by Don Vialoux, Timingthemarket.ca

StockTwits released yesterday @EquityClock

Mind the gap: S&P 500 Index closed two of three gaps during Wednesday’s session.

Technicals for S&P 500 stocks to 11:45: Bullish. Breakouts: $BBY, $ORLY, $TWC, $GIS, $WMT, $BDX, $XRAY, $PWR, $SEE, $VMC, $T, $VZ, $CMS, $PCG.

Editor’s Note: After 11:45 AM EST, another 9 S&P 500 stocks broke resistance: AEE, FSLR, INTU, IR, MMM, PVH, SYK, UTX, VFC. None broke support.

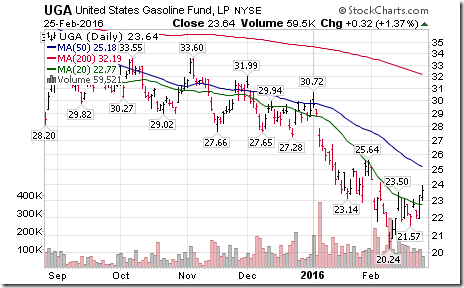

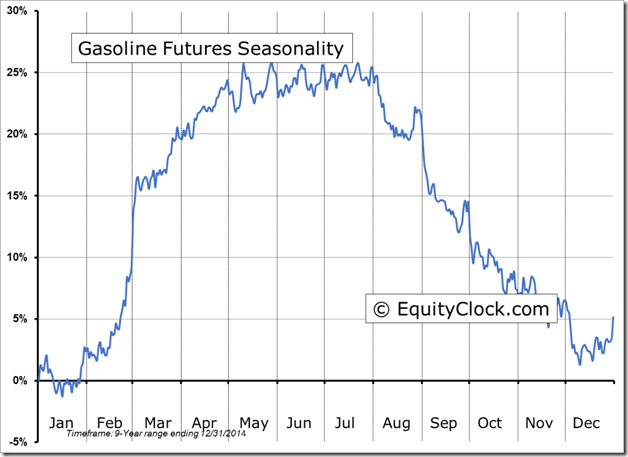

Nice breakout by $UGA above $23.50 to complete a base building pattern! ‘Tis the season for gasoline to move higher!

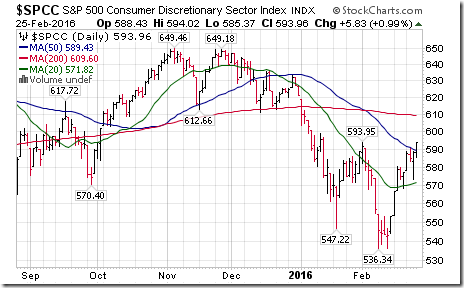

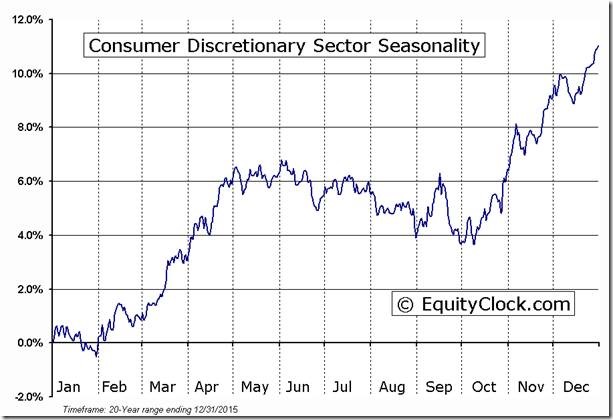

S&P 500 breakouts today are dominated by Consumer Discretionary stocks: $BBY, $ORLY, $TWC, $VFC, $PVH

Editor’s Note: S&P Consumer Discretionary Index broke above resistance at 593.95. ‘Tis the season for strength in the sector into May!

Trader’s Corner

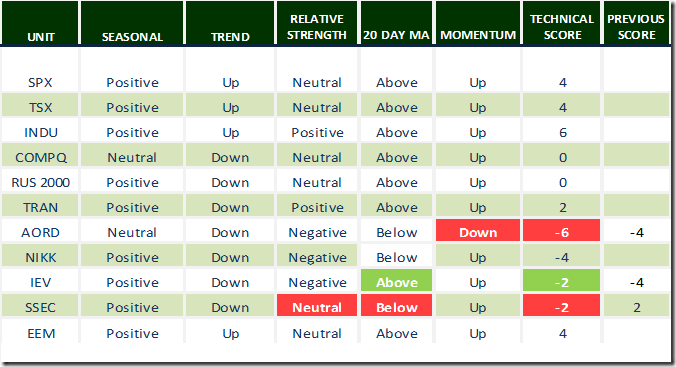

Daily Seasonal/Technical Equity Trends for February 25th 2016

Green: Increase from previous day

Red: Decrease from previous day

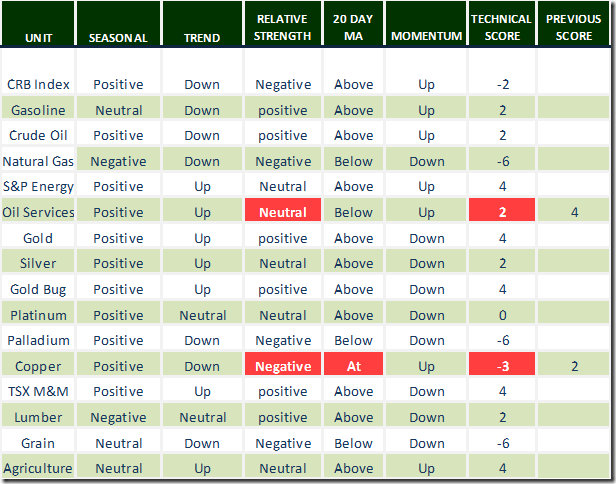

Daily Seasonal/Technical Commodities Trends for February 25th 2016

Green: Increase from previous day

Red: Decrease from previous day

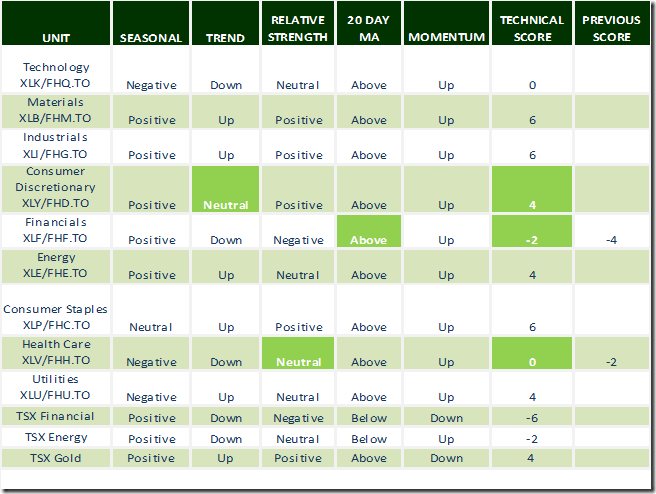

Daily Seasonal/Technical Sector Trends for February 25th 2016

Green: Increase from previous day

Red: Decrease from previous day

Interesting Charts

Nice close by the S&P 500 Index above 1947.20! Double bottom pattern!

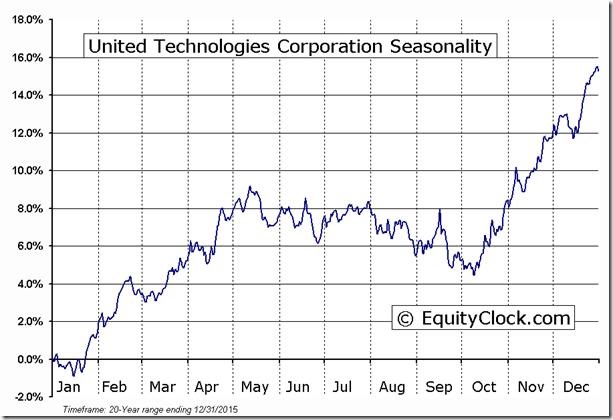

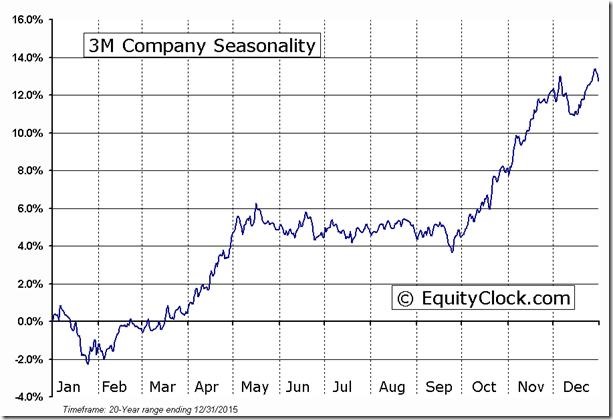

Two more Dow Jones Industrial Average stocks broke recent resistance levels yesterday. Both are Industrial sector stocks.

‘Tis the season for MMM and UTX to move higher into May!

Accountability Report

The February 1st edition of Tech Talk noted that Copper at $2.06 per lb. improved its technical score to +2 at a time when its period of seasonal strength was positive. Yesterday, technical score for Copper at $2.08 dropped to -3. A drop below -2 is a technical signal for trading accounts to liquidate the trade.

Background: Since February 1st, Tech Talk has offered 60 bullish investment ideas with positive seasonality and an initial technical score of at least +2. All investment ideas are monitored daily until either their technical scores fall below 2 and/ or they reach the end of their period of seasonal strength. Expectation is that approximately half of the investment ideas will record a small profit or gain (e.g.Copper) and the remainder will record significant gains. Stay tuned for future accountability reports.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca