (annualized gain).

Results based on the Dow Jones Industrial Average (DJIA). Recession bear=cyclical bear market overlapped by a recession. Bear markets classified as recession bears when National Bureau of Economic Research (NBER) declares a recession, which can be several months after the bear market has started. Until then, all bear markets classified as Echo Bears. Post recession bull=cyclical bull immediately following a recession bear. Echo bear=cyclical bear market during a non-recessionary period. Post echo bull=cyclical bull immediately following an echo bear. Cyclical bull market=30% rise in DJIA after 50 calendar days or 13% rise after 155 calendar days. Cyclical bear market=30% drop in DJIA after 50 calendar days or 13% decline after 145 calendar days. Blank rows indicate breaks in cycle. *Current cycle. Corresponding end date is date of high/low from trough or peak. Summary statistics don’t include current bull or bear market. Source: Ned Davis Research (NDR), Inc. Further distribution prohibited without prior permission. Copyright 2016(c) Ned Davis Research, Inc. All rights reserved.

Copyright © Charles Schwab & Co., Inc.