by Don Vialoux, Timingthemarket.ca

Another Milestone

Followers receiving EquityClock’s StockTwits exceeded 18,000 yesterday. Previous milestone was set at 17,000 followers on February 8th 2016

StockTwits Released Yesterday @EquityClock

Technical breakouts fuel strong gains in stocks to start the month of March.

Technical action by S&P 500 stocks to 10:00: Mixed. 10 stocks broke resistance (mostly financials). 8 stocks broke support (all utilities)

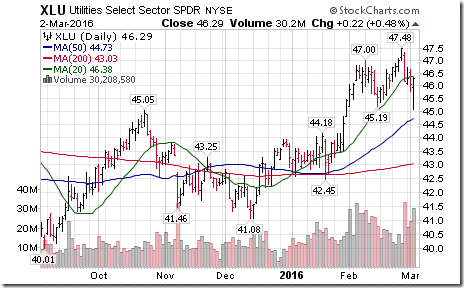

Utility SPDRs $XLU broke support at $45.19 along with 8 S&P Utility stocks.

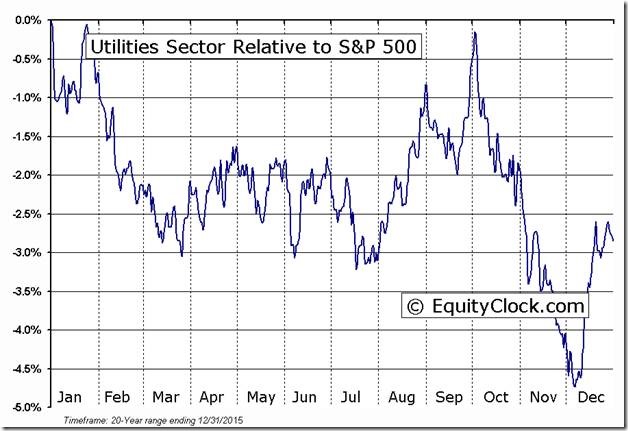

‘Tis the season for U.S. Utilities to underperform the S&P 500 Index until the end of March!

Steel ETF $SLX continues to surge. Nice breakouts by $NUE and $X this morning!

Nice breakout by Potash Corp $POT.CA above resistance at $24.04 to complete a base building pattern!

‘Tis the season for strength in Potash Corp $POT.CA until mid May!

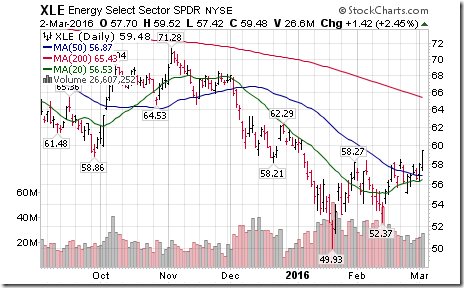

Nice breakout by Energy SPDRs $XLE above resistance at $58.52 to complete a base building pattern!

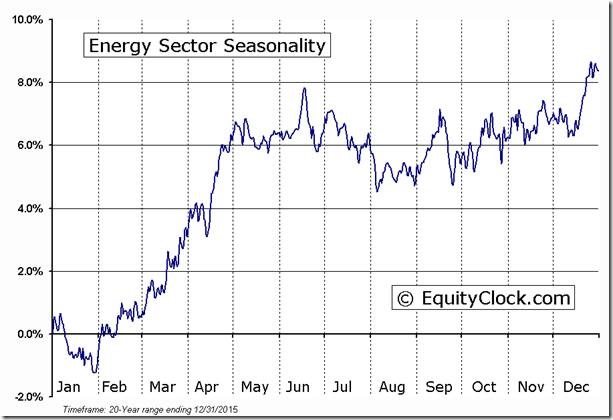

‘Tis the season for the U.S. Energy sector and its related ETFs $XLE to move higher into early May!

Editor’s Note: Four U.S. energy stocks broke above base building patterns in late trading yesterday: DNR, HAL, NE and SE.

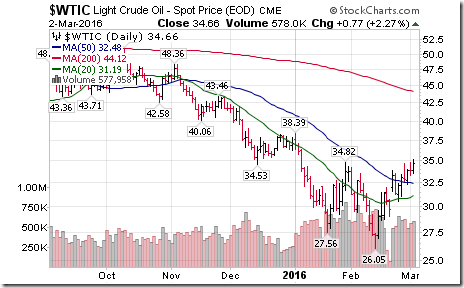

The energy sector on both sides of the border were bolstered by a breakout by WTI Crude Oil above $34.82 to complete a base building pattern

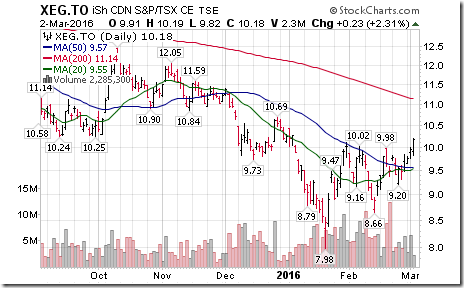

Nice breakout by the TSX Energy iShares $XEG.CA above resistance at $10.10 to complete a base building pattern!

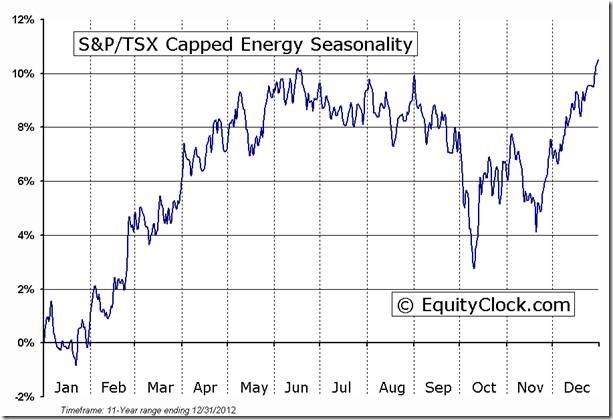

‘Tis the season for the TSX Energy Index and related ETFs $XEG.CA to move higher to mid-June!

Trader’s Corner

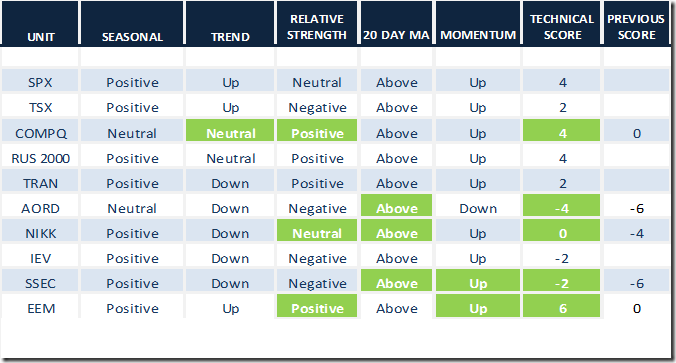

Daily Seasonal/Technical Equity Trends for March 2nd 2016

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Commodities Trends for March 2nd 2016

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Sector Trends for March 2nd 2016

Green: Increase from previous day

Red: Decrease from previous day

Adrienne Toghraie’s “Trader’s Coach” Column

|

|

Redirecting Nightmares

By Adrienne Toghraie, Trader’s Success Coach

Whenever people have told me about a recurring nightmare, I have suggested that they consciously complete it with a good outcome. The same could be said about negative thoughts that you are aware of during the day. For a trader it could mean the difference between a profitable or losing day. Our thoughts create emotions and our emotions direct our actions. When your thoughts contain stories of losing, insecurity, bad luck or any kind of negative outcome, you can combat this with the outcome that you would like to have. In doing this you direct your mind, and therefore your actions towards a positive outcome.

Negative Mike

Mike was raised in a family that would avoid compliments and see the negative side of almost every situation. His mother was the greatest influence on the family. She was extremely superstitious and was very good at making sure that everyone in the family was indoctrinated to believe in her point of view. A typical conversation with her would be, “You look very good today mama.” Her response would be: “What good, my back is killing me and my feet are swollen.” “But mama, I’m talking about your beautiful face.” And traditional to her style she would say, “Do you know what this face has seen, can’t you see the sadness in my eyes?”

While Mike understood this about his family and himself, negative conversation and thinking were ingrained in him. So then, how did Mike change so dramatically that he would eventually become an extremely profitable trader?

Enter Gina. When Mike met Gina he knew that she was too good for him, that she would never date him, let alone marry him, but she did. She was the complete opposite of Mike. What she saw in him most people could never understand. Gina said that he was her diamond in the rough. At first she behaved like a translator with him. Every time he said something negative she would translate it into something positive. Then after a while she would end his sentences in a positive tone when she knew the direction his words would most likely take him.

Mike became the apprentice of Gina’s father who was a trader. When Gina’s father had a large dose of Mike’s family at the wedding, he knew he had to change Mike if ever he was going to become a professional trader. He told Mike that there was no place for negative conversation or thinking in the office. Eventually a new habit was formed.

Negative talk directs mind towards living nightmares.

While most of us have not experienced the extreme of having Mike’s mother’s negative thinking to influence us, most of us do have negative talk in our lives. For a trader this has been one of the issues that creates losses.

You most likely do not have a Gina in your life, but you can create one. Here is how to work with her.

What would Gina say?

1. The first thing you must notice is when you have negative thinking and negative conversations with others. Just by becoming aware of it and having the intention to change will start the process of change.

2. When you are in that negative mode. Ask yourself how Gina would translate what you just said or thought.

3. The next step is to catch yourself before you say or think something negative and change it to something positive.

Conclusion

The wonderful thing about negative conditioning is that it can be changed. Once you have decided that you want the new behavior, take small steps towards the outcome that you want. Notice how those small steps lead to greater profits.

Free Webinars Presented by Adrienne Toghraie

Email for Details – Adrienne@TradingOnTarget.com

Interesting Charts

Nice reverse head and shoulders pattern recorded by China’s most actively ETF trading on U.S. markets! ‘Tis the season!

Strength in Chinese equities and ETFs prompted strength by the broadly based commodity ETF. Nice breakout by DBC above $12.79 to complete a base building pattern!

Most notable gains in commodity prices were in crude oil and copper. The copper ETN broke above a classic reverse head and shoulders pattern.

The breakout by copper and other base metal prices triggered a virtual explosion by the TSX Metals and Mining Index. ‘Tis the season!

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca