by Don Vialoux, Timingthemarket.ca

StockTwits Released Yesterday @EquityClock

Three gaps on the S&P 500 Index present support on any retracement attempt

Technical action by S&P 500 stocks to 11:30 AM: Quiet. Breakouts: $POM, $SCG, $WEC, $XEL. Breakdown: $ECL

Editor’s Note: After 11:30 AM, additional breakouts included BAX, AZO, MHK and AES. Most of the breakouts yesterday were utilities stocks.

Nice breakout by Baxter International $BAX above $38.69 to complete a base building pattern! The stock is outside of its period of seasonal strength.

Trader’s Corner

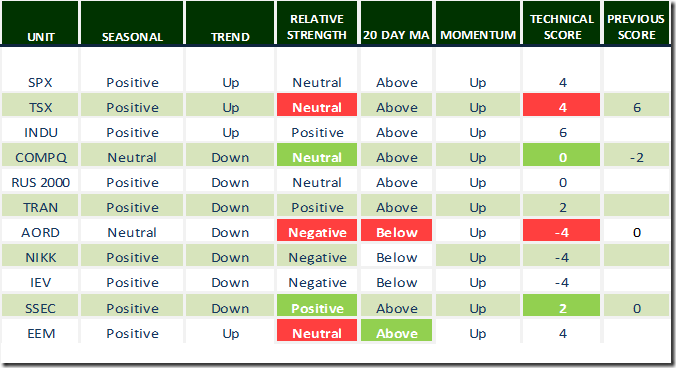

Daily Seasonal/Technical Equity Trends for February 24th 2016

Green: Increase from previous day

Red: Decrease from previous day

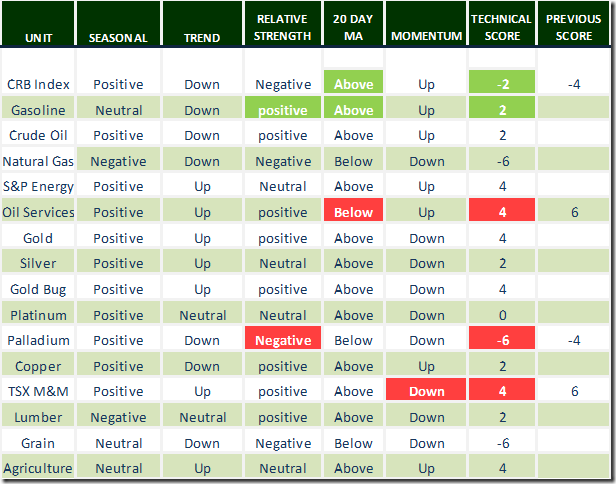

Daily Seasonal/Technical Commodities Trends for February 24th 2016

Green: Increase from previous day

Red: Decrease from previous day

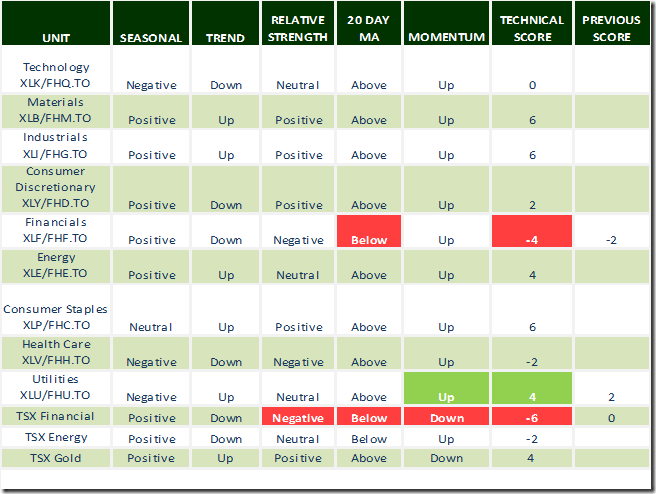

Daily Seasonal/Technical Sector Trends for February 24th 2016

Green: Increase from previous day

Red: Decrease from previous day

Interesting Charts

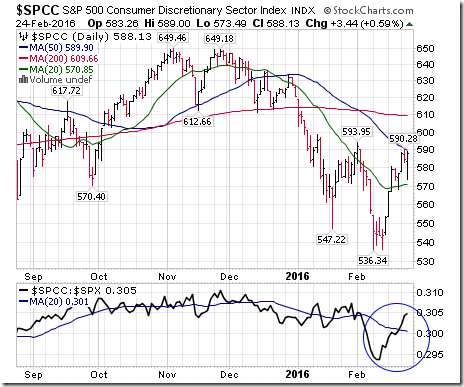

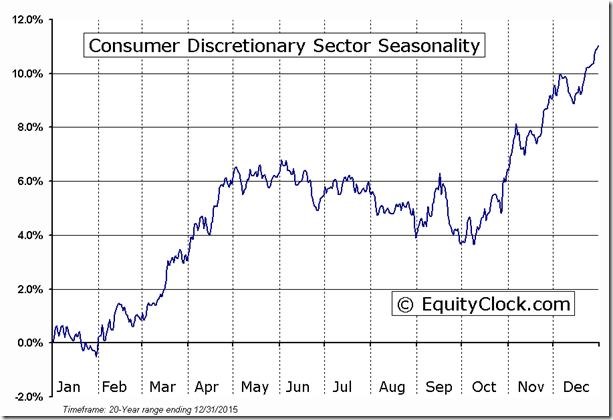

Technical score for the S&P Consumer Discretionary sector recently recovered to 2 thanks mainly to increasing strength relative to the S&P 500 Index.

‘Tis the season to own U.S. Consumer Discretionary stocks and related ETFs (eg. XLY in the U.S. and FHD on the TSX) until at least early May!

The Gasoline seasonal trade finally clicked in. See seasonality chart included in yesterday’s Tech Talk report. Technical score for UGA increased to 2 yesterday when relative strength improved and units moved above their 20 day moving average.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca