by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Monday March 14th

U.S. equity index futures were lower this morning. S&P 500 futures were down 5 points in pre-opening trade.

Tesla gained $3.07 to $210.57 after RW Baird upgraded the stock to Outperform from Neutral. Target was raised to $300 from $230.

HCA Holding added $0.75 to $75.70 after JP Morgan upgraded the stock to Overweight from Neutral. Target was raised to $85 from $76.

Starwood Hotels gained $5.83 to $76.25 after the company received an unsolicited offer from a Chinese consortium to purchase the company at $76 per share cash.

Johnson & Johnson improved $0.29 to $108.00 after Goldman Sachs upgraded the stock to Neutral from Sell.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/03/11/stock-market-outlook-for-march-14-2016/

Economic News This Week

February Retail Sales to be released at 8:30 AM EDT on Tuesday are expected to slip 0.1% versus a gain of 0.2%. Excluding auto sales, February Retail Sales are expected to slip 0.2% versus a gain of 0.1% in January.

February Producer Prices to be released at 8:30 AM EDT on Tuesday are expected to slip 0.2% versus a gain of 0.1% in January. Excluding food and energy, PPI is expected to increase 0.1% versus a gain of 0.4% in January.

March Empire Manufacturing Index to be released at 8:30 AM EDT on Tuesday is expected to improve to -9.5 from -16.6.

January Business Inventories to be released at 10:00 AM EDT on Tuesday are expected to be unchanged versus a gain of 0.1% in January.

February Consumer Prices to be released at 8:30 AM EDT on Wednesday are expected to slip 0.2% versus no change in January. Excluding food and energy, February CPI is expected to increase 0.1% versus a gain of 0.3% in January.

February Industrial Production to be released at 9:15 AM EDT on Wednesday is expected to drop 0.3% versus a gain of 0.9% in January. February Capacity Utilization is expected to slip to 76.9% from 77.1% in January.

FOMC Rate Decision to be released at 2:00 PM EDT on Wednesday is expected to maintain the Fed Fund Rate at 0.25%-0.50%.

Weekly Initial Jobless Claims to be released at 8:30 AM EDT on Thursday are expected to increase to 266,000 from 259,000 last week.

March Philadelphia Fed Index to be released at 8:30 AM EDT on Thursday is expected to improve to -1.4 from -2.8 in February.

February Leading Indicators to be released at 10:00 AM EDT on Thursday are expected to increase 0.2% versus a drop of 0.2% in January.

Canadian February Consumer Prices to be released at 8:30 AM EDT on Friday are expected to increase 0.2% versus a decline of 0.2% in January. Excluding food and energy, February CPI is expected to increase 0.5% versus a gain of 0.3% in January.

Canadian January Retail Sales to be released at 8:30 AM EDT on Friday are expected to increase 0.8% versus a drop of 2.2% in December.

March Michigan Sentiment Index to be released at 10:00 AM EDT on Friday is expected to increase to 92.2 from 91.7 in February.

Earnings News This Week

Monday: Lennar

Tuesday: Oracle

Thursday: Adobe

Friday: Tiffany

The Bottom Line

Lots of seasonal trades are working. Sectors and markets that are outperforming the S&P 500 market during their current period of seasonal strength include Emerging Markets, Industrials, Materials, U.S. Financials, Canadian and U.S. Energy, Base Metals, Oil Services, U.S.Retail, Brazil, Korea, U.K., Europe, Crude Oil, Gasoline and Canadian Banks. All have been recommended in StockTwits and daily Tech Talk reports during the past five weeks. However, short term momentum indicators for all of the above are overbought. Preferred strategy for investors following seasonal strategies is to accumulate on weakness. Short term traders are watching for momentum indicators to roll over before taking short term profits (with the possibility of repurchasing on weakness).

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 11th 2016

Green: Increase from previous day

Red: Decrease from previous day

Calculating Technical Scores

Technical scores are calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

Higher highs and higher lows

Intermediate Neutral trend: Score 0

Not up or down

Intermediate Downtrend: Score -2

Lower highs and lower lows

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower.

The S&P 500 Index gained 22.20 points (1.11%) last week. Intermediate trend remains up. The Index closed above its 200 day moving average on Friday. It remains above its 20 and 50 day moving averages. Short term momentum indicators are trending up.

Percent of S&P 500 stocks trading above their 50 day moving average increased last week to 89.80% from 83.00%. Percent remains in an intermediate uptrend and is overbought, but has yet to show signs of peaking.

Percent of S&P 500 stocks trading above their 200 day moving average increased last week to 55.20% from 48.60%. Percent remains in an intermediate uptrend.

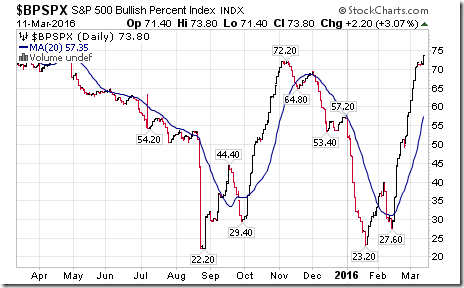

Bullish Percent Index for S&P 500 stocks increased last week to 73.80% from 70.60% and remained above its 20 day moving average. The Index remains in an intermediate uptrend and is overbought, but has yet to show signs of peaking.

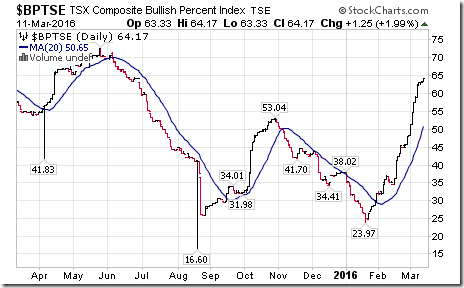

Bullish Percent Index for TSX stocks increased last week to 64.17% from 58.75% and remained above its 20 day moving average. The Index remains in an intermediate uptrend and is overbought, but has yet to show signs of peaking.

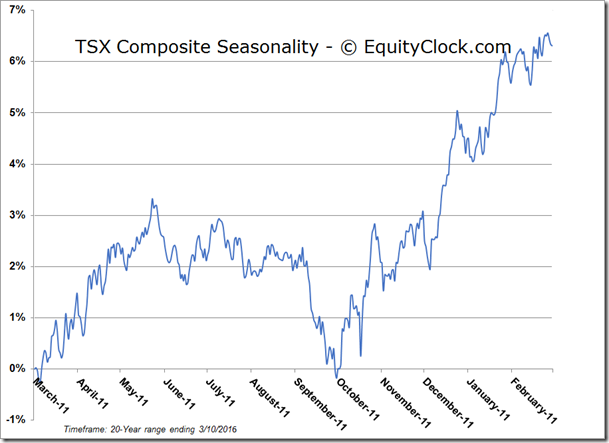

The TSX Composite Index gained 309.50 points (2.34%) last week. Intermediate trend remains up (Score: 2). Strength relative to the S&P 500 Index changed to Positive from Negative (Score: 2). The Index remained above its 20 day moving average (Score: 1). Short term momentum indicators are trending up (Score: 1), but are overbought. Technical score improved last week to 6 from 2.

Percent of TSX stocks trading above their 50 day moving average increased last week to 85.00% from 82.08%. Percent remains in an intermediate uptrend and is overbought, but has yet to show signs of peaking.

Percent of TSX stocks trading above their 200 day moving average increased last week to 52.08% from 47.50%. Percent remains in an intermediate uptrend and is overbought, but has yet to show signs of peaking.

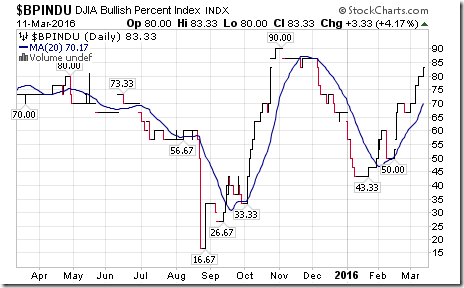

The Dow Jones Industrial Average gained 206.54 points (1.21%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index changed to Neutral from Negative. The Average remains above its 20 day moving average and closed above its 200 day moving average on Friday. Short term momentum indicators are trending up. Technical score improved last week to 4 from 2.

Bullish Percent Index for increased last week to 83.33% from 76.67% and remained above its 20 day moving average. The Index remains in an intermediate uptrend and is overbought, but has yet to show signs of peaking.

