by Don Vialoux, Timingthemarket.ca

Economic News This Week

December Personal Income to be released at 8:30 AM EST on Monday is expected to increase 0.2% versus a gain of 0.1% in November. December Personal Spending is expected to increase 0.2% versus a gain of 0.3% in November.

December Construction Spending to be released at 10:00 AM EST on Monday is expected to increase 0.5% versus a decline of 0.4% in November.

January ISM Manufacturing to be released at 10:00 AM EST on Monday is expected to increase to 48.3 from 48.2 in December.

January ADP Private Employment Report to be released at 8:15 AM EST on Wednesday is expected to slip to 190,000 from 257,000 in December.

January ISM Services to be released at 10:00 AM EST on Wednesday is expected to slip to 55.0 from 55.3 in December.

Weekly Initial Jobless Claims to be released at 8:30 AM EST on Thursday is expected to slip to 275,000 from 278,000 last week.

Fourth Quarter Productivity to be released at 8:30 AM EST on Thursday is expected to fall 1.7% versus a gain of 2.2% in the third quarter.

January Non-farm Payrolls to be released at 8:30 AM EST on Friday are expected to fall to 188,000 from 292,000 in December. January Private Non-farm Payrolls are expected to fall to 183,000 from 275,000 in December. January Unemployment Rate is expected to remain at 5.0% recorded in December. January Hourly Earnings are expected to increase 0.3% versus no gain in December

December Canadian International Trade Deficit to be released at 8:30 AM EST on Friday is expected to ease to $1.8 billion from $2.0 billion in November.

January Canadian Unemployment Rate to be released at 8:30 AM EST on Friday is expected to increase to 7.2% from 7.1% in December. January net change in employment is expected to increase 5,000 versus a gain of 22,800 in December

Earnings News This Week

The Bottom Line

Technical signs of a bottom and start of an intermediate uptrend in most equity indices, commodities and sectors appeared last week. Volatility remains high, but declining: another technical sign of improving intermediate prospects. Owning economically sensitive equity markets (e.g. Canadian equity market), commodities (e.g. energy, oil services, mines & metals) and sectors (e.g. Technology, Consumer Discretionary, Financials, Materials, Energy) makes sense.

Equities

Technical scores for most equity indices increase significantly last week thanks mainly to breaks above their 20 day moving average on Friday.

Daily Seasonal/Technical Equity Trends for January 29th 2016

Green: Increase from previous day

Red: Decrease from previous day

The S&P 500 Index gained 33.33 points (1.75%) last week thanks to a 47 point gain on Friday. Intermediate trend remains down. Short term momentum indicators are trending up. The Index moved above its 20 day moving average on Friday.

Percent of S&P 500 stocks trading above their 50 day moving average increased last week to 30.20% from 17.80%. Percent is trending up from an intermediate oversold level. A recovery above the 25% level following a volatility spike typically signals the start of an intermediate uptrend for the S&P 500 Index.

Percent of S&P 500 stocks trading above their 200 day moving average increased last week to 30.40% from 24.80%. Percent is trending higher from an intermediate oversold level.

Bullish Percent Index for S&P 500 stocks increased last week to 33.20% from 28.20%, but remained below their 20 day moving average. The Index has started to recover from a deep intermediate oversold level.

Bullish Percent Index for TSX stocks increased last week to 32.08% from 26.45% and moved above its 20 day moving average. The Index has started to recover from an intermediate oversold level.

The TSX Composite Index jumped 432.55 points (3.49%) last week. Intermediate trend remains down (Score:-2). Strength relative to the S&P 500 Index remains positive (Score: 2). The Index moved above its 20 day moving average (Score: 1). Short term momentum indicators are trending up (Score: 1). Technical score improved last week to 2 from 0.

Percent of TSX stocks trading above their 50 day moving average increased last week to 47.92% from 24.17%. Percent is trending up from an intermediate oversold level. Another traditional move that normally signals the start of an intermediate uptrend by the TSX Composite Index!

Percent of TSX stocks trading above their 200 day moving average increased last week to 28.75% from 21.67%. Percent is trending up from an intermediate oversold level.

The Dow Jones Industrial Average jumped 372.79 points last week (2.32%) including 396.66 points on Friday. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Average moved above its 20 day moving average on Friday. Short term momentum indicators continue to trend higher. Technical score improved last week to -2 from -4.

Bullish Percent Index for Dow Jones Industrial Average stocks increased last week to 50.00% from 46.67% and moved above its 20 day moving average. The Index is trying to resume an intermediate uptrend.

Bullish Percent Index for NASDAQ Composite stocks increased last week to 29.58% from 28.17%, but remained below its 20 day moving average. The Index is trying to recover from an intermediate oversold level.

The NASDAQ Composite Index jumped 22.77 points (4.96%) including 107.28 points on Friday. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Index remains below its 20 day moving average. Short term momentum indicators are trending up. Technical score remained at -4 last week.

The Russell 2000 Index gained 14.71 points (1.44%) last week including 32.11 points on Friday. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Index remains below its 20 day moving average. Short term momentum indicators continue to trend up. Technical score remained last week at -4.

The Dow Jones Transportation Average added 128.22 points (1.89%) including 204.79 points on Friday. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Average moved above its 20 day moving average in Friday. Short term momentum indicators are trending up. Technical score improved last week to-2 from -4.

The Australia All Ordinaries Composite Index gained 87.00 points (1.75%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains positive. The Index moved above its 20 day moving average on Friday. Short term momentum indicators are trending up. Technical score improved last week to 2 from -2

The Nikkei Average added 559.77 points (3.31%) including 476.85 points on Friday following news of additional monetary stimulus. Intermediate trend remains down. Strength relative to the S&P 500 Index improved to neutral from negative. The Average moved above its 20 day moving average on Friday. Short term momentum indicators are trending up. Technical score improved to 0 from -4.

Europe 350 iShares added $0.64 (1.72%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains neutral. Units moved above their 20 day moving average on Friday. Short term momentum indicators are trending up. Technical score improved last week to 0 from -2

The Shanghai Composite Index dropped 178.96 points (6.14%) despite a gain of 81.94 points on Friday. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Index remains below its 20 day moving average. Short term momentum indicators are mixed, but oversold. Technical score slipped last week to -5 from -4.

Emerging Markets iShares added $1.24 (4.23%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index turned positive. Units moved above their 20 day moving average on Friday. Short term momentum indicators are trending up. Technical score improved last week to 2 from -4.

Currencies

The U.S. Dollar Index added 0.06 (0.06%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Short term momentum indicators are mixed.

The Euro gained 0.35 (0.32%) despite the slight gain by the U.S. Dollar Index. Intermediate trend remains down. The Euro remains below its 20 day moving average. Short term momentum indicators are mixed.

The Canadian Dollar gained US 0.62 cents (0.88%) last week. Intermediate trend remains down. The Canuck Buck moved above its 20 day moving average. Short term momentum indicators are trending up.

The Japanese Yen plunged 1.58 (1.88%) last week including a drop of 1.54 on Friday following news that the Bank of Japan will charge a small fee for bank deposits. Intermediate trend remains up. The Yen dropped below its 20 day moving average. Short term momentum indicators are trending down

Commodities

Technical scores increased significantly last week thanks to commodities moving above their 20 day moving average. Most of the breaks occurred on Friday.

Daily Seasonal/Technical Commodities Trends for January 29th 2016

Green: Increase from previous day

Red: Decrease from previous day

The CRB Index added 2.95 points (1.80%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index has turned positive. The Index moved above its 20 day moving average on Friday. Short term momentum indicators are trending up. Technical score improved last week to 2 from -2.

Gasoline added 2.52 cents per gallon (2.28%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains neutral. Gas moved above its 20 day moving average on Friday. Short term momentum indicators are trending up. Technical score improved last week to 2 from -2.

Crude oil added $1.37 per barrel (4.25%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains positive. Crude moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 2 from 0.

Natural Gas added $0.17 per MBtu (7.98%) last week. Intermediate trend remains neutral. Strength relative to the S&P 500 Index remains positive. “Natty” moved above its 20 day moving average on Friday. Short term momentum indicators are trending up. Technical score improved last week to 4 from 0.

The S&P Energy Index gained 17.64 points (4.23%) last week. Intermediate trend remains down. Strength relative to the S&P 500 turned positive. The Index moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 2 from -2

The Philadelphia Oil Services Index gained 8.79 points (6.31%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index turned positive. The Index moved above its 20 day moving average on Friday. Short term momentum indicators are trending up. Technical score improved last week to 2 from -4.

Gold gained $18.20 per ounce (1.66%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains positive. Gold remains above its 20 day moving average. Short term momentum indicators are trending up. Technical score remained last week at 6.

Silver gained $0.22 per ounce (1.57%) last week. Intermediate trend changed to up from down on a move above $14.42. Strength relative to the S&P 500 Index remains positive. Silver remains above its 20 day moving average. Short term momentum indicators are trending up. Technical score remained last week at 2. Strength relative to Gold remained neutral.

The AMEX Gold Index gained 15.96 points (14.94%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index turned positive. The Index moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 2 from -2. Strength relative to Gold turned positive.

Platinum gained $42.40 per ounce (5.10%) last week. Trend changed to down on a move below $825.00. Relative strength: positive. Above 20 day: positive. Momentum: Up.

Palladium gained $1.70 per ounce (0.34%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains neutral. PALL remains below its 20 day moving average. Short term momentum indicators are trending up. Score remained last week at -2.

Copper added 6.70 cents per lb. (3.34%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains positive. Copper moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 2 from 0.

The TSX Metals & Mining Index gained 21.17 points (8.26%) last week including a 22.08 gain on Friday. Intermediate trend remains down. Strength relative to the S&P 500 Index turned neutral from negative on Friday. The Index moved above its 20 day moving average on Friday. Short term momentum indicators are trending up. Technical score improved last week to 0 from -6.

Lumber added $4.90 (2.08%) last week. Trend remained neutral. Strength relative to the S&P 500 Index remains negative. Below 20 day MA. Momentum: Up. Score: -2 vs -4.

The Grain ETN added $0.17 (0.55%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains positive. Units trade above their 20 day moving average. Short term momentum indicators are trending up. Technical score remained last week at 2.

The Agriculture ETF added $0.92 (2.14%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index is neutral. Units moved above their 20 day moving average on Friday. Short term momentum indicators are trending up. Technical score improved last week to 0 from -2.

Interest Rates

The yield on 10 U.S. Treasuries dropped 11.7 basis points (%) last week. Intermediate trend remains up. Yield fell below its 20 day moving average. Short term momentum indicators are trending down.

Conversely, price of the long term Treasury ETF gained $2.24 (%) last week. Short term momentum indicators are trending up.

Other Issues

The VIX Index dropped 2.24 (%) last week. Intermediate trend remains up. The VIX Index dropped below its 20 day moving average.

Economic focuses this week are on the January ISM report on Monday and the January U.S. and Canadian employment reports on Friday.

Fourth quarter reports will continue to dominate news this week. 200 S&P 500 companies have reported to date. Another 118 S&P 500 and 3 Dow Industrial companies are scheduled to release results this week. According to FactSet, 72% of companies have exceeded consensus earnings estimates and 50% have beat consensus sales estimates. On a blended basis, S&P 500 earnings are down 5.8% on a year-over-year basis and sales were down 3.5%. Look for more of the same this week.

The outlook for S&P 500 earnings and sales for 2016 continues to slip lower, but with improving prospects as the year progresses. 33 companies have issued negative earnings guidance for the first quarter while 6 companies have issued positive guidance. Earnings on a year-over-year basis are expected to decline 3.8% in the first quarter, but improve 0.8% in the second quarter, 6.3% in the third quarter and 13.5% in the fourth quarter.

International focuses this week are on China PMI reports to be released on Monday and the Bank of England interest rate announcement on Thursday.

Technical action by individual S&P 500 stocks turned positive last week: 43 stocks broke resistance levels while only 8 stocks broke support. Notable on the list of stocks breaking resistance were the utility stocks with 13 stocks breaking resistance.

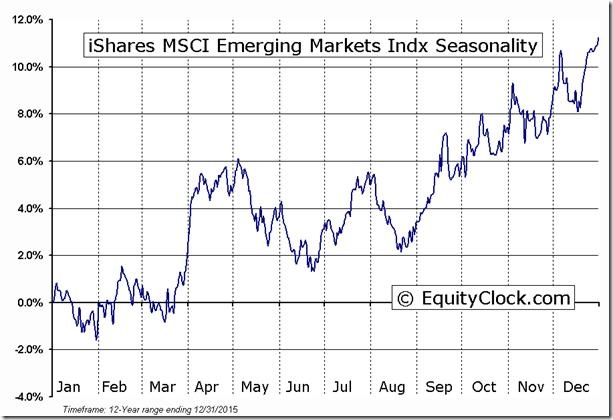

Seasonal influences turned positive last week for economically sensitive sectors (Technology, Materials, Consumer Discretionary, Energy, Financials) and Emerging markets. See the seasonality chart on Emerging markets below.

Sectors

Technical scores improved significantly last week mainly because many sectors moved above their 20 day moving average. Most of the breaks occurred on Friday

Daily Seasonal/Technical Sector Trends for January 29th 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following are examples:

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2019/08/0318ed56984a17f302e940fbeec94716.gif)