by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Wednesday March 23rd

U.S. equity index futures were mixed this morning. S&P 500 futures were uuchanged in pre-opening trade.

The Canadian Dollar dipped slightly following released of the Federal Government Budget last night.

General Mill eased $0.86 to $59.93 after reporting lower than consensus third quarter revenues.

TD Ameritrade (AMTD $31.59) is expected to open higher after SunTrust initiated coverage with a Buy rating and a $40 target.

Nike dropped $3.44 to $61.46 after reporting lower than consensus fiscal third quarter revenues. In addition, Susquehanna lowered its target price to $74 from $76.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/03/22/stock-market-outlook-for-march-23-2016/

Note seasonality charts on Health Care and Value relative to Growth

Another Milestone

Followers receiving EquityClock’s StockTwits exceeded 19,000 yesterday. Previous milestone was set at 18,000 followers on March 3rd.

StockTwits Released Yesterday @EquityClock

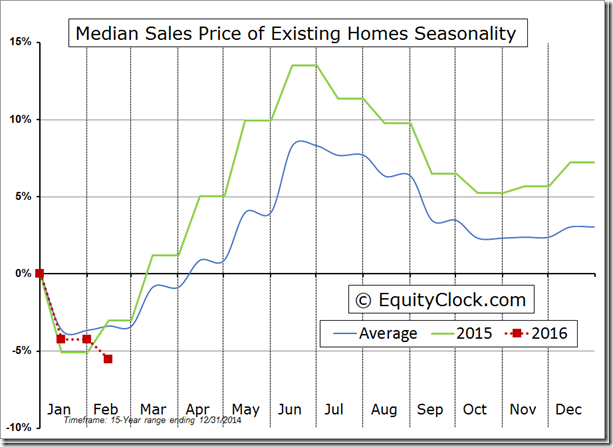

Despite tight supply, the median sales price of existing homes shows a rare decline in February.

Strange, but true! No S&P 500 stocks moved above intermediate resistance or below intermediate support by 10:00 AM EDT.

Editor’s Note: After 10:00 AM, four S&P 500 stocks broke resistance and none broke support.

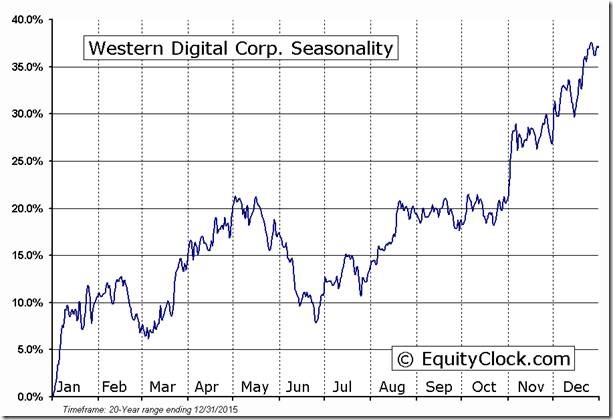

Nice reverse head and shoulders pattern by Western Digital $WDC on a move above $51.27! Also +ve on balance volume.

‘Tis the season for strength in Western Digital $WDC until early May!

Trader’s Corner

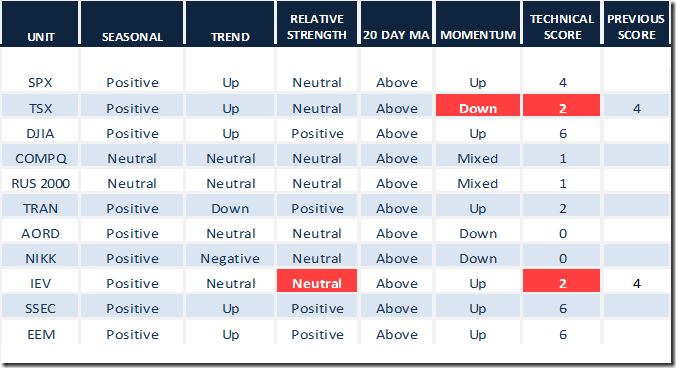

Daily Seasonal/Technical Equity Trends for March 22nd 2016

Green: Increase from previous day

Red: Decrease from previous day

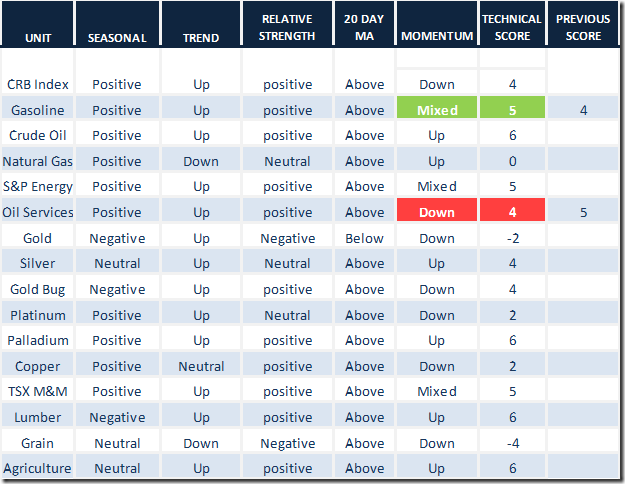

Daily Seasonal/Technical Commodities Trends for March 22nd 2016

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Sector Trends for March 22nd 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

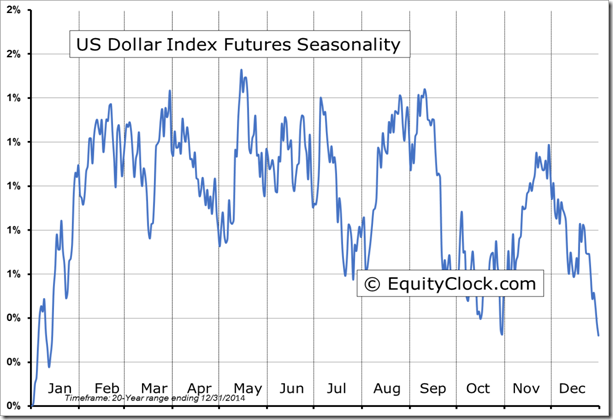

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Accountability Report

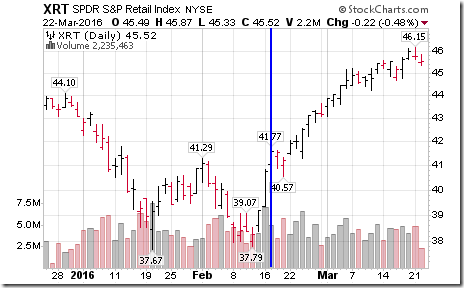

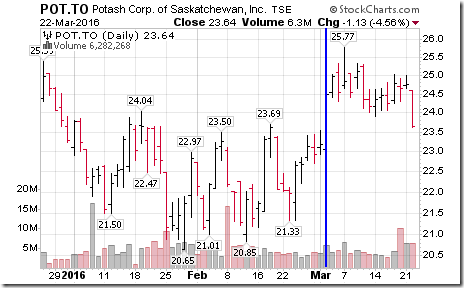

Several equities and ETFs previously supported by StockTwits and Tech Talk reports with seasonality and price charts have recorded early technical signs of rolling over. Accordingly, plans to take profits/liquidate in trading accounts makes sense.

Retail ETF (XRT $45.52) originally recommended in Tech Talk on February 17th at $41.75

Macy’s (M $43.78) originally recommended in Tech Talk on February 24th at 42.31

Target (TGT $81.70) originally recommended in Tech Talk on February 24th at $73.99

Potash Corp (POT $23.64) originally recommended in a StockTwit on March 3rd at Cdn$23.82

Editor’s Note: The stock was hit yesterday by an analyst downgrade by Paradigm to Sell.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca

![clip_image002[1] clip_image002[1]](https://advisoranalyst.com/wp-content/uploads/2019/08/ae03393c723e697cdb65f94dd8462be1.png)