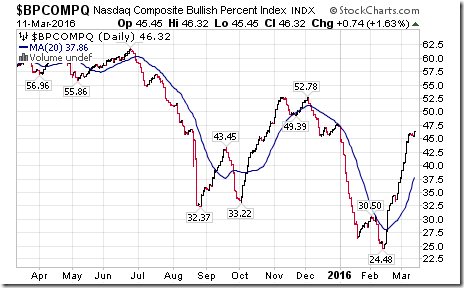

Bullish Percent Index for NASDAQ Composite stocks increased last week to 46.32% from 44.42% and remained above its 20 day moving average. Intermediate trend remains up.

The NASDAQ Composite Index gained 31.45 points (0.67%) last week. Intermediate trend remains Neutral. Strength relative to the S&P 500 Index changed to Neutral from Positive. The Index remains above its 20 day moving average. Short term momentum indicators are mixed. Technical score slipped last week to 1 from 4.

The Russell 2000 Index gained 5.63 points (0.52%) last week. Intermediate trend remained Neutral. Strength relative to the S&P 500 Index remained Positive. The Index remained above its 20 day moving average. Short term momentum indicators are mixed. Technical score slipped last week to 3 from 4.

The Dow Jones Transportation Average added 41.24 points (0.54%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index slipped to Neutral from Positive. The Average remains above its 20 day moving average. Short term momentum indicators are trending down. Technical score slipped last week to -2 from 2.

The Australia All Ordinaries Composite Index added 73.70 points (1.43%) last week. Intermediate trend remained Neutral. Strength relative to the S&P 500 Index remained Neutral. The Index remained above its 20 day moving average. Short term momentum indicators are trending up. Technical score remained last week at 2.

The Nikkei Average slipped 75.91 points (0.45%) last week. Intermediate trend remained down. Strength relative to the S&P 500 Index remained Neutral. The Average remained above its 20 day moving average. Short term momentum indicators are trending down. Technical score slipped last week to 0 from 2.

iShares Europe gained $0.80 (2.08%) last week. Intermediate trend remains Neutral. Strength relative to the S&P 500 Index turned Positive from Neutral on Friday. Units remain above their 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 4 from 2.

The Shanghai Composite Index dropped 63.84 points (2.22%) last week. Intermediate trend remained down. Strength relative to the S&P 500 Index remained Negative. The Index moved below its 20 day moving average. Short term momentum indicators are trending down. Technical score dropped last week to -6 from -2.

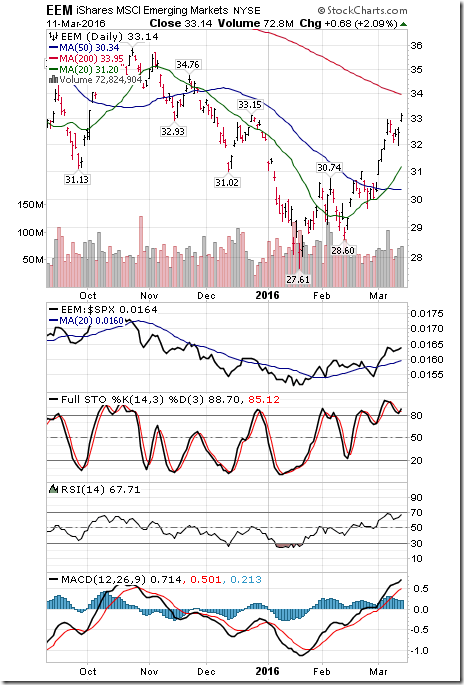

Emerging Markets gained $0.32 (0.98%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remained Positive. Units remained above their 20 day moving average. Short term momentum indicators are trending up. Technical score remained last week at 6.

Currencies

The U.S. Dollar Index dropped another 1.05 (1.08%) last week. Intermediate trend remains down. The Index remained below its 20 day moving average. Short term momentum indicators are trending down.

The Euro added 1.45 (1.32%) last week. Intermediate trend remains up. The Euro moved above its 20 day moving average. Short term momentum indicators are trending up.

The Canadian Dollar gained another US 0.60 cents (0.80%) last week. Intermediate trend remains up. The Canuck Buck remains above its 20 day moving average. Short term momentum indicators are trending up and are overbought, but have yet to show signs of peaking.

