by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Friday March 18th

U.S. equity index futures were higher this morning. S&P 500 futures were up 5 points in pre-opening trade.

Volumes on U.S. equity markets are expected to spike. Today is Quadruple Witching Day.

The Canadian Dollar improved slightly following release of economic news at 8:30 AM EDT. Consensus for January Retail Sales was a gain of 0.6% versus a decline of 2.1%. Actual was a gain of 2.1%. Consensus for Canadian February Consumer Prices on a year-over-year basis was an increase of 1.5%. Actual was an increase of 1.4%. Excluding food and energy, consensus for Canadian February Consumer Prices was an increase of 2.0%. Actual was an increase of 1.9%.

TransCanada has offered to purchase Columbia Pipeline Group for $25.50 per share cash. Value of the deal is estimated at $13 billion Columbia gained $1.58 to $25.09. TransCanada slipped $1.34 to US$36.74

Bank of America added $0.22 to 13.62 after announcing a new $800 million stock buyback program.

Adobe gained $6.19 to $96.15 after reporting higher than consensus fourth quarter results.

PayPal (PYPL $) slipped $0.38 to $39.55 after Stifel Nicolaus downgraded the stock to Hold from Buy.

Tiffany added $0.33 to $70.45 after beating fourth quarter consensus earnings. The company also issued negative first quarter earnings guidance.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/03/17/stock-market-outlook-for-march-18-2016/

Note seasonality report on the Philadelphia Fed Index

StockTwits Released Yesterday @EquityClock

Technical action by S&P 500 stocks to Noon: Bullish. Breakouts: $SPLS, $AVB, $AIV, $TRV, $CMI, $FDX, $IR, $MAS, $UNP, $UPS, $ADBE, $DUK, $PCG, $PPL, O

Editor’s Note: After Noon, another 15 stocks broke resistance: AIV, EMC, HON, HPQ, INTU, JEC, JWN, LMT, MON, NKE, PAYX, PBI, SJM, SRCL, TXT.

Industrial sector leads S&P 500 Index stocks with breakouts: XLI, CMI, FDX, IR, MAS, UPS, UNP

Nice head and shoulders reversal by Staples $SPLS on rumors of sale of a major division.

Gold and silver stocks higher on a breakout by $SLV above $15.20. $ABX.CA $G.CA

Nice breakout by CGI Group $GIB above resistance at US$44.68 to resume an intermediate uptrend.

Interesting Charts

The U.S. Dollar Index extended its intermediate downtrend on a break below 95.28

Commodity prices responded accordingly.

Trader’s Corner

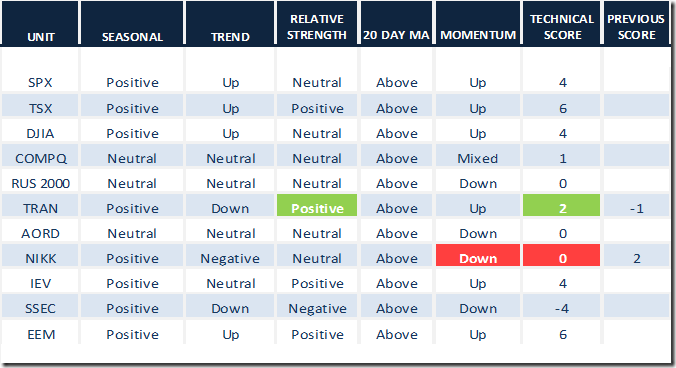

Daily Seasonal/Technical Equity Trends for March 17th 2016

Green: Increase from previous day

Red: Decrease from previous day

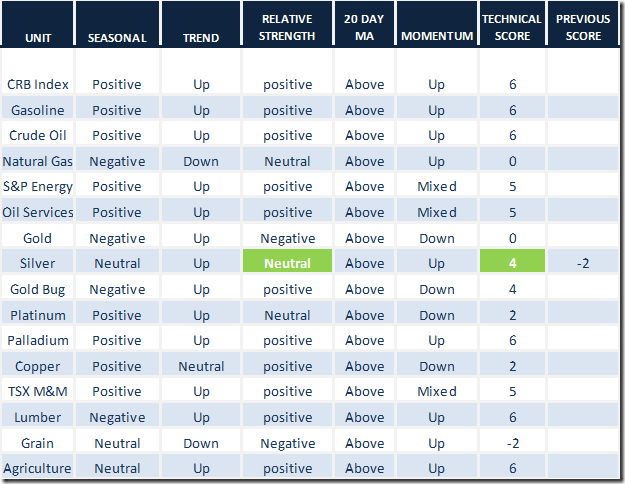

Daily Seasonal/Technical Commodities Trends for March 17th 2016

Green: Increase from previous day

Red: Decrease from previous day

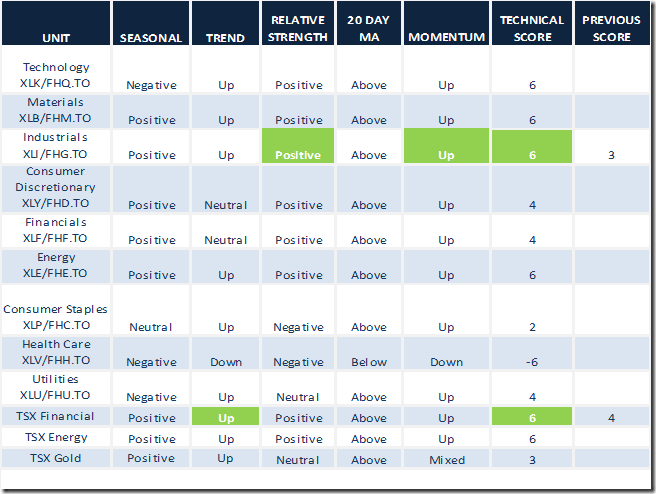

Daily Seasonal/Technical Sector Trends for March 17th 2016

Green: Increase from previous day

Red: Decrease from previous day

Keith Richards’ Blog

Headline reads, “It’s all about discipline”. Following is a link:

http://www.valuetrend.ca/discipline/

Special Free Services available through www.equityclock.com

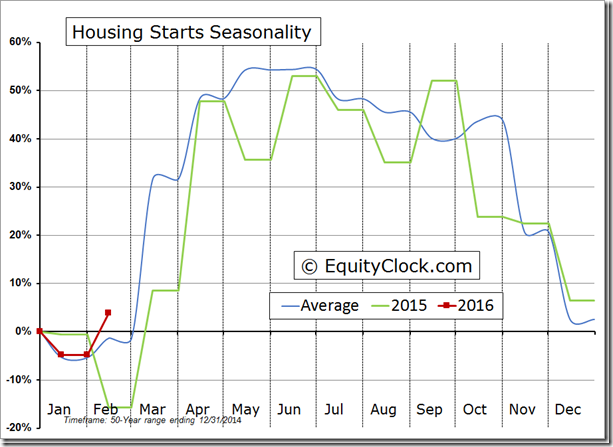

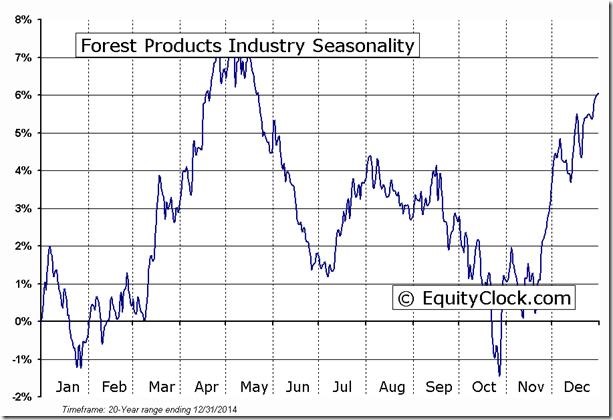

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Editor’s Note: Lumber stocks are responding

‘Tis the season for strength in lumber stocks into the end of April!

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca