by Don Vialoux, Timingthemarket.ca

Trader’s Corner

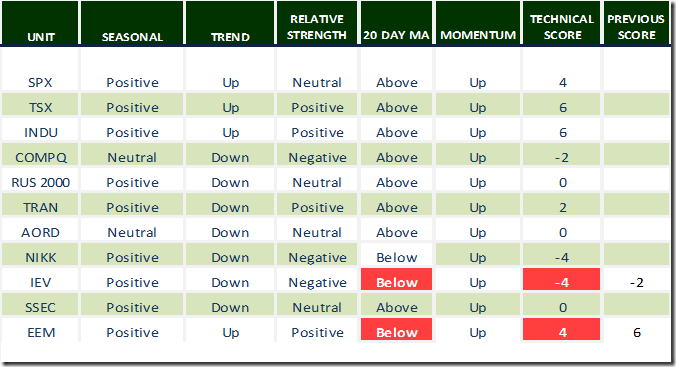

Daily Seasonal/Technical Equity Trends for February 23rd 2016

Green: Increase from previous day

Red: Decrease from previous day

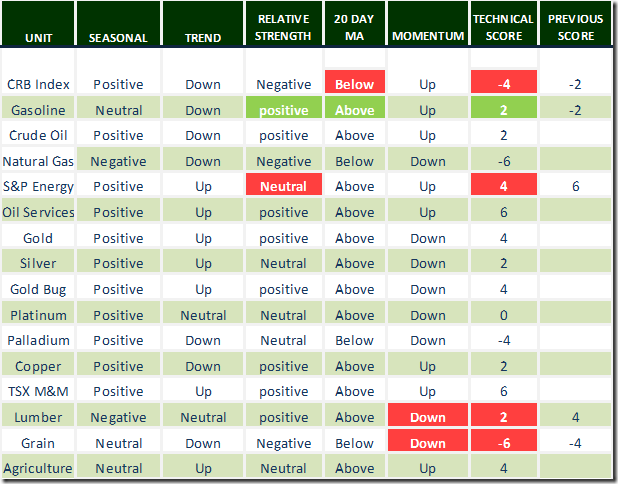

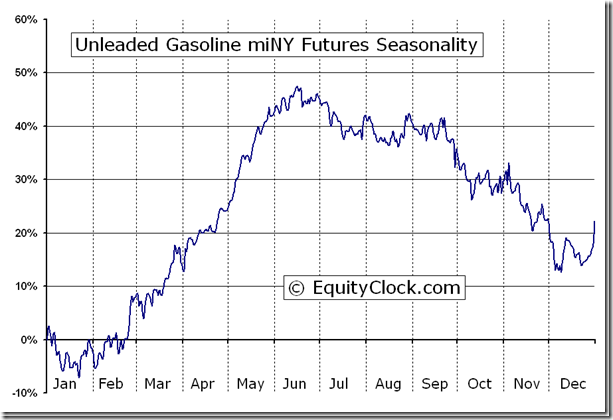

Daily Seasonal/Technical Commodities Trends for February 23rd 2016

Green: Increase from previous day

Red: Decrease from previous day

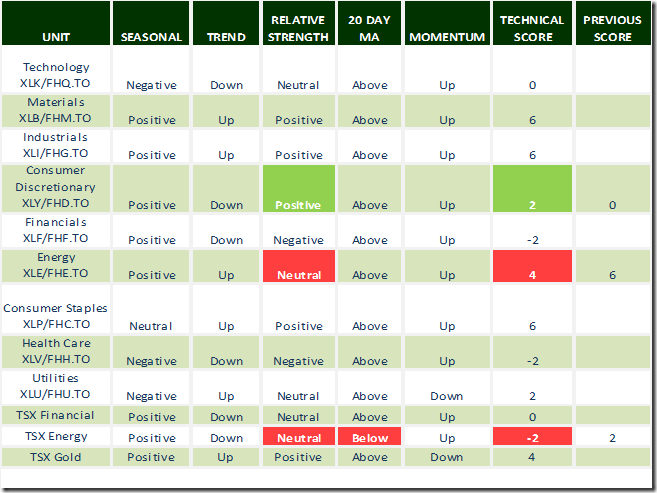

Daily Seasonal/Technical Sector Trends for February 23rd 2016

Green: Increase from previous day

Red: Decrease from previous day

Interesting Charts

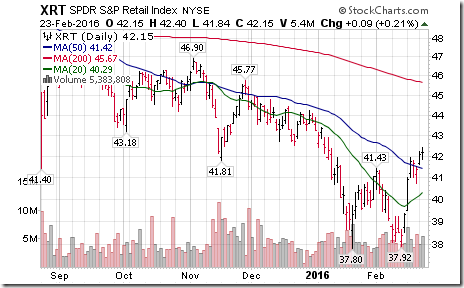

