Profitable Correlations in the Stock Market

by Gatis Roze, Stockcharts.com

Whether it’s life or investing, if you ignore the reality of correlations – be they positive or negative – you are literally engaged in paradigm shifting. This is the equivalent of trying to put the milk back into the cow.

We all witness examples of positive correlations in our daily lives. The more it rains, the more umbrella sales go up. The more miles you run on the treadmill, the more calories you burn. When one variable increases, the other variable increases as well.

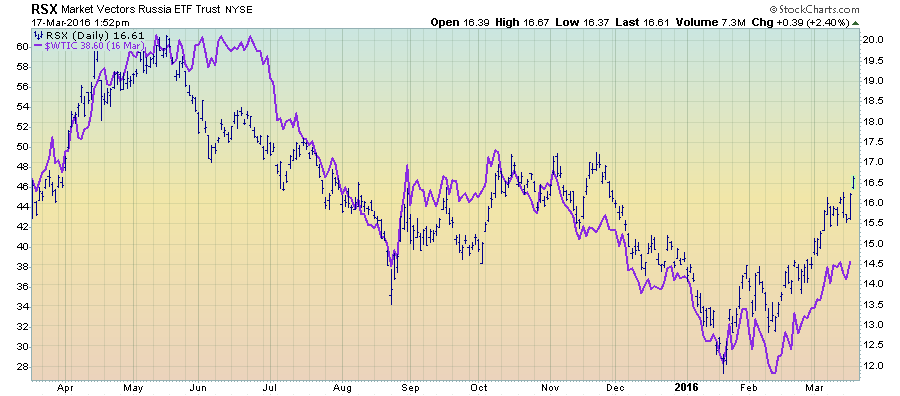

Those are the easy examples. You could have guessed them intuitively. It’s the more complex correlations that are less intuitive – ones such as the positive correlation between the Russia Fund (RSX) and Light Crude Oil (#WTIC).

The flip side is negative correlations where one variable increases while the other variable decreases. The more alcohol a person consumes, the less judgment one exhibits. The more one works out, the less body fat one has. Once again, these negative correlations are intuitive. If they aren’t obvious to you, perhaps some counseling is advisable!

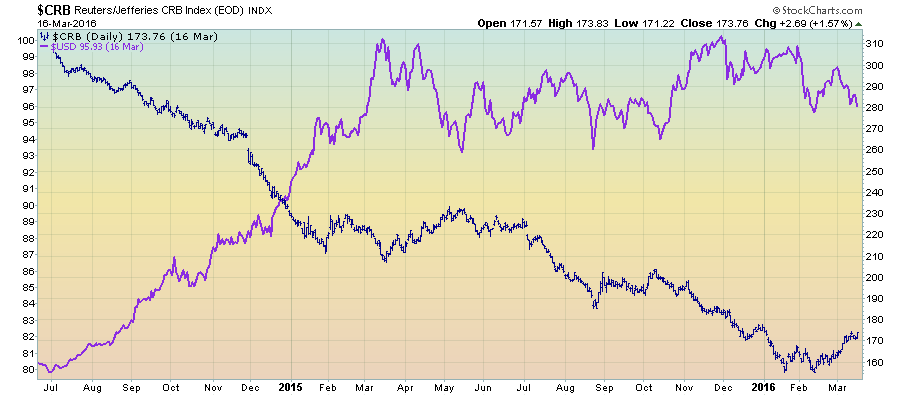

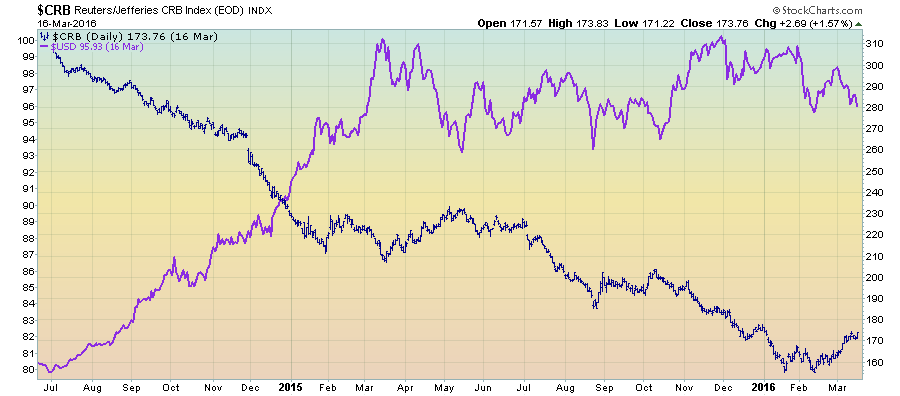

With the markets, there are negative correlations you best understand as well. Relationships such as the inverse connection between Commodities ($CRB) and the US Dollar (#USD).

You get my point. You can’t fight a rising tide just as you can’t – or shouldn’t—fight correlations in nature or in the markets. Otherwise, the blowback will be swift and painful.

I’ll concede that these correlations must be carefully assembled and will indeed determine a disproportionate percentage of your long term investment success, but it’s still number two in the ratings!

Just as surely as these previous examples exist, successful investors need to acknowledge what I consider the most important correlation. In the stock market arena, there is a direct and inversely correlated relationship between investors’ own emotional levels of stress and their productivity and profitability. Academic studies consistently bear this out. There is simply no place for emotional earthquakes or personal tsunamis when it comes to your investing discipline. These upheavals kill the soul of any trader and will sucker punch your portfolio.

The French call it “sangfroid” which means the ability to stay cool, calm and collected in stressful situations. When I review my own “oops” trades, it’s not that stress led to disastrous results. It’s usually something much more subtle. Most likely, the market was unable to speak to me because stress had made me distant and unavailable. With my personal stress level elevated, my usual sangfroid may have been missing. The result would have meant filtered listening on my part as I was unable to hear what the market was trying to tell me.

I challenge you to personally embrace the reality that stress and profitability are inversely correlated. You should pledge to trade the markets with the calm confidence and bravado of a monk. We don’t get to choose what our stock market days look like, but we do get to choose the lens through which we view it. Between you and I, let’s think of it as the “monk’s sangfroid lens.”

Trade well; trade with discipline!

-Gatis Roze, MBA, CMT