The Japanese Yen added 0.10 (0.11%) last week. Intermediate trend remains up. The Yen remains below its 20 day moving average. Short term momentum indicators are trending down.

Commodities

Daily Seasonal/Technical Commodities Trends for March 11th 2016

Green: Increase from previous day

Red: Decrease from previous day

The CRB Index gained 4.98 points (2.95%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index changed to Positive from Neutral. The Index remained above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 6 from 4

Gasoline jumped $0.15 per gallon (11.28%) last week. Intermediate trend changed to Up from Down. Strength relative to the S&P 500 Index remained Positive. Gas remained above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved to 6 from 2.

Crude Oil gained another $2.58 per barrel (7.18%) last week. Intermediate trend changed to Up from Neutral on a move above $38.39. Strength relative to the S&P 500 Index remained Positive. Crude remained above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 6 from 4.

Natural Gas gained $0.15 (8.98%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index changed to Neutral from Negative on Friday. “Natty” moved above its 20 day moving average on Friday. Short term momentum indicators are trending up. Technical score improved last week to 0 from -6.

The S&P Energy Index gained 8.59 points (1.89%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index remained Positive. The Index remained above its 20 day moving average. Strength relative to the S&P 500 Index is mixed. Technical score slipped last week to 5 from 6.

The Philadelphia Oil Services Index gained 2.09 points (1.28%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index remained Positive. The Index remained above its 20 day moving average. Short term momentum indicators are mixed. Technical score slipped last week to 5 from 6.

Gold dropped $11.30 per ounce (0.89%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remained Neutral. Gold remains above its 20 day moving average. Short term momentum indicators have turned down. Technical score slipped last week to 2 from 4.

Silver dropped $0.08 per ounce (0.51%) last week. Strength relative to the S&P 500 Index changed to Negative from Neutral. Silver remains above its 20 day moving average. Short term momentum indicators are trending up. Technical score remained last week at 2. Strength relative to Gold is Neutral.

The AMEX Gold Bug Index added 3.39 points (0.20%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index remained Positive. The Index remained above its 20 day moving average. Short term momentum indicators are trending down. Technical score remained last week at 4. Strength relative to Gold remained positive.

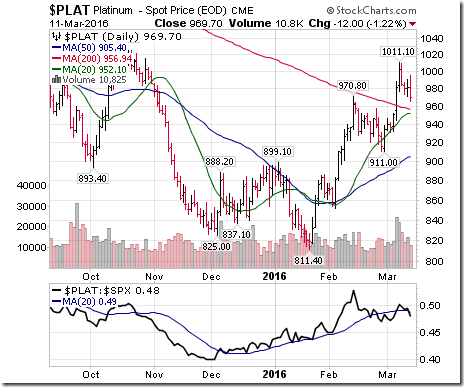

Platinum lost $16.60 per ounce (1.68%) last week. Trend remains up. Relative strength remained Neutral. PLAT remains above its 20 day MA. Momentum indicators trending down.

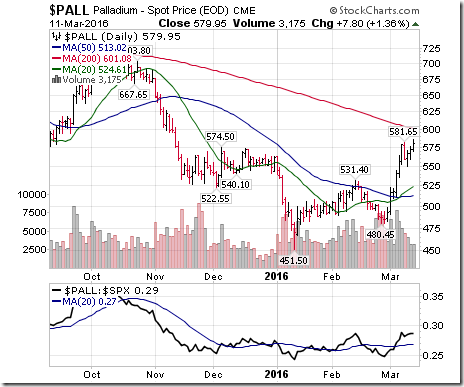

Palladium gained $16.85 per ounce (2.99%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remained Positive. PALL remains above its 20 day moving average. Short term momentum indicators are trending up. Technical score remained at 6

Copper slipped $0.03 per lb (1.32%) last week. Intermediate trend remained at Neutral. Strength relative to the S&P 500 Index remained Positive. Copper remains above its 20 day moving average. Short term momentum indicators are trending down. Technical score slipped last week to 2 from 4.

The TSX Metals and Mining Index slipped 1.77 points (0.38%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remained Positive. The Index remained above its 20 day moving average. Short term momentum indicators are trending down. Technical score slipped last week to 4 from 6.

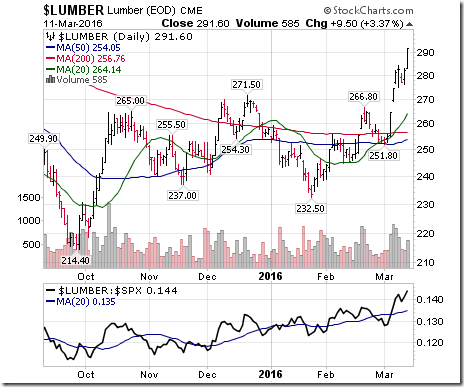

Lumber gained $17.00 (6.19%) last week. Trend remained up. Relative strength remained Positive. Lumber remained above its 20 day moving average. Momentum remained Positive.

The Grain ETN added $0.66 (2.19%) last week. Intermediate trend remained down. Strength relative to the S&P 500 Index remained Negative. Units moved above their 20 day moving average. Short term momentum indicators are trending up. Score improved to -2 from -4

The Agriculture ETF gained $0.54 (1.16%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remained Positive. Units remained above their 20 day moving average. Short term momentum indicators are trending up. Technical score remained at 6.

Interest Rates

Yield on 10 year U.S. Treasuries increase 9.4 basis points (4.99%) last week. Yield remains above its 20 day moving average. Short term momentum indicators are trending up.

Conversely, price of the long term Treasury ETF dropped $1.24 (0.96%) last week. Price remains below its 20 day moving average. Short term momentum indicators continue to trend down.

Other Issues

The VIX Index slipped 0.37 (2.19%) last week. Intermediate trend remained down. The Index remained below its 20 day moving average. Short term momentum indicators are trending down, but are oversold and showing early signs of bottoming.

Economic focus this week is on the FOMC meeting on Wednesday. No change in the Fed Fund rate is expected, but guidance toward timing of the next increase is likely. Other economic news released this week is expected to show modest gains in the third quarter.

Earnings news this week is sparse: seven S&P 500 stocks are scheduled to report.

According to FactSet, earnings and sales estimates for 2016 continue to come down. For example, first quarter earning per share estimates on a year-over-year basis for S&P 500 companies slipped last week to a decline of 8.3% from a decline of 8.0% last week while sales slipped to a decline of 2.2% from a decline of 2.0% last week.

Prospects for a recovery in earnings and sales on a year-over-year basis improve as the year progresses. Consensus estimates for earnings call for -8.3% in the first quarter, -2.2% in the second quarter, +4.2% in the third quarter and +9.0% in the fourth quarter. Consensus estimates for sales is -0.8% in the first quarter, -0.7% in the second quarter, +1.9% in the third quarter and 4.5% in the fourth quarter.

Short and intermediate technical indicators are overbought, but have yet to show significant signs of peaking. Last week another 55 S&P 500 stocks broke intermediate resistance levels and only two broke support.

Seasonal influences for most equity markets in the world are positive until mid-May.

Sectors

Daily Seasonal/Technical Sector Trends for March 11th 2016

Green: Increase from previous day

Red: Decrease from previous day

StockTwits Released on Friday @EquityClock

Currencies chart significant outside reversal sessions as equity investors cast a vote of indecision.

Technicals for S&P 500 stocks to 10:15 AM: Bullish. Breakouts: $EXPE, $MAT, $TAP, $PXD, $HIG, $BSX, $XRAY, $AAP, $AVGO, $MCHP. No breakdowns.

Editor’s Note: After 10:15 AM, another 8 S&P 500 stocks broke resistance: FTI, LH, APD, ISRG, EQIX, BXP, TMK, ANTM and ADT.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Mark Leibovit’s Comment on Natural Gas

Following is a link:

https://www.youtube.com/watch?v=HIHmlb1_Izw&feature=youtu.be

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca

![clip_image002[4] clip_image002[4]](https://advisoranalyst.com/wp-content/uploads/2019/08/21665e518c1f739a5e11aa20dc55a844.png)

![clip_image002[8] clip_image002[8]](https://advisoranalyst.com/wp-content/uploads/2019/08/fa2a0a69eb85a7fcec669e450aa26e80.png)

![clip_image002[6] clip_image002[6]](https://advisoranalyst.com/wp-content/uploads/2019/08/7b4584ab667dfb31f0914e99705433cb.png)