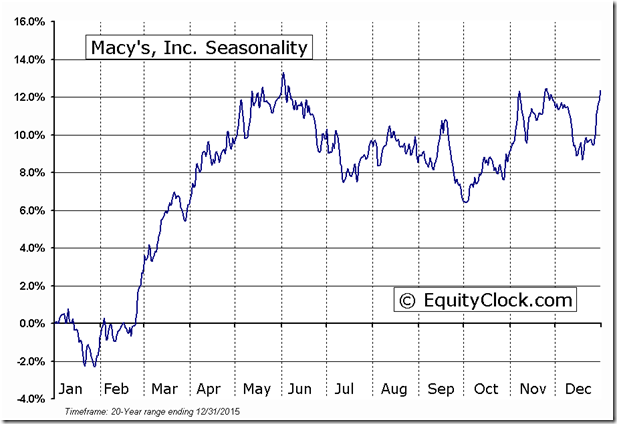

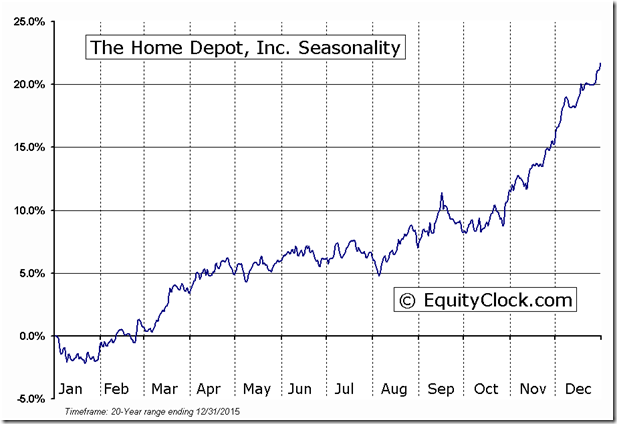

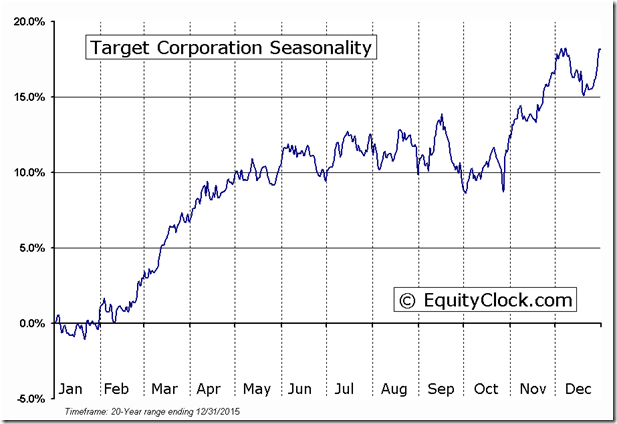

After a difficult fiscal fourth quarter sales due to warmer than average North American weather, retail stocks are anticipating stronger sales in their fiscal first quarter.

‘Tis the season for strength in the Retail sector!

Technical action by S&P 500 Stocks Yesterday

Given weakness by the Index yesterday, technical action was surprisingly bullish. Breakouts included COH, EIX, ES. FTR, HD, M, MO, MSI, NBR, PNW, RAI, TGT. No breakdowns.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following are examples:

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca