by Don Vialoux, Timingthemarket.ca

StockTwits Released Yesterday @EquityClock

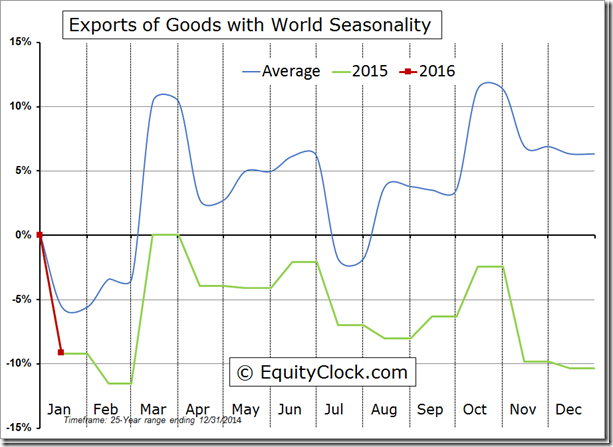

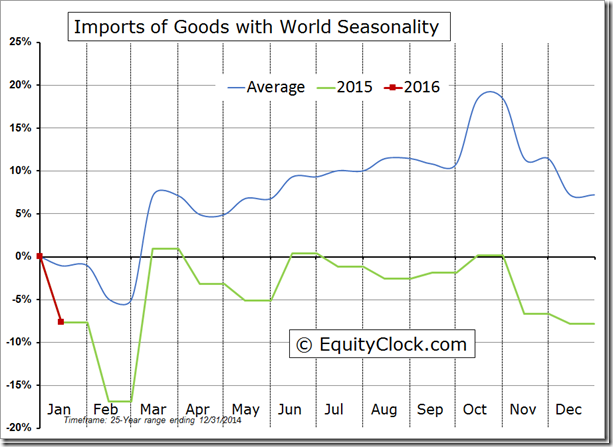

Import and exports for January show an eerily similar change to the same period last year.

Technical action by S&P 500 stocks to 10:15 AM: Quiet. Breakouts: $WY, $MCHP, $PYPL. Breakdown: $ENDP

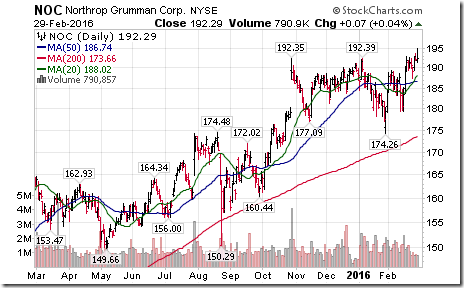

Editor’s Note: After 10:15 AM, five more S&P 500 stocks broke intermediate resistance levels: ADM, KR, MCO, NOC, WRK.

Nice breakout by Northrop Grumman $NOC above $192.39 to reach an all-time high!

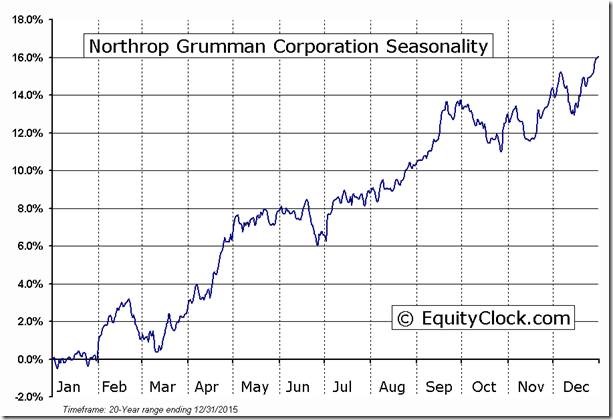

‘Tis the season for Northrop Grumman $NOC to move higher into mid-May!

Trader’s Corner

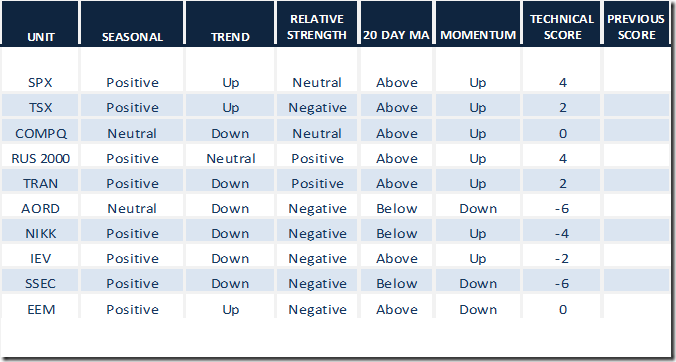

Daily Seasonal/Technical Equity Trends for February 29th 2016

Green: Increase from previous day

Red: Decrease from previous day

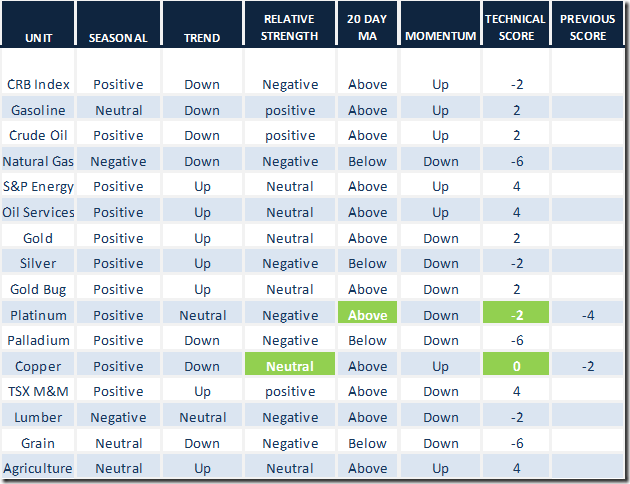

Daily Seasonal/Technical Commodities Trends for February 29th 2016

Green: Increase from previous day

Red: Decrease from previous day

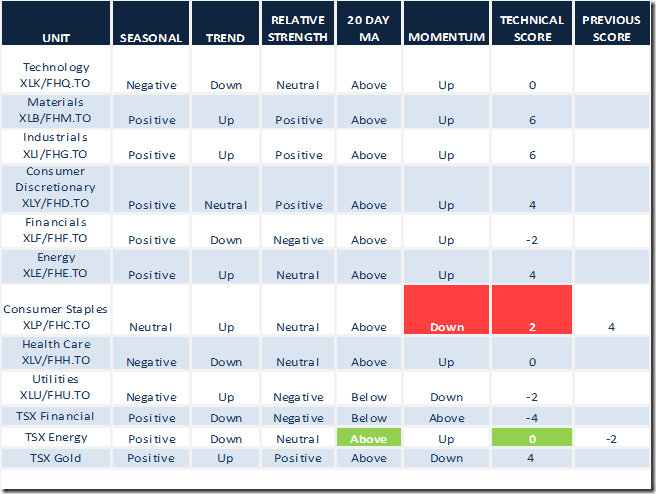

Daily Seasonal/Technical Sector Trends for February 29th 2016

Green: Increase from previous day

Red: Decrease from previous day

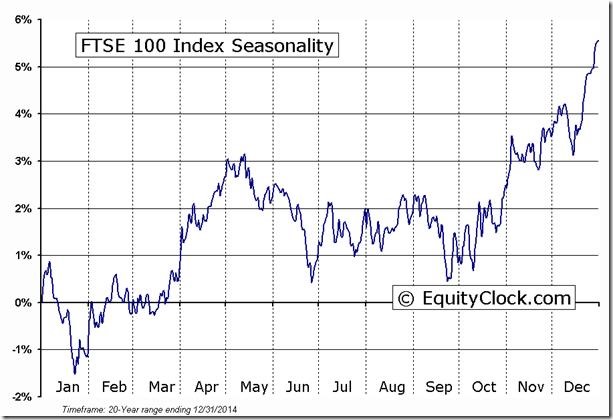

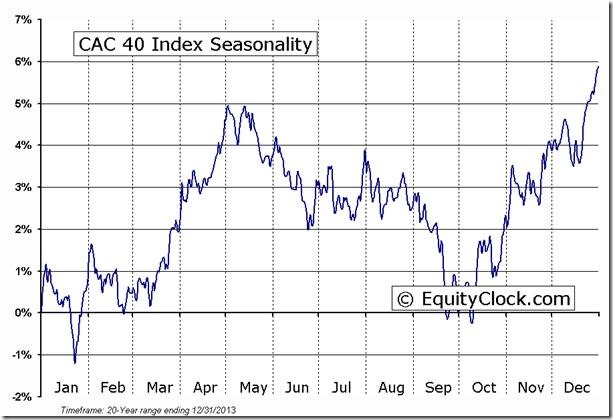

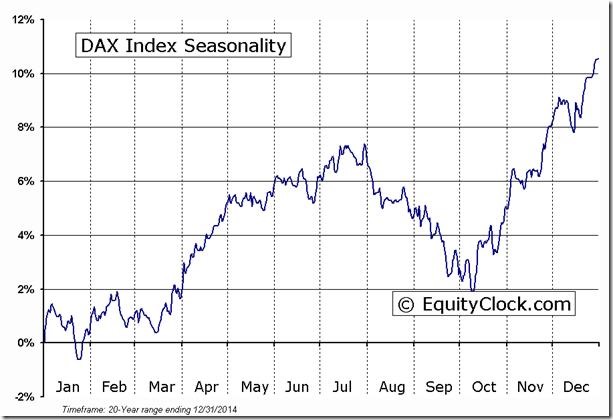

Interesting Observations on European Equity Markets

(Not a recommendation yet: Place on the radar screen)

Seasonal influences of European equity markets turn higher at this time of year. Their strength relative to the S&P 500 Index is starting to turn positive. The European Central Bank is expected to add monetary stimulus at its next meeting in mid-March.

Keith Richards’ Blog

Headline reads, “Time to buy oil”? Following is a link:

http://www.valuetrend.ca/time-to-buy-oil/

Keith suggests that WTI crude oil is becoming interesting from a technical and seasonal perspective and should be put on the radar screen. Tech Talk agrees. A favourable seasonal and technical comment was offered in the February 23rd edition of this report with Crude Oil at $33.39 when strength relative to the S&P 500 Index turned positive. Technical buying is triggered on a move above $34.82 when a base building pattern is completed.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca