2016 Investment and Market Outlook

by ETF Research, iSectors

Posted on: 02/11/2016

By Vern Sumnicht, MBA, CFP® – CEO, iSectors®, LLC

In the famous words of Warren Buffet, “be fearful when others are greedy and be greedy when others are fearful,” I think it would be easy to argue that investors are fearful, and therefore, they should be greedy (or buying stocks, not selling them). Currently, it seems as though oil prices are linked at the hip to the stock market.

When oil prices go up, the stock market goes up; when oil prices go down, the stock market goes down. This is because the market believes the issue with oil prices is demand. Historically, oil prices go down because the economy is slow and there is a low demand for gas and oil. Of course, a slowing economy would generally cause the stock market to go lower. In actuality, I don’t believe oil prices are lower because of a lack of demand caused by a slowing economy. Oil prices are down because of an increase in the supply of oil. The glut in oil, causing oil prices to be lower, is extremely good for consumers and consumer spending.

Remember, consumer spending makes up 70% of GDP (economic growth). Apparently, consumers have been using their windfall from lower gas and oil prices to pay down debt and increase their savings. At some point, consumers will begin to stimulate the economy with their windfall from lower oil prices.

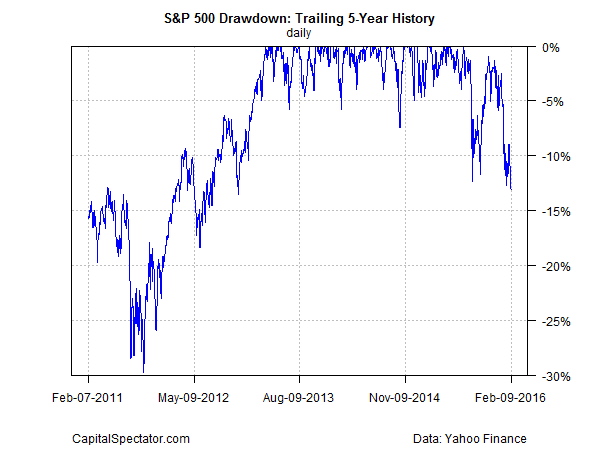

Keeping all of these things in mind, the big question in the minds of investors currently is: are we experiencing a normal market correction or is the economy slowing down and moving into a new recessionary phase? Because of the economic stimulus to consumer spending from low oil prices, the fact that investors are fearful and not greedy, interest rates are still relatively low, and world-wide central banks continue to be accommodative, it stands to reason we are in a market correction and not on the precipice of a new recessionary phase.

When will this correction end? I believe one of the first indications will be when we see the stock market detach itself from the movement in oil prices.

If Mr. Buffet’s old adage continues to hold true, it may be a good time for investors to get greedy. At a minimum, investors should stay the course, maintain their allocation to equities, and continue their regular purchase of equities in their 401(k) and other retirement vehicles.

This post was originally published at iSectors.

Copyright © iSectors