by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Wednesday March 16th

U.S. equity index futures were lower this morning prior to news from the FOMC meeting scheduled at 2:00 PM EDT. S&P 500 futures were down 5 point in pre-opening trade.

Index futures moved slightly lower following release of economic news at 8:30 AM EDT. Consensus for February Consumer Prices was a decline of 0.2% versus no change in January. Actual was a decline of 0.2%. Excluding food and energy, consensus for February Consumer Prices was an increase of 0.1% versus a gain of 0.3% in January. Actual was an increase of 0.3%. On a year-over-year basis, February CPI rose 2.3%, significantly higher than the Federal Reserve’s 2.0% target. Consensus for February Housing Starts was an increase of 1.125 million units versus an upwardly revised 1.120 million units. Actual was 1.178 million units.

Chipotle dropped $28.50 to $474.50 after the company lowered its first quarter guidance.

Oracle added $1.51 to $40.25 after reporting better than expected earnings and after an additional $10 billion share buyback.

Linkedin dropped $4.98 to $110.60 after Morgan Stanley downgraded the stock to Equal Weight from Overweight.

Gap Stores eased$1.01 to $28.70 after Morgan Stanley downgraded the stock to Underweight from Equal Weight.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/03/15/stock-market-outlook-for-march-16-2016/

Note seasonality charts on Retail Trade, Empire State Manufacturing Index and Business Inventories

StockTwits Released Yesterday @EquityClock

Stocks closed mixed in the lowest volume session of the year.

Technical action by S&P 500 stocks to 10:15 AM: Quiet. Breakout: $MJN, $KLAC. Breakdown: $LLY

Editor’s Note: Quiet day! After 10:15 AM, breakouts were CAN and KIM.

Trader’s Corner

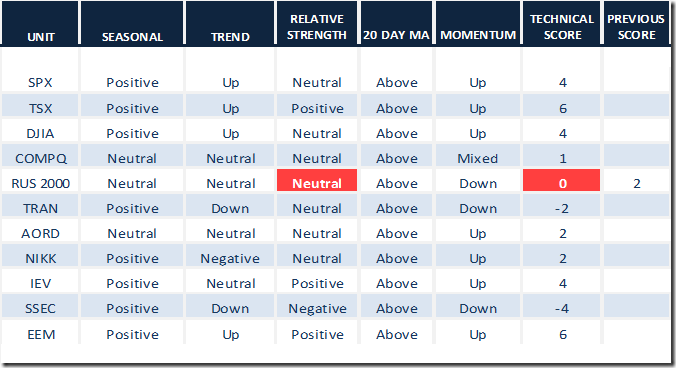

Daily Seasonal/Technical Equity Trends for March 15th 2016

Green: Increase from previous day

Red: Decrease from previous day

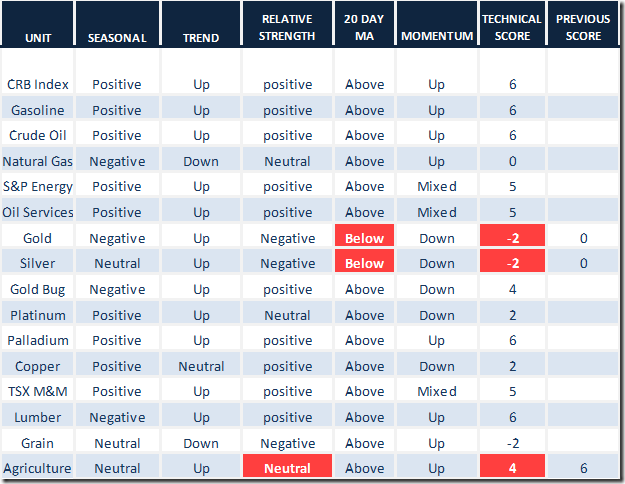

Daily Seasonal/Technical Commodities Trends for March 15th 2016

Green: Increase from previous day

Red: Decrease from previous day

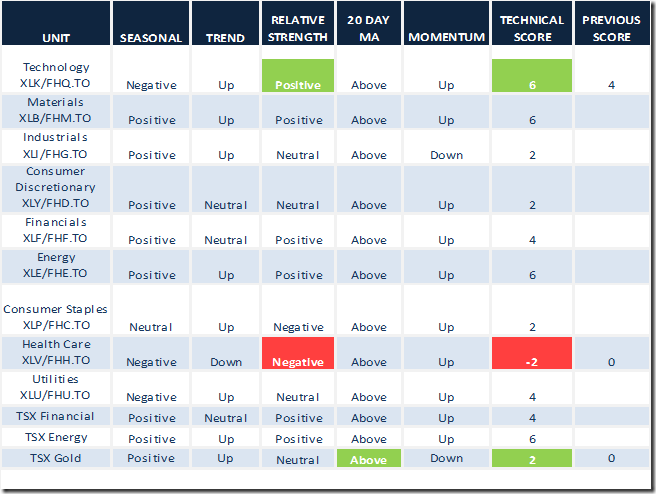

Daily Seasonal/Technical Sector Trends for March 15th 2016

Green: Increase from previous day

Red: Decrease from previous day

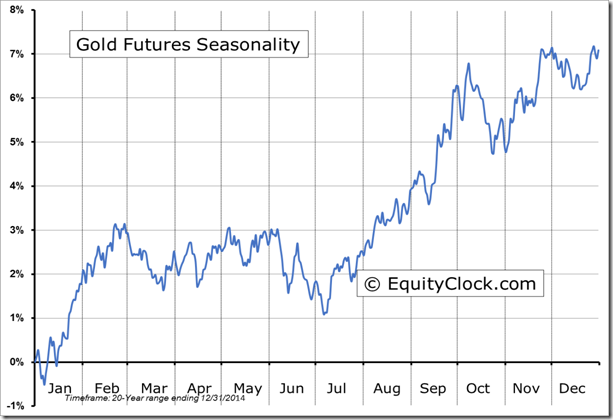

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Adrienne Toghraie’s “Trader’s Coach” Column

|

|

A Closer Look at Anxiety

By Adrienne Toghraie, Trader’s Success Coach

Too much of a “good” thing ceases to be good. Too much of a “bad” thing is terrible. But, what about a little bit of a bad thing? One of those “bad” things is anxiety. With so many traders dealing with increasingly higher levels of anxiety, is a little bit of anxiety really such a “bad” thing after all?

These questions came up when I worked with a trader I will call Andy who wanted to get rid of the anxiety that plagued him. From the time he awoke in the morning to the time he went to bed, Andy’s mind was filled with anxieties. These anxieties came in the form of a tightness or nausea in his stomach, or a pounding headache, or sometimes just a sense of panic rising in his throat. The somatic nature of his anxiety was beginning to affect his health.

What was Andy worried about? Most of his anxieties were related to money. Andy was trading on so small a margin that he continually feared that a single trade could wipe him out. He had put all of his life savings plus loans from family members into his trading account, which left nothing for other living expenses. For that reason, he was depending upon his wife’s income as a teacher in their local school system to cover their basic needs. Unfortunately, the county in which Andy’s wife taught was experiencing a reduction in the student population and was calling for the combining of certain schools and the laying off of teachers in her particular field.

The second category of anxieties was related to his health. Andy had gained a great deal of weight recently and no longer had the stamina he once had. Furthermore, he had developed sleep apnea from the excess weight. Of course, the more he worried, the more he ate and the worse his situation became.

His third set of anxieties was all about his anxiety. Andy had begun to feel anxious about being anxious, which made him even more anxious. This, in turn, affected his trading by destroying his ability to focus, which made him even more anxious.

At this point, a lot of a “bad” thing had become terrible.

“Please help me to get rid of all this anxiety,” Andy implored. He wanted me to find a way for him to stop feeling so anxious so that he could focus on his trading. “If you recommend taking medication, I’m all for it. Whatever will make it go away…!”

It is a fact that levels of serotonin in the brain that are too low will result in a person feeling anxious, possibly at intolerable levels. The best way to treat anxiety that is biochemical in nature is to start with natural ways to increase the body’s production of serotonin such as exercise or an improved diet. One hour of exercise can double the amount of serotonin in the body and a diet that is high in the amino acid tryptophan (i.e. spinach, turkey, soy) provides the raw material for the production of serotonin. The final solution is medication.

Killing the messenger

Andy’s problem with anxiety was not the result of a low level of serotonin in his brain. In fact, Andy’s anxiety was a friend. His anxiety was acting like the light on the dashboard of his car trying to warn him that something was wrong in the engine and that a problem was on the way to destroying his engine. In typical Andy-fashion, however, he would have ignored that flashing light as well and considered it a great annoyance.

Instead of trying to make the anxiety go away, my approach to the problem was to convince Andy that he had to take action to correct the very issues of which his anxiety was attempting to make him aware.

In other words, Andy’s anxiety was the messenger – just like pain in your body is a messenger that something is wrong – and Andy wanted it killed rather than fixing the thing that was wrong. My job was to convince Andy that, once he addressed the fact that he was undercapitalized and that he needed to take concrete steps to improve his health, the anxiety would disappear without any medical intervention.

Once Andy accepted the fact that his anxiety was not the enemy but a warning signal that was trying to get his attention, he stopped trading and returned to his previous job as an engineer. He put his trading capital into a set of investments that he carefully monitored. In the meantime, he saved his income for the next two years and was able to return to his trading with a head that was clear. He joined a gym, started to eat better and discovered that he could now sleep through the night and awaken with energy.

For traders who are plagued with anxiety, you might ask yourself these questions:

1. Is my anxiety trying to be a friend, a messenger that is alerting me that something needs to be taken care of? Or is my anxiety an ever-present condition that is probably biochemical in nature?

2. If I addressed the situation and solved the problem that is making me feel anxious, what would that action entail?

3. What, if anything, is holding me back from addressing the situation? What resources do I need to solve it?

Like Andy, you may be ignoring the problem and focusing on the discomfort of your anxiety. Sometimes, in order to get past the discomfort to fix the underlying problem, you will need to enlist the energy and/or assistance of someone who is able to refocus your attention. In any event, the fact that anxiety, like pain, can be your friend can help you to find a way out!

Adrienne Presents Free Webinar – Evening With Adrienne

Wednesday, March 23 at 4:30 pm ET

This is an opportunity to ask questions on the discipline of trading.

Email Adrienne to Register – Adrienne@TradingOnTarget.com

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca